Kraft 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

KRAFT FOODS INC (KFT)

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 02/28/2011

Filed Period 12/31/2010

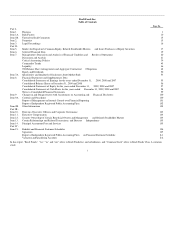

Table of contents

-

Page 1

KRAFT FOODS INC (KFT)

10-K

Annual report pursuant to section 13 and 15(d) Filed on 02/28/2011 Filed Period 12/31/2010

-

Page 2

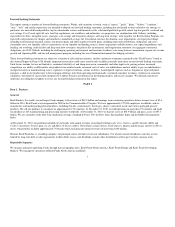

... one) FORM 10-K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 COMMISSION FILE NUMBER 1-16483

Kraft Foods Inc. (Exact...

-

Page 3

... 31, 2009, 2008 and 2007 Consolidated Statements of Cash Flows for the years ended December 31, 2009, 2008 and 2007 Notes to Consolidated Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Report of Management on Internal...

-

Page 4

...-looking statements, including but not limited to those related to our strategy, in particular, our unrivaled brand portfolio, top-tier shareholder returns and financial results, substained profitable growth, robust top-line growth, overhead and cost savings, Post Cereals split-off; new food law...

-

Page 5

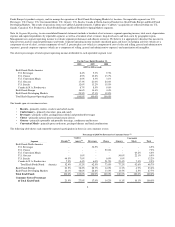

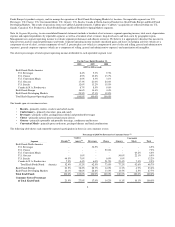

...For the Years Ended December 31, 2010 2009 (2009 & 2008 revised) 2008

Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total Kraft Segment Operating Income Our brands span...

-

Page 6

... America: U.S. Beverages Beverages: Maxwell House, Starbucks (under license), Gevalia, General Foods International, Yuban and Seattle's Best (under license) coffees; Tassimo hot beverage system; Capri Sun (under license) and Kool-Aid packaged juice drinks; Kool-Aid, Crystal Light and Country Time...

-

Page 7

...Ão cheeses; and Philadelphia cream cheese. Grocery: Kraft pourable and spoonable salad dressings; Miracel Whip spoonable dressings; and Mirácoli sauces. Convenient Meals: Lunchables lunch combinations; Mirácoli pasta dinners and sauces; and Simmenthal canned meats. Kraft Foods Developing Markets...

-

Page 8

...As a result of the split-off, we recorded a gain on discontinued operations of $926 million, or $0.61 per diluted share, in 2008. See Note 2, Acquisitions and Divestitures, to our consolidated financial statements for additional information on these transactions. Customers Our five largest customers...

-

Page 9

... Best coffee for sale in U.S. and European grocery stores and other distribution channels; Starbucks and Seattle's Best coffee T-Discs for use in our Tassimo hot beverage system; Capri Sun packaged juice drinks for sale in the U.S. and Canada; and Taco Bell Home Originals Mexican style food products...

-

Page 10

...and Suzhou, China. These technology centers are equipped with pilot plants and state-of-the-art instruments. Research and development expense was $583 million in 2010, $466 million in 2009, and $487 million in 2008. Regulation Our U.S. food products and packaging materials are primarily regulated by...

-

Page 11

... Officer Executive Vice President, Operations and Business Services Executive Vice President and President, Kraft Foods Europe Executive Vice President, Corporate and Legal Affairs and General Counsel Executive Vice President and President, Developing Markets Executive Vice President, Global...

-

Page 12

.... Rosenfeld was employed continuously by Kraft Foods, and its predecessor, General Foods Corporation, in various capacities from 1981 until 2003, including President of Kraft Foods North America and, before that, President of Operations, Technology, Information Systems of Kraft Foods Canada, Mexico...

-

Page 13

... by writing to: Corporate Secretary, Kraft Foods Inc., Three Lakes Drive, Northfield, IL 60093. Available Information Our Internet address is www.kraftfoodscompany.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed...

-

Page 14

... or to develop and market their own retailer brands. Further retail consolidation may materially and adversely affect our product sales, financial condition and results of operations. Retail consolidation also increases the risk that adverse changes in our customers' business operations or financial...

-

Page 15

...to comply with new or revised regulations or their interpretation and application, including proposed requirements designed to enhance food safety or to regulate imported ingredients, could materially and adversely affect our product sales, financial condition and results of operations. Legal claims...

-

Page 16

... in integrating Cadbury's operations and products, many of which have a strong presence in a number of developing markets, is critical to our growth strategy. If we cannot successfully increase our business in developing markets, our product sales, financial condition and results of operations could...

-

Page 17

... could affect our product sales, financial condition and results of operations. We are subject to foreign currency exchange rate fluctuations. Our acquisition of Cadbury and disposition of our Frozen Pizza business increased the portion of our assets, liabilities and earnings denominated in non...

-

Page 18

... issue and could raise our borrowing costs for both short- and long-term debt offerings. Volatility in the equity markets or interest rates could substantially increase our pension costs and have a negative impact on our operating results and profitability. At the end of 2010, the projected benefit...

-

Page 19

These facilities are located throughout the following regions:

Number of Manufacturing Facilities Number of Distribution Facilities

Region

U.S. Canada Western Europe Central & Eastern Europe, Middle East Latin America Asia Pacific Total

and Africa

46 11 59 50 20 37 223

128 11 23 8 6 60 236

...

-

Page 20

... to our Cadbury acquisition in 2010, we removed them from our performance peer group. The Kraft Foods new performance peer group consists of the following companies considered our market competitors, or that have been selected on the basis of industry, level of management complexity, global focus or...

-

Page 21

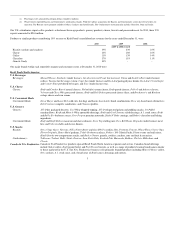

... exercise options, and who used shares to pay the related taxes for grants of restricted and deferred stock that vested. Accordingly, these are non-cash transactions.

Total Number of Shares Average Price Paid per Share

October 1-31, 2010 November 1-30, 2010 December 1-31, 2010 For the Quarter Ended...

-

Page 22

... Free cash flow* Depreciation Property, plant and equipment, net Inventories, net Total assets Long-term debt Total debt Total long-term liabilities Total Kraft Foods shareholders' equity Total equity Book value per common share outstanding Market price per Common Stock share - high / low Closing...

-

Page 23

... of this Annual Report on Form 10-K, including the consolidated financial statements and related notes contained in Item 8. Description of the Company We market biscuits, confectionery, beverages, cheese, grocery products and convenient meals in approximately 170 countries. Executive Summary The...

-

Page 24

... brands people love. Our future growth is centered on three strategies: To delight global Snacks consumers; To unleash the Power of our Iconic Heritage Brands; and To Create a Performance-Driven, Values-Led Organization, which we believe will allow us to deliver top-tier shareholder returns. We plan...

-

Page 25

... distribution, information technology, accounting and finance services to Nestlé for up to two years. Summary results of operations for the Frozen Pizza business through March 1, 2010 were as follows:

For the Years Ended December 31, 2010 2009 (in millions) 2008

Net revenues Earnings before income...

