Chrysler 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 77

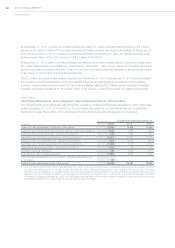

Notes Issued Under The GMTN Programme

Certain notes issued by the Group, excluding FCA US, are governed by the terms and conditions of the GMTN

Programme. A maximum of €20 billion may be used under this program, of which notes of approximately €10.3 billion

were outstanding at December31, 2015 (€12.1 billion at December31, 2014). The GMTN Programme is guaranteed

by FCA, which may from time to time buy back notes in the market that have been issued. Such buybacks, if made,

depend upon market conditions, the Group’s financial situation and other factors which could affect such decisions.

Changes in notes issued under the GMTN Programme during 2015 were due to the:

repayment at maturity of two notes that had been issued by Fiat Chrysler Finance Europe S.A, one with a principal

value of €1,500 million and one with a principal value of CHF 425 million (€390 million).

Changes in notes issued under the GMTN Programme during 2014 were due to the:

issuance of 4.75 percent notes at par in March 2014, having a principal of €1 billion and due March 2021 by Fiat

Chrysler Finance Europe S.A;

issuance of 4.75 percent notes at par in July 2014, having a principal of €850 million and due July 2022 by Fiat

Chrysler Finance Europe S.A; the notes issuance was reopened in September 2014 for a further €500 million

principal value, priced at 103.265 percent of par value, increasing the total principal amount to €1.35 billion;

issuance of 3.125 percent notes at par in September 2014 having a principal of CHF 250 million and due

September 2019 by Fiat Chrysler Finance Europe S.A.; and

repayment at maturity of two notes that had been issued by Fiat Chrysler Finance Europe S.A, one with a principal

value of €900 million and one with a principal value of €1,250 million.

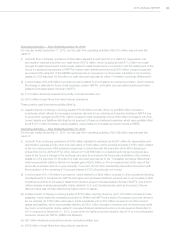

The notes issued by Fiat Chrysler Finance Europe S.A. and by Fiat Chrysler Finance North America Inc. impose

covenants on the issuer and, in certain cases, on FCA as guarantor, which include: (i)negative pledge clauses

which require that, in case any security interest upon assets of the issuer and/or FCA is granted in connection with

other notes or debt securities having the same ranking, such security should be equally and ratably extended to the

outstanding notes; (ii)pari passu clauses, under which the notes rank and will rank pari passu with all other present

and future unsubordinated and unsecured obligations of the issuer and/or FCA; (iii)periodic disclosure obligations;

(iv)cross-default clauses which require immediate repayment of the notes under certain events of default on other

financial instruments issued by FCA’s main entities; and (v)other clauses that are generally applicable to securities of a

similar type. A breach of these covenants may require the early repayment of the notes. At December 31, 2015, FCA

was in compliance with the covenants of the GMTN Programme.

FCA US Secured Senior Notes

In February 2014, FCA US and certain of its U.S. subsidiaries, either as a co-issuer or guarantor, issued additional

secured senior notes:

secured senior notes due 2019 – U.S.$1,375 million (€1,133 million at December 31, 2014) aggregate principal

amount of 8.0 percent secured senior notes due June15, 2019 (collectively with the May 2011 issuance of

U.S.$1,500 million (€1,235 million at December 31, 2014) secured senior notes due 2019, the “2019 Notes”) at an

issue price of 108.25 percent of the aggregate principal amount; and

secured senior notes due 2021 – U.S.$1,380 million (€1,137 million at December 31, 2014) aggregate principal

amount of 8.25 percent secured senior notes due June15, 2021 (collectively with the May 2011 issuance of

U.S.$1,700 million (€1,400 million at December 31, 2014) secured senior notes due 2021, the “2021 Notes”) at an

issue price of 110.50 percent of the aggregate principal amount.

The 2019 Notes and 2021 Notes are collectively referred to as the “Secured Senior Notes”.

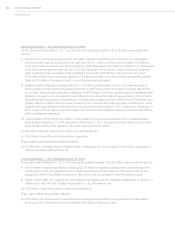

On May 14, 2015, FCA US prepaid its 2019 Notes with an aggregate principal outstanding amount of U.S.$2,875

million (€2,518 million) at a price equal to the principal amount of the notes redeemed, plus accrued and unpaid

interest to the date of redemption and a “make-whole” premium calculated in accordance with the terms of the

indenture. The redemption payment of U.S.$3.1 billion (€2.7 billion) was made with cash on hand at FCA US.