Kraft 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

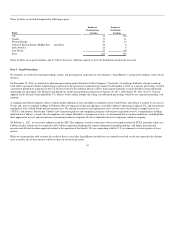

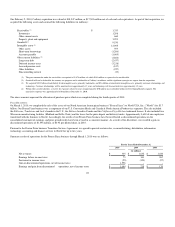

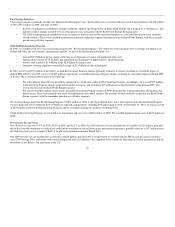

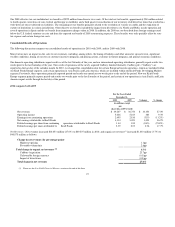

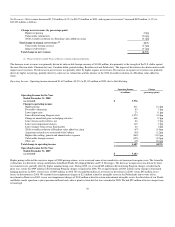

Our February 2, 2010, Cadbury acquisition was valued at $18,547 million, or $17,503 million net of cash and cash equivalents. As part of that acquisition, we

acquired the following assets and assumed the following liabilities (in millions):

Receivables (1) $ 1,333

Inventories 1,298

Other current assets 660

Property, plant and equipment 3,293

Goodwill (2) 9,530

Intangible assets (3) 12,905

Other assets 593

Short-term borrowings (1,206)

Accounts payable (1,605)

Other current liabilities (4) (1,866)

Long-term debt (2,437)

Deferred income taxes (3,218)

Accrued pension costs (817)

Other liabilities (927)

Noncontrolling interest (33)

(1) The gross amount due under the receivables we acquired is $1,474 million, of which $141 million is expected to be uncollectable.

(2) Goodwill will not be deductible for statutory tax purposes and is attributable to Cadbury's workforce and the significant synergies we expect from the acquisition.

(3) We acquired $10.3 billion of indefinitely lived intangible assets, primarily trademarks, and $2.6 billion of amortizable intangible assets, primarily customer relationships and

technology. Customer relationships will be amortized over approximately 13 years and technology will be amortized over approximately 12 years.

(4) Within other current liabilities, a reserve for exposures related to taxes of approximately $70 million was established within our Developing Markets segment. The

cumulative exposure was approximately $150 million at December 31, 2010.

The above amounts represent the allocation of purchase price which was completed during the fourth quarter of 2010.

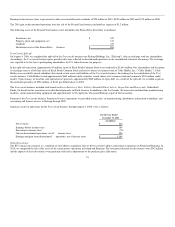

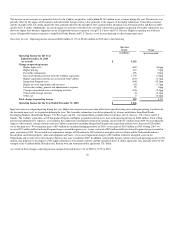

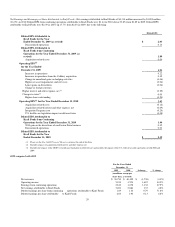

Pizza Divestiture:

On March 1, 2010, we completed the sale of the assets of our North American frozen pizza business ("Frozen Pizza") to Nestlé USA, Inc. ("Nestlé") for $3.7

billion. Our Frozen Pizza business was a component of our U.S. Convenient Meals and Canada & North America Foodservice segments. The sale included

the DiGiorno, Tombstone and Jack's brands in the U.S., the Delissio brand in Canada and the California Pizza Kitchen trademark license. It also included two

Wisconsin manufacturing facilities (Medford and Little Chute) and the leases for the pizza depots and delivery trucks. Approximately 3,600 of our employees

transferred with the business to Nestlé. Accordingly, the results of our Frozen Pizza business have been reflected as discontinued operations on the

consolidated statement of earnings, and prior period results have been revised in a consistent manner. As a result of the divestiture, we recorded a gain on

discontinued operations of $1,596 million, or $0.92 per diluted share, in 2010.

Pursuant to the Frozen Pizza business Transition Services Agreement, we agreed to provide certain sales, co-manufacturing, distribution, information

technology, accounting and finance services to Nestlé for up to two years.

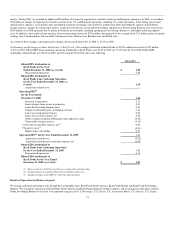

Summary results of operations for the Frozen Pizza business through March 1, 2010 were as follows:

For the Years Ended December 31,

2010 2009 2008

(in millions)

Net revenues $ 335 $ 1,632 $ 1,440

Earnings before income taxes 73 341 267

Provision for income taxes (25) (123) (97)

Gain on discontinued operations, net of income taxes 1,596 - -

Earnings and gain from discontinued operations, net of income taxes $ 1,644 $ 218 $ 170

22