-

Page 26

...information technology, and accounting and finance services to Ralcorp through 2009. Summary results of operations for the Post cereals business through August 4, 2008, were as follows:

For the Year Ended December 31, 2008 (in millions)

Net revenues Earnings before income taxes Provision for income...

-

Page 27

... divestiture of the Frozen Pizza and Post cereals businesses, were not material to our financial statements in any of the periods presented. Refer to Note 16, Segment Reporting, for details of the gains and losses on divestitures by segment. The net impacts to segment operating income from gains and...

-

Page 28

... Years Ended December 31, 2010 Gains / (losses) & asset impairment 2009 (in millions) 2008

charges on divestitures, net: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets...

-

Page 29

... and other project costs. We incurred costs associated with our Cost Savings Initiatives of $170 million in 2010, $318 million in 2009, and none in 2008. • • In 2010, we primarily recorded these changes within the segment operating income of Kraft Foods Europe and Canada & N.A. Foodservice. The...

-

Page 30

... Kraft Foods Europe segment primarily reports period-end results two weeks prior to the last Saturday of the period, and certain of our operations in Asia Pacific and Latin America report results through the last day of the period. 2010 compared with 2009

For the Years Ended December 31, 2010 2009...

-

Page 31

... Markets, Kraft Foods Europe, U.S. Beverages and U.S. Convenient Meals, partially offset by declines in U.S. Grocery, U.S. Cheese and U.S. Snacks. The Cadbury acquisition, net of Integration Program and higher acquisition-related costs, increased operating income by $260 million. Total selling...

-

Page 32

... costs Acquisition-related interest and other expense, net Integration Program costs U.S. health care legislation impact on deferred taxes Diluted EPS Attributable to Kraft Foods from Continuing Operations for the Year Ended December 31, 2010 2010 gain on the divestiture of our Frozen Pizza business...

-

Page 33

... 2008 favorable resolution of Brazilian value added tax claim Acquisition-related costs associated with Cadbury Higher other selling, general and administrative expense Unfavorable foreign currency Other, net Total change in operating income Operating Income for the Year Ended December 31, 2009...

-

Page 34

... Developing Markets. We manage the operations of Kraft Foods North America and Kraft Foods Europe by product category, and we manage the operations of Kraft Foods Developing Markets by location. Our reportable segments are U.S. Beverages, U.S. Cheese, U.S. Convenient Meals, U.S. Grocery, U.S. Snacks...

-

Page 35

... 40,492

For the Years Ended December 31, (in millions; 2009 & 2008 revised)

Operating income: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Unrealized gains / (losses...

-

Page 36

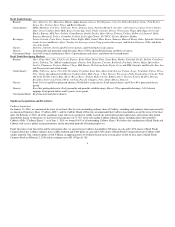

...legal matters related to certain of our U.S. and European operations, including U.S. coffee operations and represented the primary reason general corporate expenses increased $101 million in 2008. U.S. Beverages

For the Years Ended December 31, 2010 (in millions) 2009 $ change % change

Net revenues...

-

Page 37

... lower manufacturing costs, lower costs due to the completion of the Restructuring Program and lower other selling, general and administrative expenses, partially offset by lower net pricing and higher marketing support costs. U.S. Convenient Meals

For the Years Ended December 31, 2010 2009 $ change...

-

Page 38

... completion of the Restructuring Program and favorable volume/mix, partially offset by higher other selling, general and administrative expenses and higher marketing support costs. U.S. Grocery

For the Years Ended December 31, 2010 (in millions) 2009 $ change % change

Net revenues Segment operating...

-

Page 39

...certain products containing pistachios). Canada & N.A. Foodservice

For the Years Ended December 31, 2010 2009 $ change % change (in millions; 2009 revised)

Net revenues Segment operating income

$

4,696 582

$

3,922 462

$

774 120

19.7% 26.0%

For the Years Ended December 31, 2009 2008 $ change...

-

Page 40

...higher net pricing, partially offset by unfavorable foreign currency, higher manufacturing costs, unfavorable volume/mix and higher marketing support costs. Kraft Foods Europe

For the Years Ended December 31, 2010 (in millions) 2009 $ change % change

Net revenues Segment operating income

$

11,628...

-

Page 41

... category management and value chain model was completed in 2009 for our chocolate, coffee and cheese categories. The integration of our European biscuits business was principally completed in the second quarter of 2010. Our subsidiary, Kraft Foods Europe GmbH, acts as the European Principal Company...

-

Page 42

... volume/mix (improved product mix, net of lower shipments), lower costs due to the completion of the Restructuring Program (including the reversal of prior year costs) and 2008 asset impairment charges related to certain international intangible assets, a juice operation in Brazil and a cheese plant...

-

Page 43

... that affect a number of amounts in our financial statements. Significant accounting policy elections, estimates and assumptions include, among others, pension and benefit plan assumptions, lives and valuation assumptions of goodwill and intangible assets, marketing programs and income taxes. We...

-

Page 44

...-participant, weighted-average cost of capital of 7.5% to discount the projected cash flows of those operations. For reporting units within our Kraft Foods Developing Markets geographic unit, we used a risk-rated discount rate of 10.5%. In 2010, we recorded aggregate asset impairment charges of $55...

-

Page 45

.... Kraft Foods' shipping and handling costs are classified as part of cost of sales. A provision for product returns and allowances for bad debts are also recorded as reductions to revenues within the same period that the revenue is recognized. Selling, general and administrative expenses: Marketing...

-

Page 46

...in earnings for these employee benefit plans during the years ended December 31, 2010, 2009 and 2008:

2010 2009 (in millions) 2008

U.S. pension plan cost Non-U.S. pension plan cost Postretirement health care cost Postemployment benefit plan cost Employee savings plan cost Multiemployer pension plan...

-

Page 47

...rate of return on plan assets on pension costs Effect of change in discount rate on postretirement health care costs

$

(64) $ (31) (12)

66 $ 31 12

(38) $ (38) (1)

36 38 1

Financial Instruments: As we operate globally, we use certain financial instruments to manage our foreign currency exchange...

-

Page 48

... in our consolidated balance sheets as either current assets or current liabilities. Changes in the fair value of a derivative that is highly effective and designated as a cash flow hedge, to the extent that the hedge is effective, are recorded each period in accumulated other comprehensive earnings...

-

Page 49

... tax payments on the Frozen Pizza divestiture, increased inventory levels and the unfavorable impact of acquisition-related financing fees, partially offset by increased earnings. The increase in operating cash flows in 2009 primarily related to working capital improvements over the prior year. The...

-

Page 50

... at the time of repayment) with proceeds from the divestiture of our Frozen Pizza business. Upon repayment, the Cadbury Bridge Facility was terminated. Long-term Debt: Our total debt was $28.7 billion at December 31, 2010 and $19.0 billion at December 31, 2009. Our debt-to-capitalization ratio was...

-

Page 51

... $12.0 billion in general long-term financing authority. As a well-known seasoned issuer, we plan to file an automatic shelf registration statement on Form S-3 with the SEC shortly after this Annual Report on Form 10-K is filed with the SEC. Off-Balance Sheet Arrangements and Aggregate Contractual...

