Chrysler 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 2015 | ANNUAL REPORT

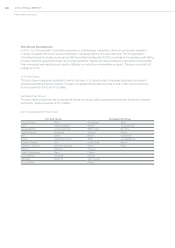

Remuneration of Directors

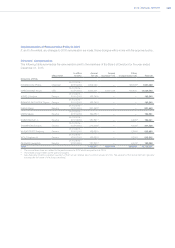

The bonus earned for the CEO for 2015 was U.S.$ 6,856,000, as determined by the achievement and corresponding

company performance factors illustrated in the table below:

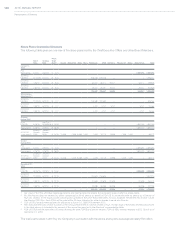

2015 Annual Bonus Program

2015 Performance

Metric Weight

Threshold

(€ millions)

Target

(€ millions)

Maximum

(€ millions)

Company

Performance -

Actual

(€ millions)

Weighted

Company

Performance

Factor

Adjusted EBIT* 1/3 3,870 4,300 6,450 5,267 55.8%

Adjusted net profit** 1/3 990 1,100 1,650 1,255 47.4%

Net industrial debt*** 1/3 (8,525) (7,750) (3,875) (5,049) 68.2%

Overall Company Performance Factor: 171.4%

* Adjusted EBIT is calculated as EBIT excluding gains/losses on the disposal of investments, restructuring, impairments, asset write offs and

other unusual income/(expenses) which are considered rare or discrete events that are infrequent in nature. Actual performance includes

Ferrari, comparable to the target.

** Adjusted net profit is calculated as Net profit/(loss) excluding post-tax impacts of the same items excluded from Adjusted EBIT: gains/(losses)

on the disposal of investments, restructuring, impairments, asset write-offs and other unusual income/(expenses) that are considered rare or

discrete events that are infrequent in nature. However, the bonus achievement excludes only certain non-operational unusuals, as deemed

appropriate by the Compensation Committee. Actual performance includes Ferrari, comparable to the target.

*** Net industrial debt is defined as ending absolute balance.

The annual bonus target incentive for the CEO is 100 percent of the U.S.$4 million annual base salary, which is below

market, based on the average of our U. S. and European peers. This positioning further reinforces the value we place

on a longer term perspective. The three performance metrics’ objectives are consistent with the Company’s five-

year business plan and with the the Company’s guidance that is published. Threshold performance for any incentive

earned is 90 percent of target; whereas, the upper limit performance to earn a maximum payout of 250 percent of

base salary is 150 percent or greater of target. The Compensation Committee reviews results and achievement and

presents the results to the Non-Executive Directors, typically in January of each year in connection with the completion

of the Company’s year-end earnings release. For 2015, the threshold, target and maximum percentage opportunities

for our CEO did not change.

Additionally, the Compensation Committee retains authority to grant periodic cash bonuses for specific transactions

that are deemed exceptional in terms of strategic importance and effect on the Company’s results. This authority has

not been exercised with respect to the Company’s performance in 2015.

Discussion of 2015 Results

Significant growth and improvement were achieved in 2015 in each of the three key performance criteria linked to the

CEO’s annual incentive:

The Company achieved Adjusted EBIT of €5,267 million, including Ferrari, which was an increase of 40 percent over

2014 (excluding Ferrari, Adjusted EBIT was €4,794 million, which reflected a 43 percent increase from 2014).

Adjusted net profit increased over 90 percent from 2014 (€2,026 million in 2015 as compared to €1,060 million

in 2014). With regard to the CEO’s annual bonus determination, although the authorized objective was to apply

adjusted net profit, subsequently Management recommended that it was appropriate to include some of the

unusual expenses in operating income, notwithstanding their unusual nature. The Compensation Committee

considered Management’s recommendation, and within the confines of the authority granted to them in the

Remuneration Policy permitting them to “review any unusual items that occurred in the performance year

to determine the appropriate overall measurement of achievement”, agreed and took action consistent with

Management’s recommendation. If the full extent of the 2015 unusual items had been excluded, the bonus would

have been higher.

For the third metric, Net industrial debt, the Company significantly reduced its Net industrial debt from €7.7 billion at

December 31, 2014 to €5.0 billion at December 31, 2015. The successful implementation of the strategic initiative

to spin-off Ferrari helped contribute to the reduction and was deemed appropriate to consider in determining the

2015 performance that links to the CEO’s short-term incentive in 2015.