Chrysler 2015 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

224 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

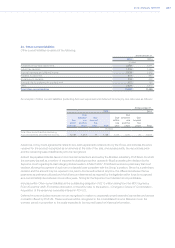

In 2014, the Chief Executive Officer received a cash award of €24.7 million and was assigned a €12 million post-

mandate award as recognition that he was instrumental in major strategic and financial accomplishments for the

Group. Most notably, through his vision and guidance, FCA was formed, creating enormous value for the Company,

its shareholders and stakeholders.

In 2014, Ferrari S.p.A. recorded a cost of €15 million in connection with the resignation of Mr. Luca Cordero di

Montezemolo, as Chairman of Ferrari S.p.A., former Director of Fiat.

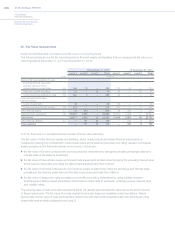

27. Explanatory notes to the Consolidated Statement of Cash Flows

The Consolidated Statement of Cash Flows sets out changes in Cash and cash equivalents during the year. As

required by IAS7 – Statement of Cash Flows, cash flows are separated into operating, investing and financing

activities. The effects of changes in exchange rates on cash and cash equivalents are shown separately under the line

item Translation exchange differences.

Non-cash items

For the year ended December 31, 2015, Other non-cash items of €812 million mainly included (i) €713 million non-

cash charges for asset impairments impairments which mainly related to asset impairments in connection with the

realignment of the Group’s manufacturing capacity in NAFTA to better meet market demand and (ii) €80 million

charge recognized as a result of the adoption of the SIMADI exchange rate to re-measure the net monetary assets of

the Group’s Venezuelan subsidiary in U.S.$ (Note 30) (reported, for the effect on cash and cash equivalents, within

Translation exchange differences).

For the year ended December 31, 2014, Other non-cash items of €348 million mainly included (i) €381 million related

to the non-cash portion of the expense recognized in connection with the execution of the UAW MOU entered into

by FCA US, as described in the section —Changes in the Scope of Consolidation -Acquisition of the remaining

ownership interest in FCA US and (ii) €98 million remeasurement charge recognized as a result of the Group’s change

in the exchange rate used to remeasure its Venezuelan subsidiary’s net monetary assets in U.S.$ (Note 30) (reported,

for the effect on cash and cash equivalents, within Translation differences), which were partially offset by (iii) the non-

taxable gain of €223 million on the remeasurement to fair value of the previously exercised options on approximately

10 percent of FCA US’s membership interest in connection with the acquisition of the remaining interest in FCA US

previously not owned.

For the year ended December 31, 2013, Other non-cash items of €531 million mainly included (i) €336 million of

impairment losses and asset write-offs on tangible and intangible assets, (ii) €59 million loss related to the devaluation

of the official exchange rate of the VEF relative to the U.S.$ (Note 30) and (iii) €56 million related to the write-off of the

book value of the right associated with the acquisition of the remaining interest in FCA US previously not owned.

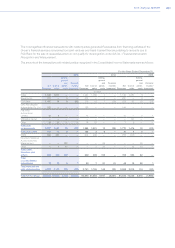

Change in working capital

For the year ended December 31, 2015, the negative change in working capital of €158 million was primarily driven by

(i)€958 million increase in inventories, which reflects the increased consumer demand for our vehicles and inventory

buildup in NAFTA due to production changeovers (ii)€191 million increase in trade receivables and (iii)€580million

increase in net other current assets and liabilities reflecting the net payment of taxes and deferred expenses, which were

partially offset by (iv)€1,571 million increase in trade payables, mainly related to increased production levels in EMEA.

For the year ended December 31, 2014, change in working capital of €779 million was primarily driven by (i)€1,470

million increase in trade payables, mainly related to increased production in EMEA and NAFTA as a result of increased

consumer demand for our vehicles, (ii)€106 million decrease in trade receivables and (iii)€24 million increase in net

other current assets and liabilities, which were partially offset by (iv)€821 million increase in inventory (net of vehicles

sold under buy-back commitments), mainly related to increased finished vehicle and work in process levels at

December31, 2014 compared to December31, 2013, in part driven by higher production levels in late 2014 to meet

anticipated consumer demand in NAFTA, EMEA and Maserati.