-

Page 52

... 30 days). Any amounts reflected on the consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table above. Other long-term liabilities primarily consist of estimated future benefit payments for our postretirement health care plans through December 31, 2020 of...

-

Page 53

... 1.5 million shares of stock in connection with our long-term incentive plan. The market value per share was $27.00 on the date of grant. In February 2009, as part of our annual equity program, we issued 4.1 million shares of restricted and deferred stock to eligible employees. The market value per...

-

Page 54

...on the Cadbury shares that were outstanding at the time of the acquisition. The 2.9% increase in 2009 reflects a higher dividend rate, partially offset by fewer shares outstanding resulting from the split-off of the Post cereals business and share repurchases. The present annualized dividend rate is...

-

Page 55

... of results because it excludes certain impacts related to the Cadbury acquisition and other one-time impacts from earnings per share. The limitation of this measure is that it excludes items that have an impact on diluted EPS attributable to Kraft Foods from continuing operations. The best way...

-

Page 56

...Activities Capital Expenditures Free cash flow

$ $

3,748 (1,661) 2,087

$ $

5,084 (1,330) 3,754

$ $

4,141 (1,367) 2,774

Item 7A. Quantitative and Qualitative Disclosures about Market Risk. As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate...

-

Page 57

... tool designed to statistically estimate the maximum probable daily loss from adverse movements in interest rates, foreign currency rates and commodity prices under normal market conditions. The computation does not represent actual losses in fair value or earnings to be incurred by Kraft Foods, nor...

-

Page 58

Item 8. Financial Statements and Supplementary Data. Kraft Foods Inc. and Subsidiaries Consolidated Statements of Earnings for the years ended December 31, (in millions of dollars, except per share data)

2010 2009 2008

Net revenues Cost of sales Gross profit Selling, general and administrative ...

-

Page 59

... Long-term debt Deferred income taxes Accrued pension costs Accrued postretirement health care costs Other liabilities TOTAL LIABILITIES Contingencies (Note 13) EQUITY Common Stock, no par value (1,996,537,778 shares issued in 2010 and 1,735,000,000 shares issued in 2009) Additional paid-in capital...

-

Page 60

... of new benefit plan guidance Exercise of stock options and issuance of other stock awards Cash dividends declared ($1.12 per share) Acquisitions of noncontrolling interest and other activities Common Stock repurchased Common Stock tendered Balances at December 31, 2008 Comprehensive earnings: Net...

-

Page 61

... Consolidated Statements of Cash Flows for the years ended December 31, (in millions of dollars)

2010 2009 2008

CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES Net earnings Adjustments to reconcile net earnings to operating cash flows: Depreciation and amortization Stock-based compensation...

-

Page 62

... that affect a number of amounts in our financial statements. Significant accounting policy elections, estimates and assumptions include, among others, pension and benefit plan assumptions, lives and valuation assumptions of goodwill and intangible assets, marketing programs and income taxes. We...

-

Page 63

... rate for imports of food, medicine and other essential items. Accordingly, we were required to revalue our net assets in Venezuela. In July 2010, the Venezuelan government eliminated the secondary (or parallel) market exchange rate and replaced it with the governmentregulated Transaction System...

-

Page 64

... our future plans, industry and economic conditions. For reporting units within our Kraft Foods North America and Kraft Foods Europe geographic units, we used a market-participant, weighted-average cost of capital of 7.5% to discount the projected cash flows of those operations. For reporting units...

-

Page 65

... over the working life of the covered employees. In September 2006, new guidance was issued surrounding employers' accounting for defined benefit pension and other postretirement plans. The new guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning...

-

Page 66

... hedges but do not designate for hedge accounting treatment, we recognize gains and losses directly as a component of cost of sales. Foreign currency cash flow hedges - We use various financial instruments to mitigate our exposure to changes in exchange rates from third-party and intercompany...

-

Page 67

...000 pence in cash and 0.7496 shares of Kraft Foods Common Stock per Cadbury ADS validly tendered. This valued Cadbury at $18.5 billion, or approximately £11.6 billion (based on the average price of $28.36 for a share of Kraft Foods Common Stock on February 2, 2010 and an exchange rate of $1.595 per...

-

Page 68

... operations on the consolidated statement of earnings, and prior period results have been revised in a consistent manner. Pursuant to the Frozen Pizza business Transition Services Agreement, we agreed to provide certain sales, co-manufacturing, distribution, information technology, accounting...

-

Page 69

..., net Property, plant and equipment, net Goodwill Distributed assets of the Frozen Pizza business $ 102 317 475 894

$

Post Cereals Split-off: On August 4, 2008, we completed the split-off of the Post cereals business into Ralcorp Holdings, Inc. ("Ralcorp"), after an exchange with our shareholders...

-

Page 70

... not reflect the related asset impairment charges discussed in Note 5, Goodwill and Intangible Assets. The aggregate operating results of the divestitures discussed above, other than the divestiture of the Frozen Pizza and Post cereals businesses, were not material to our financial statements in any...

-

Page 71

... by reportable segment was:

2010 (in millions) 2009

Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total goodwill Intangible assets at December 31, 2010 and 2009 were...

-

Page 72

... in our Kraft Foods Europe segment and $3,745 million in our Kraft Foods Developing Markets segment. Divestitures - We reduced goodwill by $475 million due to our Frozen Pizza business divestiture. Asset impairments - During our 2010 review of goodwill and non-amortizable intangible assets, we...

-

Page 73

... businesses in these reporting units over the next two years; however, if we are unable to, it would adversely affect the estimated fair values of these reporting units.

•

•

During the fourth quarter of 2009, we completed the annual review of goodwill and non-amortizable intangible assets...

-

Page 74

...and other project costs. We incurred costs associated with our Cost Savings Initiatives of $170 million in 2010 and $318 million in 2009 and none in 2008. • • In 2010, we primarily recorded these changes within the segment operating income of Kraft Foods Europe and Canada & N.A. Foodservice. The...

-

Page 75

... Program charges, primarily related to severance, and recorded a $17 million loss on the divestiture of the plant in 2009. The reversal occurred in our Kraft Foods Europe segment. We also reversed $50 million of previously accrued Restructuring Program charges in 2009, primarily due to planned...

-

Page 76

...:

For the Year Ended December 31, 2008 Restructuring Costs Implementation Costs (in millions) Total

Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total Note 7. Debt and...

-

Page 77

...205 million at the time of repayment) with proceeds from the divestiture of our Frozen Pizza business. Upon repayment, the Cadbury Bridge Facility was terminated. Long-Term Debt: On February 8, 2010, we issued $9.5 billion of senior unsecured notes at a weighted-average effective rate of 5.364% and...

-

Page 78

... and Other Expense: Interest and other expense was:

For the Years Ended December 31, 2010 2009 (in millions) 2008

Interest and other expense, net: Interest expense, debt Acquisition-related financing fees Other income, net Total interest and other expense, net

$ $ $ 75

1,790 $ 251 $ (17) 2,024...

