Chrysler 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 55

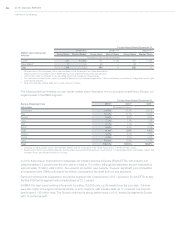

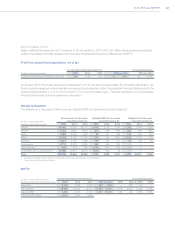

Other income/(expenses)

For the Years Ended December 31, Increase/(decrease)

(€ million, except percentages) 2015 2014 2013 2015 vs. 2014 2014 vs. 2013

Other income/(expenses) 152 (26) (28) 178 n.m.(1) (2) (7.1)%

(1) Number is not meaningful.

2015 compared to 2014

Other income/(expenses) for the year ended December31, 2015 included €104 million of income related to the

favorable settlements of legal matters to which we were the plaintiff, and which has been excluded from Adjusted

EBIT. This was partially offset by a total charge of €81 million resulting from a consent order agreed with NHTSA on

July 24, 2015, (the “Consent Order”) which resolved the issues raised by NHTSA with respect to FCA US’s execution

of 23 recall campaigns in NHTSA’s Special Order issued to FCA US on May 22, 2015. Pursuant to the Consent Order,

FCA US made a U.S.$70 million (€63 million) cash payment to NHTSA in September 2015 and will spend U.S.$20

million (€18 million) on industry and consumer outreach activities and incentives to enhance certain recall and service

campaign completion rates. In addition, an amendment to the Consent Order was issued in December 2015 whereby

a penalty of U.S.$70 million (€63 million) was imposed by NHTSA following the Group’s admission of deficiencies in

its Transportation Recall Enhancement, Accountability and Documentation (“TREAD Act”) reporting to NHTSA (refer

to the section —Results by Segment - NAFTA below). The penalty was paid on January 6, 2016. There were no other

items that were individually material.

2014 compared to 2013

For the year ended December31, 2014, Other income/(expenses) included the €495 million expense recognized in

connection with the execution of the MOU with the UAW entered into by FCA US in January 2014, which was partially

offset by the non-taxable gain of €223 million on the remeasurement to fair value of the previously exercised options

on approximately 10 percent of FCA US’s membership interest in connection with the acquisition of the remaining

equity interest in FCA US previously not owned. There were no other items that were individually material.

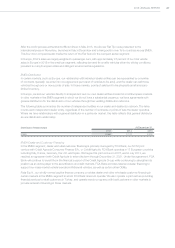

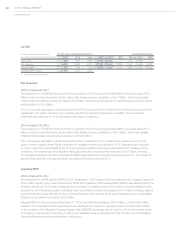

EBIT

For the Years Ended December 31, Increase/(decrease)

(€ million, except percentages) 2015 2014 2013 2015 vs. 2014 2014 vs. 2013

EBIT 2,625 2,834 2,638 (209) (7.4)% 196 7.4%

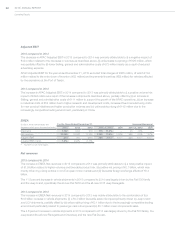

2015 compared to 2014

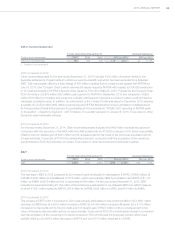

The decrease in EBIT in 2015 compared to 2014 was primarily attributable to decreases in (i) APAC of €690 million, (ii)

LATAM of €483 million and (iii) Maserati of €173 million, which were partially offset by increases in (iv)NAFTA of €1,172

million, (v) EMEA of €275 million and (vi) Components of €84 million. For the year ended December 31, 2015, EBIT

included net expenses totaling €2,169 million of items that were excluded from our Adjusted EBIT non-GAAP measure,

of which €1,631 million related to NAFTA, €219 million to LATAM, €205 million to APAC and €47 million to EMEA.

2014 compared to 2013

The increase in EBIT in 2014 compared to 2013 was primarily attributable to the combined effect of (i)a €397 million

decrease in EMEA loss, (ii) a €202 million increase in APAC (iii) a €169 million increase in Maserati, (iv) a €114 million

increase in Components and (v) the non-cash and non-taxable gain of €223 million on the re-measurement to fair

value of the previously exercised options on approximately 10 percent of FCA US’s membership interest in connection

with the acquisition of the remaining 41.5 percent interest in FCA US that was not previously owned, which were

partially offset by (vi) a €643 million decrease in NAFTA and (vi) a €315 million decrease in LATAM.