Chrysler 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140 2015 | ANNUAL REPORT

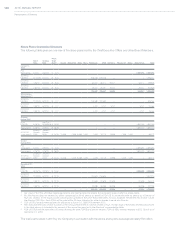

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

In October 2015, in connection with the Ferrari IPO and in preparation for the spin-off of the remaining common shares

of Ferrari N.V. owned by FCA, FCA carried out an internal corporate restructuring. As part of this reorganization, FCA

transferred its shares of Ferrari S.p.A. to Ferrari N.V. and provided a capital contribution to Ferrari N.V., while Ferrari

N.V. issued a note payable to FCA in the amount of €2.8 billion. This internal restructuring was a common control

transaction and did not have an accounting impact on the Consolidated Financial Statements. As a result and in

connection with the transactions in which Piero Ferrari exchanged his shares in Ferrari S.p.A. for Ferrari N.V. shares,

FCA paid €280 million to Piero Ferrari as consideration for the dilution of his share value due to the issuance of the

€2.8 billion note payable, which was recorded as a reduction to non-controlling interests.

On December 3, 2015, an extraordinary general meeting of FCA shareholders was held, whereby the transactions

intended to separate FCA’s remaining ownership interest in Ferrari N.V. and to distribute that ownership interest to

holders of FCA shares and mandatory convertible securities were approved. The transactions to separate Ferrari N.V.

from the Group were completed on January 3, 2016 (Note 32).

As the spin-off of Ferrari N.V. became highly probable with the aforementioned shareholders’ approval and since it

was available for immediate distribution at that date, the Ferrari segment met the criteria to be classified as a disposal

group held for distribution to owners and a discontinued operation pursuant to IFRS 5 - Non-current Assets Held for

Sale and Discontinued Operations. Since Exor S.p.A., which controls and consolidates FCA (Note 26), will continue to

control and consolidate Ferrari N.V. after the spin-off, this was deemed to be a common control transaction and was

accounted for at book value.

The presentation of the Ferrari segment was as follows:

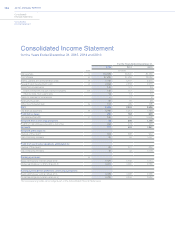

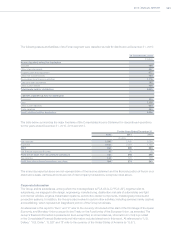

The operating results of Ferrari have been excluded from the Group’s continuing operations and are presented

as a single line item within the Consolidated Income Statements for the years ended December 31, 2015, 2014

and 2013. In order to present the financial effects of a discontinued operation, revenues and expenses arising

from intercompany transactions were eliminated except for those revenues and expenses that are considered to

continue after the spin-off of the discontinued operation. However, no profit or loss is recognized for intercompany

transactions within the Consolidated Income Statements.

The assets and liabilities of Ferrari have been classified as Assets held for distribution and Liabilities held for

distribution within the Consolidated Statement of Financial Position at December 31, 2015, while the assets and

liabilities of Ferrari have not been re-classified for the comparative Consolidated Statement of Financial Position at

December 31, 2014.

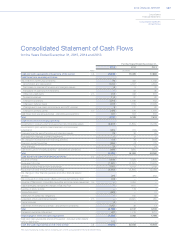

Cash flows arising from the Ferrari segment have been presented separately as discontinued cash flows from

operating, investing and financing activities within the Consolidated Statement of Cash Flows for the years ended

December 31, 2015, 2014 and 2013. The cash flows represent those arising from transactions with third parties.

In anticipation of the spin-off of Ferrari N.V., on November 30, 2015, Ferrari N.V. entered into a €2.5 billion syndicated

loan facility. The facility consisted of a bridge loan (the “Ferrari Bridge Loan”) and a term loan (the “Ferrari Term Loan”)

of €2 billion in aggregate as well as a revolving credit facility of €500 million (the “Ferrari RCF”). Proceeds of the Ferrari

Bridge Loan and Ferrari Term Loan were used to refinance indebtedness owed to FCA. The €2.5 billion syndicated

loan facility is limited in recourse to Ferrari N.V. and any of its subsidiaries which borrow under the facility, and is

without recourse to any other part of FCA. The Ferrari Bridge Loan and the Ferrari Term Loan are classified within

Liabilities held for distribution within the Consolidated Statement of Financial Position at December 31, 2015. The

Ferrari RCF was undrawn at December 31, 2015.