-

Page 79

... 2010, we issued 262 million additional shares of our Common Stock as part of the Cadbury acquisition. The issued stock had a total fair value of $7,457 million based on the average of the high and low market prices on the dates of issuance. On August 4, 2008, we completed the split-off of the Post...

-

Page 80

... awards based on our Common Stock, as well as performance-based annual and long-term incentive awards. We are authorized to issue a maximum of 168.0 million shares of our Common Stock under the 2005 Plan. In addition, under the Kraft Foods 2006 Stock Compensation Plan for NonEmployee Directors (the...

-

Page 81

... off-cycle shares of stock options during 2010 at a weighted-average exercise price of $29.73 on the date of grant, including options issued to Cadbury employees under our annual equity program. In February 2009, as part of our annual equity program, we granted 16.3 million stock options to eligible...

-

Page 82

...shares issued to Cadbury employees under our annual equity program. In aggregate, we issued 5.8 million restricted and deferred shares during 2010, including those issued as part of our long-term incentive plan. In January 2009, we granted 1.5 million shares of stock in connection with our long-term...

-

Page 83

... or deferred share, in 2008. The vesting date fair value of restricted and deferred stock was $117 million in 2010, $153 million in 2009, and $196 million in 2008. Note 11. Benefit Plans: Pension Plans Obligations and Funded Status: The projected benefit obligations, plan assets and funded status of...

-

Page 84

...fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Year-end discount rates for our non-U.S. plans (other than Canadian plans) were developed from local bond indices that match local benefit obligations as closely as possible. Changes in...

-

Page 85

...cost for the years ended December 31:

U.S. Plans 2010 2009 2008 2010 Non-U.S. Plans 2009 2008

Discount rate 5.85% 6.10% Expected rate of return on plan assets 7.99% 8.00% Rate of compensation increase 3.98% 4.00% Plan Assets: The fair value of pension plan assets at December 31, 2010 was determined...

-

Page 86

... funds. Fair value estimates are calculated for insurance contracts based on the future stream of benefit payments discounted using prevailing interest rates based on the valuation date. Below is a rollforward of our Level 3 assets for the year ended December 31, 2010.

January 1, 2010 Balance Asset...

-

Page 87

... pension plans totaling $30 million in 2010, $29 million in 2009, and $27 million in 2008. Postretirement Benefit Plans Obligations: Our postretirement health care plans are not funded. The changes in the accrued benefit obligation and net amount accrued at December 31, 2010 and 2009 were:

2010...

-

Page 88

...fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Year-end discount rates for our non-U.S. plans (other than Canadian plans) were developed from local bond indices that match local benefit obligations as closely as possible. Changes in...

-

Page 89

... discount rate of 6.3% in 2010 and 6.5% in 2009, an assumed ultimate annual turnover rate of 0.5% in 2010 and 2009, assumed compensation cost increases of 4.0% in 2010 and 2009, and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer employees...

-

Page 90

...

Level 2 financial assets and liabilities consist of commodity forwards; foreign exchange forwards, currency swaps, and options; and interest rate swaps. Commodity derivatives are valued using an income approach based on the observable market commodity index prices less the contract rate multiplied...

-

Page 91

... income taxes, as follows:

2010 2009 (in millions) 2008

Accumulated gain / (loss) at beginning of period Transfer of realized (gains) / losses in fair value to earnings Unrealized gain / (loss) in fair value Accumulated gain / (loss) at December 31 The effect of cash flow hedges for the years ended...

-

Page 92

... on hedged long-term debt and the offsetting loss or gain on the related interest rate swap in interest and other expense, net. Hedges of Net Investments in Foreign Operations: The effect of hedges of net investments in foreign operations for the years ended December 31, 2010 and 2009 was:

2010 Gain...

-

Page 93

...on our financial results. In 2010, we recorded an insignificant amount of legal charges. In 2009, we recorded $50 million of charges for legal matters related to certain of our European operations. Third-Party Guarantees: We have third-party guarantees primarily covering the long-term obligations of...

-

Page 94

... 1,136 $

The 2010 earnings and gain from discontinued operations from the sale of the Frozen Pizza business included tax expense of $1.2 billion. Additionally, the 2008 earnings and gain from discontinued operations from the split-off of the Post cereals business included a net tax benefit of $104...

-

Page 95

... reasons for the years ended December 31, 2010, 2009 and 2008:

2010 2009 (2009 & 2008 revised) 2008

U.S. federal statutory rate Increase / (decrease) resulting from: State and local income taxes, net of federal tax benefit excluding IRS audit impacts Benefit principally related to reversal of...

-

Page 96

... audit and the resolution of several items in our international operations, partially offset by a $137 million write-off of deferred tax assets as a result of the U.S. health care legislation enacted in March 2010. Our 2009 effective tax rate included net tax benefits of $225 million, primarily due...

-

Page 97

...:

For the Years Ended December 31, 2010 2009 2008 (in millions, except per share data; 2009 & 2008 revised)

Earnings from continuing operations Earnings and gain from discontinued operations, income taxes Net earnings Noncontrolling interest Net earnings attributable to Kraft Foods

$ net of...

-

Page 98

... options for the year ended December 31, 2008. Note 16. Segment Reporting: We manufacture and market packaged food products, including snacks, beverages, cheese, convenient meals and various packaged grocery products. We manage and report operating results through three geographic units: Kraft Foods...

-

Page 99

...in segment operating income as follows:

For the Years Ended December 31, 2010 2009 (in millions) 2008

Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets

$

(6) -

$

11 (17...

-

Page 100

Gains / (losses) on divestitures, net

$

(6) 95

$

(6)

$

(92)

-

Page 101

... balances. For the Years Ended December 31, 2010 2009 (in millions; 2009 & 2008 revised) 2008

Depreciation expense: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total...

-

Page 102

..., Kraft Foods Europe and Kraft Foods Developing Markets into sector components, were:

For the Year Ended December 31, 2010 Kraft Foods North America Kraft Foods Europe (in millions) Kraft Foods Developing Markets

Total

Biscuits (1) Confectionery (1) Beverages Cheese Grocery Convenient Meals Total...

-

Page 103

... to Kraft Foods: Continuing operations Discontinued operations Net earnings attributable to Kraft Foods Diluted EPS attributable to Kraft Foods: Continuing operations Discontinued operations Net earnings attributable to Kraft Foods Dividends declared Market price - high - low

$ $ $ net of income...

-

Page 104

... presented. Accordingly, the sum of the quarterly EPS amounts may not equal the total for the year. During 2010, we recorded the following pre-tax charges / (gains) in earnings from continuing operations:

2010 Quarters First Second (in millions) Third Fourth

Asset impairment and exit costs (Gains...

-

Page 105

...-year program includes the delivery of SAP enterprise software applications and business solutions. During the quarter ended December 31, 2010, we transitioned some of our processes and procedures into the SAP control environment within Kraft Foods North America and Kraft Foods Developing Markets...

-

Page 106

... with management and director authorization; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of assets that could have a material effect on the consolidated financial statements.

Internal control over financial reporting...

