Chrysler 2015 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

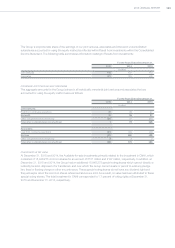

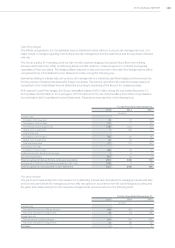

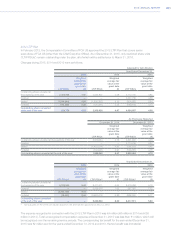

Mandatory Convertible Securities

In December 2014, FCA issued an aggregate notional amount of U.S.$2,875 million (€2,293 million) of mandatory

convertible securities (the “Mandatory Convertible Securities”). Pursuant to the terms of the prospectus, the Mandatory

Convertible Securities will pay cash coupons at a rate of 7.875 percent per annum, which can be deferred at the option

of FCA. The Mandatory Convertible Securities will mature on December 15, 2016 (the “Mandatory Conversion Date”).

The purpose of the issuance was to provide additional financing to the Group for general corporate purposes.

As part of the issuance of the Mandatory Convertible Securities, the underwriters had the option to purchase, within

30 days beginning on, and including, the date of initial issuance of U.S.$2,500 million (€1,994 million) of Mandatory

Convertible Securities, up to an additional U.S.$375 million (€299 million) of Mandatory Convertible Securities from

FCA at the same price as that sold to the public, less the underwriting discounts and commissions (the “over-allotment

option”). The underwriters exercised the over-allotment option concurrent with the issuance of the Mandatory

Convertible Securities and purchased an additional U.S.$375 million (€299 million) of Mandatory Convertible

Securities, resulting in the aggregate notional amount of U.S.$2,875 million (€2,293 million) of Mandatory Convertible

Securities that were issued.

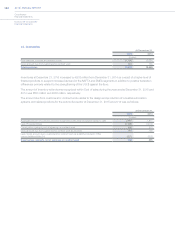

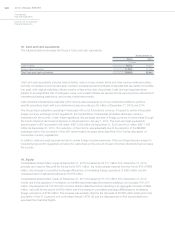

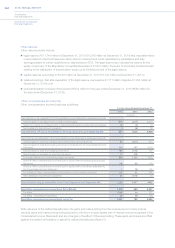

The Mandatory Convertible Securities will automatically convert on the Mandatory Conversion Date into a number of

common shares equal to the conversion rate calculated based on the share price relative to the applicable market

value (“AMV”), as defined in the prospectus, as follows:

Maximum Conversion Rate: 261,363,375 shares if the AMV ≤ Initial Price (U.S.$11), in aggregate the Maximum

Number of Shares(1)

A number of shares equivalent to the value of U.S.$100 (i.e., U.S.$100 / AMV), if Initial Price (U.S.$11) ≤ the AMV ≤

Threshold Appreciation Price (U.S.$12.925)(1)

Minimum Conversion Rate: 222,435,875 shares if the AMV ≥ Threshold Appreciation Price (U.S.$12.925), in

aggregate the Minimum Number of Shares(1)

Upon Mandatory Conversion: Holders receive: (i) any deferred coupon payments, (ii) accrued and unpaid coupon

payments in cash or in Shares at the election of the Group.

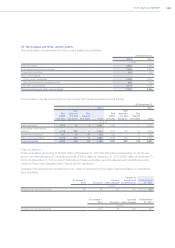

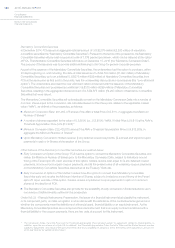

Other features of the Mandatory Convertible Securities are outlined below:

Early Conversion at Option of the Group: FCA has the option to convert the Mandatory Convertible Securities and

deliver the Maximum Number of Shares prior to the Mandatory Conversion Date, subject to limitations around

timing of the Ferrari spin-off. Upon exercise of this option, holders receive cash equal to: (i) any deferred coupon

payments, (ii) accrued and unpaid coupon payments, and (iii) the present value of all remaining coupon payments

on the Mandatory Convertible Securities discounted at the Treasury Yield rate.

Early Conversion at Option of the Holder: holders have the option to convert their Mandatory Convertible

Securities early and receive the Minimum Number of Shares, subject to limitations around timing of the Ferrari

spin-off. Upon exercise of this option, holders receive any deferred coupon payments in cash or in common

shares at the election of FCA.

The Mandatory Convertible Securities also provide for the possibility of early conversion in limited situations upon

occurrence of defined events outlined in the prospectus.

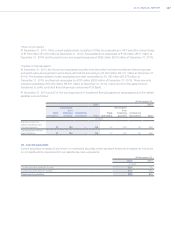

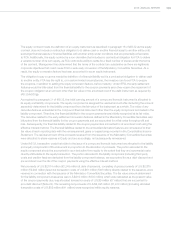

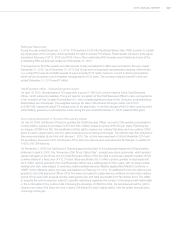

Under IAS 32 - Financial Instruments: Presentation, the issuer of a financial instrument shall classify the instrument,

or its component parts, on initial recognition in accordance with the substance of the contractual arrangement and

whether the components meet the definitions of a financial asset, financial liability or an equity instrument. As the

Mandatory Convertible Securities are a compound financial instrument that is an equity contract combined with a

financial liability for the coupon payments, there are two units of account for this instrument.

(1) The Conversion Rates, the Initial Price and the Threshold Appreciation Price are each subject to adjustment related to dilutive events. In

addition, upon the occurrence of a Spin-Off (as defined), the Threshold Appreciation Price, the Initial Price and the Stated Amount are also

subject to adjustment. As a result of the spin-off of Ferrari that was completed on January 3, 2016, the metrics were adjusted on January 15,

2016 (see Note 32 for additional information).