Chrysler 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 193

The equity contract meets the definition of an equity instrument as described in paragraph 16 of IAS 32 as the equity

contract does not include a contractual obligation to (i) deliver cash or another financial asset to another entity or (ii)

exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable

to FCA. Additionally, the equity contract is a non-derivative that includes no contractual obligation for FCA to deliver

a variable number of its own equity, as FCA controls its ability to settle for a fixed number of shares under the terms

of the contract. Management has determined that the terms of the contract are substantive as there are legitimate

corporate objectives that could cause FCA to seek early conversion of the Mandatory Convertible Securities. As a

result, the equity conversion feature has been accounted for as an equity instrument.

The obligation to pay coupons meets the definition of a financial liability as it is a contractual obligation to deliver cash

to another entity. FCA has the right to, or in certain limited circumstances, the investors can force FCA to prepay

the coupons, in addition to settling the equity conversion feature, before maturity. Under IFRS, the early settlement

features would be bifurcated from the financial liability for the coupon payments since they require the repayment of

the coupon obligation at an amount other than fair value or the amortized cost of the debt instrument as required by

IAS 39.AG30(g).

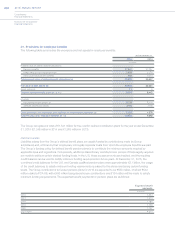

As required by paragraph 31 of IAS 32, the initial carrying amount of a compound financial instrument is allocated to

its equity and liability components. The equity component is assigned the residual amount after deducting the amount

separately determined for the liability component from the fair value of the instrument as a whole. The value of any

derivative features embedded in the compound financial instrument other than the equity component is included in the

liability component. Therefore, the financial liability for the coupon payments was initially recognized at its fair value.

The derivative related to the early settlement conversion features defined in the Mandatory Convertible Securities was

bifurcated from the financial liability for the coupon payments and are accounted for at fair value through profit and

loss. Subsequently, the financial liability related to the coupon payments is accounted for at amortized cost using the

effective interest method. The financial liabilities related to the embedded derivative features are remeasured to their

fair value at each reporting date with the remeasurement gains or losses being recorded in the Consolidated Income

Statement. The residual amount of the proceeds received from the issuance of the Mandatory Convertible Securities

were allocated to share reserves in Equity and are accordingly, not subsequently remeasured.

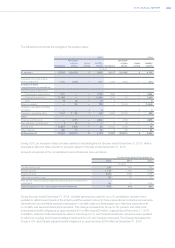

Under IAS 32, transaction costs that relate to the issue of a compound financial instrument are allocated to the liability

and equity components of the instrument in proportion to the allocation of proceeds. The portion allocated to the

equity component should be accounted for as a deduction from equity to the extent that they are incremental costs

directly attributable to the equity transaction. The portion allocated to the liability component (including third party

costs and creditor fees) are deducted from the liability component balance, are accounted for as a debt discount and

are amortized over the life of the coupon payments using the effective interest method.

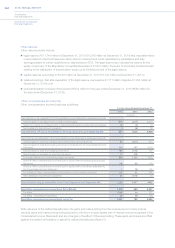

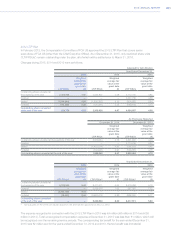

Net proceeds of U.S.$2,814 million (€2,245 million at date of issuance), consisting of gross proceeds of U.S.$2,875

million (€2,293 million) less total transaction costs of U.S.$61 million (€48 million) directly related to the issuance, were

received in connection with the issuance of the Mandatory Convertible Securities. The fair value amount determined

for the liability component at issuance was U.S.$419 million (€335 million) which was calculated as the present value

of the coupon payments due, less allocated transaction costs of U.S.$9 million (€7 million) that are accounted for

as a debt discount (Note 23). The remaining net proceeds of U.S.$2,395 million (€1,910 million) (including allocated

transaction costs of U.S.$52 million (€41 million) were recognized within equity reserves.