-

Page 107

... consolidated balance sheets and the related consolidated statements of earnings, equity and cash flows present fairly, in all material respects, the financial position of Kraft Foods Inc. and its subsidiaries at December 31, 2010 and 2009, and the results of their operations and their cash flows...

-

Page 108

... of deferred and long-term incentive plan stock.

Information related to the security ownership of certain beneficial owners and management is included in our 2011 Proxy Statement under the heading "Ownership of Equity Securities" and is incorporated by reference into this Annual Report. Item 13...

-

Page 109

... Balance Sheets at December 31, 2010 and 2009 Consolidated Statements of Equity for the years ended December 31, 2010, 2009 and 2008 Consolidated Statements of Cash Flows for the years ended December 31, 2010, 2009 and 2008 Notes to Consolidated Financial Statements Report of Management on Internal...

-

Page 110

... the year ended December 31, 1995).+ Kraft Foods Inc. 2006 Stock Compensation Plan for Non-Employee Directors, amended as of December 31, 2008 (incorporated by reference to Exhibit 10.14 to the Registrant's Annual Report on Form 10-K filed with the SEC on February 27, 2009).+ Kraft Foods Inc. 2001...

-

Page 111

... materials from Kraft Foods' Annual Report on Form 10-K for the fiscal year ended December 31, 2010, formatted in XBRL (eXtensible Business Reporting Language): (i) the Consolidated Statements of Earnings, (ii) the Consolidated Statements of Equity, (iii) the Consolidated Balance Sheets, (iv) the...

-

Page 112

...duly authorized. KRAFT FOODS INC. By: /s/ TIMOTHY R. MCLEVISH (Timothy R. McLevish, Executive Vice President and Chief Financial Officer)

Date: February 28, 2011 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf...

-

Page 113

... 28, 2011 appearing in the 2010 Annual Report on Form 10-K of Kraft Foods Inc. also included an audit of the financial statement schedule listed in Item 15(a) of this Form 10-K. In our opinion, this financial statement schedule presents fairly, in all material respects, the information set forth...

-

Page 114

Kraft Foods Inc. and Subsidiaries Valuation and Qualifying Accounts for the years ended December 31, 2010, 2009 and 2008 (in millions)

Col. A

Col. B Balance at Beginning of Period Charged to Costs and Expenses

Col. C Additions Charged to Other Accounts (a)

Col. D

Col. E Balance at End of Period...

-

Page 115

.... AMENDED AND RESTATED 2005 PERFORMANCE INCENTIVE PLAN RESTRICTED STOCK AGREEMENT FOR KRAFT FOODS COMMON STOCK KRAFT FOODS INC., a Virginia corporation (the "Company"), hereby grants to the employee (the "Employee") named in the Award Statement (the "Award Statement") attached hereto, as of the date...

-

Page 116

... to the then-current international assignment and tax and/or social insurance equalization policies and procedures of the Kraft Foods Group, or arrangements satisfactory to the Company for the payment thereof have been made. In this regard, the Employee authorizes the Company and/or the Employer, in...

-

Page 117

..., dismissal, end of service payments, bonuses, long-service awards, pension, retirement or welfare benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for any member of the Kraft Foods Group; (h) the Restricted Shares grant...

-

Page 118

... contract with any member of the Kraft Foods Group, on or after the date specified as the normal retirement age in the pension plan or employment contract, if any, under which the Employee is at that time accruing pension benefits for his or her current service (or, in the absence of a specified...

-

Page 119

... the Kraft Foods Group, in each case subject to any Board or Committee action specifically addressing any such adjustments, cash payments, or continued employment treatment. 15. Electronic Delivery. The Company may, in its sole discretion, decide to deliver any documents related to current or future...

-

Page 120

...PERFORMANCE INCENTIVE PLAN NON-QUALIFIED U.S. STOCK OPTION AWARD AGREEMENT KRAFT FOODS INC., a Virginia corporation (the "Company"), hereby grants to the employee identified in the Award Statement (the "Optionee" identified in the "Award Statement") attached hereto under the Kraft Foods Inc. Amended...

-

Page 121

...by the Kraft Foods Group, and (ii) when he or she is no longer actively employed by a corporation, or a parent or subsidiary thereof, substituting a new option for this Option (or assuming this Option) in connection with a merger, consolidation, acquisition of property or stock, separation, split-up...

-

Page 122

...provide for cash payments in lieu of the Option, and to determine whether continued employment with any entity resulting from such transaction or event will or will not be treated as a continued employment with the Kraft Foods Group, in each case, subject to any Board of Director or Committee action...

-

Page 123

... relating in any way to, past services for the Company or the Employer; (h) the Option grant and the Optionee's participation in the Plan will not be interpreted to form an employment contract or relationship with any member of the Kraft Foods Group; (i) the future value of the underlying shares of...

-

Page 124

... Kraft Foods Group, or under an employment contract with any member of the Kraft Foods Group, on or after the date specified as normal retirement age in the pension plan or employment contract, if any, under which the Optionee is at that time accruing pension benefits for his or her current service...

-

Page 125

... the application of such terms is necessary or advisable in order to comply with local law or facilitate the administration of the Plan. The Appendix constitutes part of this Agreement. IN WITNESS WHEREOF, this Non-Qualified U.S. Stock Option Award Agreement has been granted as of KRAFT FOODS INC...

-

Page 126

... establishing a direct relationship between the payment of bonuses to certain of the officers and other employees of the Company and the financial success of the Company in order to enhance shareholder value. As such, the Committee hereby establishes the Kraft Foods Inc. Long-Term Incentive Plan, as...

-

Page 127

...the Company or an Affiliate and who has been designated as receiving a base salary in Band F or above as of July 1st of the first year of the applicable Performance Cycle. Section 1.8 - GAAP. "GAAP" means United States generally accepted accounting principles. Section 1.9 - Kraft Foods Group. "Kraft...

-

Page 128

..., operating cash flow, free cash flow, cash flow return on equity, and cash flow return on investment), earnings before or after taxes, interest, depreciation, and/or amortization, gross or operating margins, productivity ratios, share price (including, but not limited to, growth measures and total...

-

Page 129

... LTIP Award. Performance Goals may be determined on an absolute basis or relative to internal goals or relative to levels attained in prior years or related to other companies or indicies or as ratios expressing relationships between two or more Performance Goals. In addition, Performance Goals may...

-

Page 130

... Award that is paid, in whole or in part, in the form of an LTIP Award Share Payout, and that results in less than a whole number of shares of Common Stock shall be rounded up to the next whole share of Common Stock (no fractional shares of Common Stock shall be issued in payment of an LTIP Award...

-

Page 131

... payment shall not constitute good standing for purposes of this Plan. For Participants residing outside the United States, and unless otherwise required by local law as determined by the Company on a country-by-country basis, in the event of termination of the Participant's employment (whether...

-

Page 132

...shall be paid at the same time that all other Participants are paid the LTIP Award in accordance with Section 3.4 hereof, and in any event within 90 days following the end of the applicable Performance Cycle. If the Company determines that there has been a legal judgment and/ or legal development in...

-

Page 133

... an LTIP Award Cash Payout or LTIP Award Share Payout (including any specific adjustments to be made under Section 2.3 hereof). The Performance Goals (including any adjustments resulting in an increase to the amount payable under the LTIP Award) shall be established in writing by the Committee...

-

Page 134

...the extent permitted by applicable law, the Committee may also consist of one or more officers of the Company in the case of LTIP Awards not intended to constitute Qualified Performance-Based Compensation granted to Eligible Employees who are not (i) subject to Section 16 of the Exchange Act of 1934...

-

Page 135

... calendar year beginning January 1, 2011. Section 6.3 - No Fiduciary Relationship. The Board and the officers of the Company shall have no duty to manage or operate the LTI Plan in order to maximize the benefits granted to the Participants hereunder, but rather shall have full discretionary power to...

-

Page 136

.... Nothing in the LTI Plan shall provide a basis for any person to take action against the Company or any affiliate based on matters covered by Section 409A of the Code, including the tax treatment of any amount paid or LTIP Award made under the LTI Plan, and neither the Company nor any of its...

-

Page 137

Exhibit 10.14 KRAFT EXECUTIVE DEFERRED COMPENSATION PLAN - PLAN DOCUMENT -

-

Page 138

... the Employer (as defined below), and to allow such Employees or Other Service Providers the opportunity to defer a portion of their current salaries, bonuses and other compensation, subject to the terms of the Plan. Participants (and their Beneficiaries) shall have only those rights to payments as...

-

Page 139

.... Any notice or document relating to the Plan which is to be filed with the Administrator may be delivered, or mailed by registered or certified mail, postage pre-paid, to the Administrator, or to any designated representative of the Administrator, in care of the Employer, at its principal office. 2

-

Page 140

... shall constitute a part of the Plan. 2.4 Beneficiary "Beneficiary" means the person or persons to whom a deceased Participant's benefits are payable under subsection 9.5. 2.5 Board "Board" means the Board of Directors of the Employer (if applicable), as from time to time constituted. 2.6 Board...

-

Page 141

... key employees under subsection 9.3 of the Plan shall be determined solely in accordance with subsection 9.3. To the extent not otherwise designated by the Employer in a separate document forming part of the Plan, Compensation payable after December 31 of a given year solely for services performed...

-

Page 142

... salary payments or Non-Performance Based Bonuses based on service periods other than the Employer's fiscal year would not be Fiscal Year Compensation. 2.19 Investment Funds "Investment Funds" means the notional funds or other investment vehicles designated by the Administrator from time to time...

-

Page 143

... shall not apply. To the extent that an Other Service Provider uses an accrual method of accounting for a given taxable year, amounts deferred under the Plan in such taxable year shall not be subject to Code Section 409A and other applicable guidance thereunder, notwithstanding any provision of the...

-

Page 144

... shall not be considered a Termination of Employment. 2.32 Valuation Date "Valuation Date" means the last day of each Plan Year and any other date that the Employer, in its sole discretion, designates as a Valuation Date, as of which the value of an Investment Fund is adjusted for notional deferrals...

-

Page 145

.... However, the balance credited to the Participant's Accounts shall continue to be adjusted for notional investment gains, losses, and expenses under the terms of the Plan and shall be distributed to him at the time and manner set forth in Section 9. 3.3 Eligibility for Employer Contributions

An...

-

Page 146

... Section 409A during a Plan Year (by virtue of a promotion, Compensation increase, commencement of employment with the Employer, execution of an agreement to provide services to an Employer, or any other reason) shall be provided enrollment documents (including Deferral Election forms) as soon as...

-

Page 147

... payment of his total Account balances under the Plan, and on or before the date of the last payment was not eligible to participate in this Plan or (ii) did not previously receive payment of his total Account balances under the Plan, but is rehired (or recommences providing services to an Employer...

-

Page 148

... Regulations §1.409A-2(a)(8). An Employee or Other Service Provider who first becomes an Eligible Individual during a Plan Year (by virtue of a promotion, Compensation increase, commencement of employment with the Employer, execution of an agreement to provide services to an Employer, or any other...

-

Page 149

... is on file, then such amounts shall be paid to him in a single lump sum). Performance-Based Bonus Deferrals shall be credited to the Participant's Compensation Deferral Account as soon as administratively feasible after such amounts would have been payable to the Participant. 4.3 Other Employer...

-

Page 150

... adjusted from time to time pursuant to the terms of the Plan). The Administrator may limit a Participant's Deferral Election if, as a result of any election, a Participant's Compensation from the Employer would be insufficient to cover taxes, withholding, and other required deductions applicable to...

-

Page 151

... to time establish new Investment Funds or eliminate existing Investment Funds. The Investment Funds are for recordkeeping purposes only and do not allow Participants to direct any Employer assets (including, if applicable, the assets of any trust related to the Plan). Each Participant's Accounts...

-

Page 152

notional Investment Fund transfers in accordance with rules established from time to time by the Employer or the Administrator, and in accordance with subsection 5.2. 15

-

Page 153

... Valuation Date. The "value" of an Investment Fund at any Valuation Date may be based on the fair market value of the Investment Fund, as determined by the Administrator in its sole discretion. 6.3 Accounting Methods

The accounting methods or formulae to be used under the Plan for purposes of...

-

Page 154

... be returned to the Employer. Neither the Administrator nor the Employer guarantee the Participant's Account balance from loss or depreciation. Notwithstanding any provision of the Plan to the contrary, the Participant's Account balance is subject to Section 8. Vesting Years of Service in the event...

-

Page 155

... or other person shall acquire by reason of the Plan any right in or title to any assets, funds, or property of the Employer whatsoever, including, without limiting the generality of the foregoing, any specific funds, assets, or other property of the Employer. Benefits under the Plan are unfunded...

-

Page 156

... that the applicable In-Service Distribution date may not be earlier than the number of years designated by the Employer in the Adoption Agreement following the year in which the applicable Compensation would have been paid absent the deferral, or as further determined or limited in accordance...

-

Page 157

..., in the event a Change in Control of the Employer occurs) prior to the date the Participant had previously elected to have an In-Service Distribution payment made to him, such amount shall be paid to the Participant under the rules applicable for payment on Termination of Employment in accordance...

-

Page 158

... full payment of his Accounts, payments will continue to be made to his Beneficiary in the same manner and at the same time as would have been payable to the Participant, but substituting the Participant's date of death for the Participant's Retirement Date. To the extent elected by the Employer in...

-

Page 159

... designated by the Employer in a separate document forming a part of the Plan, the definition of compensation used to determine key employee status shall be determined under Treas. Reg. § 1.415(c)-2(a). This subsection 9.3 is applicable only with respect to companies whose stock is publicly traded...

-

Page 160

... to such rehire or return to service. See subsections 4.1 and 4.2 of the Plan for special rules applicable to deferral elections for rehired or ReEligible Participants. 9.7 Special Distribution Rules

Except as otherwise provided herein and in Section 12, Account balances of Participants in this...

-

Page 161

... or other applicable laws. Payments intended to pay employment taxes or payments made as a result of income inclusion of an amount in a Participant's Accounts as a result of a failure to satisfy Section 409A of the Code shall be permitted at the Employer or Administrator's discretion at any time and...

-

Page 162

... of this Section 9.9. If plan payments are made on account of a Change in Control and are calculated by reference to the value of the Employer's stock, such payments shall be completed not later than 5 years after the Change in Control event. To the extent designated by the Employer in the Adoption...

-

Page 163

...had a current Account balance (regardless of whether or not the Participant actually was making Compensation Deferrals at the time of his death); The Participant was an active Employee with the Employer at the time of his death; The Participant completed and submitted an insurance application to the...

-

Page 164

...or claim to any benefit under the Plan, unless such right or claim has specifically accrued under the terms of the Plan. The Employer expressly reserves the right to discharge any Employee at any time. 10.3 Litigation by Participants or Other Persons If a legal action begun against the Administrator...

-

Page 165

... singular. 10.11 Examination of Documents Copies of the Plan and any amendments thereto are on file at the office of the Employer where they may be examined by any Participant or other person entitled to benefits under the Plan during normal business hours. 10.12 Elections Each election or request...

-

Page 166

... Administrator for distribution of the Accounts within 7 years after the date the Accounts are frozen, and if the Administrator or Employer determines that such claim is valid, then the frozen balance shall be paid by the Employer to the Participant or Beneficiary in a lump sum cash payment as soon...

-

Page 167

...or Employer may, at its option, deduct the amount of such excess or erroneous payment from any future benefits payable to the applicable Participant, Spouse, or Beneficiary. 10.17 Effect on Other Benefits Except as otherwise specifically provided under the terms of any other employee benefit plan of...

-

Page 168

... 11. THE ADMINISTRATOR 11.1 Information Required by Administrator Each person entitled to benefits under the Plan must file with the Administrator from time to time in writing such person's mailing address and each change of mailing address. Any communication, statement, or notice addressed to any...

-

Page 169

... a court of law or equity for benefits under the Plan until the Plan's claim process and appeal rights have been exhausted and the Plan benefits requested in that appeal have been denied in whole or in part. However, the claimant may only bring a suit in court if it is filed within 90 days after the...

-

Page 170

... the claimant is entitled to receive, upon request and free of charge, access to and copies of all documents, records and other information relevant to the benefit claim, and (iv) a statement regarding the claimant's right to bring a civil action under Section 502(a) of ERISA following a denial on...

-

Page 171

... such amendment. The Employer's power to amend the Plan includes (without limitation) the power to change the Plan provisions regarding eligibility, contributions, notional investments, vesting, distribution forms, and timing of payments, including changes applicable to benefits accrued prior to the...

-

Page 172

Exhibit 10.15 KRAFT EXECUTIVE DEFERRED COMPENSATION PLAN ADOPTION AGREEMENT This adoption agreement and the accompanying plan document have not been approved by the Department of Labor, Internal Revenue Service, Securities Exchange Commission, or any other governmental entity. Employers may not rely...

-

Page 173

...under the terms of the prior plan document. Restatement of Previous Nonqualified Deferred Compensation Plan - Kraft Foods Global, Inc. (the "Employer") previously has adopted a Nonqualified Deferred Compensation Plan, known as the Kraft Executive Deferred Compensation Plan, and the execution of this...

-

Page 174

... Corporate Compensation and the Executive Vice President, Human Resources [fill in the name(s) of the individual(s) or job title(s) or entity (such as a committee) that is (are) responsible for administration of the Plan], and such other person(s) or entity as the Employer shall appoint from time...

-

Page 175

... immediately upon properly completed designation by the Plan administrator or Employer; Eligible after the following period of employment, Board service, etc. [enter number of days, months or years, for example, 90 days] 30 days; Other [enter description]:

7.

Types and Amounts of Participant...

-

Page 176

...¨

Other Service Provider Fees or other earned income from the Employer: ¨ % and, maximum

¨ ¨ 8.

401(k) Refund (amount deferred from Participant's regular Compensation equal in value to any refund paid to Participant in that year resulting from excess deferrals in Employer's 401(k) plan - see...

-

Page 177

... Compensation as in Employer's 401(k) or other applicable qualified retirement plan, earned while the Participant is an Eligible Individual, as determined by the Employer. Participant's total wages, salary, commissions, overtime, bonus, etc. for a given year which the Employer is required to report...

-

Page 178

...¨ (b) At a percentage determined from time to time in the discretion of the Employer of each Participant's Compensation Deferrals for the applicable period (percentage should be documented in writing when determined, and such writings will form part of the plan). or [Optional: If 11(a) or (b) above...

-

Page 179

... last day of the Plan Year or who retired, died or were Disabled during the Plan Year, or, in the case of Other Service Providers, who provided services to the Employer on the last day of the Plan Year or who died or were Disabled during the Plan Year. [If this option is selected, complete Item 30...

-

Page 180

... or restatement of a prior plan, definition from prior plan will override this definition.] x ¨ ¨ Years of service (12-consecutive-month periods) with the Employer since date of hire (or date of commencement of Board service). Years of participation in the Plan (12-consecutive-month period between...

-

Page 181

... in Control of the Employer [complete Items 28 and 29 - definition of "Change in Control"] 100% vesting upon occurrence of other event: [describe event]

¨

¨ ¨ ¨ ¨ 18.

Service Before Plan's Establishment Excluded. Years of service earned prior to establishment of the Plan shall be disregarded...

-

Page 182

....

Employer Stock as Deemed Investment Option. If Employer stock will be a deemed investment option, indicate below how shares are to be tracked: [select one] ¨ x Partial and whole shares. Unitized fund.

21.

In-Service Distributions. If the Employer elects below, the Plan will allow distributions...

-

Page 183

...after age 53 with at least 5 Vesting Years of Service. Early Retirement [describe criteria such as age (must be whole years), years of service with the Employer (must be whole years of service), or years of participation in the Plan (must be whole years of participation)] Termination (other than for...

-

Page 184

... number of years].

28.

"Change in Control" - Dates of Distribution. Distributions upon a Change in Control shall occur upon [select all that apply - see Subsection 9.9 of the Plan document for more details]: x The consummation of a merger of consolidation of Kraft Foods Inc. and another company...

-

Page 185

... Kraft Foods Inc. The date that a person or group acquires ownership of 20% or more of the outstanding voting securities of Kraft Foods Inc. excluding, however, the following: (a) any acquisitions by Kraft Foods Inc. or any of it affiliates; (b) any acquisition by an employee benefit plan or related...

-

Page 186

...In the event that life insurance is utilized as a funding vehicle for the Plan, the Employer may wish to provide additional Survivor Benefit from the following options: [select one] x ¨ ¨ ¨ No additional Survivor Benefit offered, but rather Participant's vested Account balance. Face value of life...

-

Page 187

... from the Participant accounts and Plan's trust or other custodial account (mutual fund plans only, if applicable).

"De Minimis" Small Amount Cashouts. If selected by the Employer, Participant account balances that do not exceed a certain threshold amount will be automatically cashed out upon the...

-

Page 188

...law relating to nonqualified deferred compensation or other employee benefit plans may require that the Plan be amended. * * *

The undersigned duly authorized owner, or officer of the Employer hereby executes the Plan on behalf of the Employer. Dated this 1 day of May, 2009. Kraft Foods Global, Inc...

-

Page 189

... of your compensation and benefits that will apply to this offer. Annualized Compensation (Range of Opportunity)

Target - Maximum

Annual Base Salary Annual Incentive Plan (Target - 60%) Long-Term Incentive Plan (Target - 85%) Annual Equity Award Range Total Annual Compensation * Target as a percent...

-

Page 190

...: Cash Sign-On Incentive Equity Sign-On Incentive $800,000 paid as follows: one-half paid at hire and one-half paid on 1st anniversary; both payments will have a two-year repayment agreement $600,000 restricted stock award to vest one-half over two years; you will receive dividends on the shares...

-

Page 191

...stock held directly or indirectly, unvested restricted stock or share equivalents held in the Company's 401(k) plan. It does not include unexercised stock option shares. Other Benefits Your offer includes Kraft's comprehensive benefits package available to full-time salaried employees. This benefits...

-

Page 192

... not subject to liquidation or exchange for any other benefit.

This offer is contingent upon successful completion of our pre-employment checks, which may include a background screen, reference check, and post-offer drug test pursuant to testing procedures determined by Kraft Foods. If you have any...

-

Page 193

December 21, 2010 Page 5 of 5 Executive Vice President - Global Human Resources I accept the offer as expressed above. /s/ Sam Rovit Signature Enclosure: Kraft Foods Benefits Summary Restricted Stock Agreement Employee Expense Repayment Agreement 5 January 14, 2011 Date

-

Page 194

... Kraft Foods Inc. and Subsidiaries Computation of Ratios of Earnings to Fixed Charges (in millions of dollars)

Years Ended December 31, 2010 2009 2008 2007 2006

Earnings from continuing operations before income taxes Add / (Deduct): Equity in net earnings of less than 50% owned affiliates Dividends...

-

Page 195

... Organization

Country of Incorporation/ Organization

152999 Canada Inc. 1567159 Alberta ULC 1567163 Alberta ULC 1567165 Alberta ULC 3072440 Nova Scotia Company AB Kraft Foods Lietuva Abades B.V. Aberdare Developments Ltd. Aberdare Two Developments Limited ACN 001 882 953 Pty Ltd Adams Marketing...

-

Page 196

... Importation L.L.C. Cadbury Egypt For Trade S.A.E. Cadbury Egypt Group For Food Industries Company S.A.E. Cadbury Egypt S.A.E. Cadbury Enterprises Holdings B.V. Cadbury Enterprises Pte. Ltd. Cadbury Espana, S.L. Cadbury Europe S.A. Cadbury Finance Pty Limited Cadbury Financial Services Cadbury Food...

-

Page 197

...Cadbury International Limited Cadbury Ireland Export Limited Cadbury Ireland Limited Cadbury Ireland Sales Ltd Cadbury Japan Ltd. Cadbury Kenya Limited Cadbury Limited Cadbury Limited Cadbury Marketing Services Pty Limited Cadbury Mauritius Ltd Cadbury Mexico Investments B.V. Cadbury Morocco Cadbury...

-

Page 198

... Limited Chapelat-Humphries Investments (Pty) Limited Cheil Communications Inc. Chromium Acquisitions Limited Chromium Assets Limited Chromium Suchex LLP Chromium Suchex No. 2 LLP Churny Company, Inc. Clarnico Limited Clarnico-Murray Limited Claussen Pickle Co. Closed Joint Stock Company Kraft Foods...

-

Page 199

... Forsanet Enterprises Limited Freezer Queen Foods (Canada) Limited Freia A/S Fulmer Corporation Limited Galactogen Products Limited Generale Biscuit Egypt S.A.E. Generale Biscuit Glico France Generale Biscuit SAS Geo Bassett & Co Limited Georges Beverages India Private Limited Gernika, B.V. G-Push...

-

Page 200

... Kraft Foods Argentina S.A. Kraft Foods Asia Pacific Services LLC Kraft Foods Asia-Pacific Services Pte. Ltd. Kraft Foods Ausser-Haus Service GmbH Kraft Foods Australia Investments Limited Kraft Foods Aviation, LLC Kraft Foods Bakery Companies, Inc. Kraft Foods Belgium Biscuits Production BVBA Kraft...

-

Page 201

... Kraft Foods Europe Services GmbH Kraft Foods European Business Services Centre s.r.o. Kraft Foods European Business Services Centre, S.L.U. Kraft Foods Finance Europe AG Kraft Foods Financing Luxembourg Sarl Kraft Foods Finland Production Oy Kraft Foods France Antille Guyane Distribution SAS Kraft...

-

Page 202

... International Europe Holdings LLC Kraft Foods International Holdings Delaware LLC Kraft Foods International Services LLC Kraft Foods International, Inc. Kraft Foods Investments (New Zealand) Kraft Foods Ireland Limited Kraft Foods Italia Intellectual Property S.r.l. Kraft Foods Italia Production...

-

Page 203

... Kraft Foods South Africa (Proprietary) Limited Kraft Foods Strasbourg Production S.N.C. Kraft Foods Sverige AB Kraft Foods Sverige Holding AB Kraft Foods Sverige Intellectual Property AB Kraft Foods Sverige Production AB Kraft Foods Taiwan Holdings LLC Kraft Foods Taiwan Limited Kraft Foods Trading...

-

Page 204

... Argentina LLC Neilson International Limited NISA Holdings LLC NSA Holdings, L.L.C. Nuthatch Trading Limited UK OAO Bolshevik OAO United Bakers - Pskov OKO - Pannon Kft. OMFC Service Company Onko Grossroesterei GmbH OOO Kraft Foods Rus OOO Kraft Foods Sales and Marketing

Delaware

Delaware

Nevada...

-

Page 205

... Corporation Phenix Management Corporation Pollio Italian Cheese Company Productos Kraft S. de. R.L. de C.V. Produtos Alimenticios Pilar Ltda. Promotora Cadbury Adams, C.A. PT Kraft Foods Indonesia Limited PT Kraft Indonesia PT. Cadbury Indonesia PT. Cipta Manis Makmur Reading Scientific Services...

-

Page 206

... Jellies Limited Trebor Sales Sdn. Bhd. United Biscuits Snacks (Shenzhen) Ltd. US Gum Investments Inc. Van Mar SA Vantas International Limited Vict. Th. Engwall & Co., Inc. West Indies Yeast Company Limited Xtrapack Limited Yili-Nabisco Biscuit & Food Company Limited Zonemerit Limited

Oregon

New...

-

Page 207

...137021) of Kraft Foods Inc. of our reports dated February 28, 2011 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in this Annual Report on Form 10-K. /s/ PricewaterhouseCoopers LLP Chicago, Illinois...

-

Page 208

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who...

-

Page 209

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who...

-

Page 210

... Exchange Act of 1934 and that the information contained in Kraft Foods' Annual Report on Form 10-K fairly presents in all material respects Kraft Foods' financial condition and results of operations. /s/ IRENE B. ROSENFELD Irene B. Rosenfeld Chairman and Chief Executive Officer February 28, 2011...