Chrysler 2015 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 225

For the year ended December 31, 2013, change in working capital of €1,378 million was primarily driven by (i)€1,322

million increase in trade payables, mainly related to increased production in NAFTA as a result of increased consumer

demand for our vehicles, and increased production in Maserati, (ii)€746 million in net other current assets and liabilities

mainly related to increases in accrued expenses and deferred income as well as indirect taxes payables, (iii)€232

million decrease in trade receivables principally due to the contraction of sales volumes in EMEA and LATAM, which

were partially offset by (iv)€922 million increase in inventory (net of vehicles sold under buy-back commitments),

mainly related to increased finished vehicle and work in process levels at December31, 2013 compared to

December31, 2012, in part driven by higher production levels in late 2013 to meet anticipated consumer demand in

the NAFTA, APAC and Maserati segments.

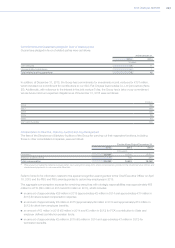

Financing activities

For the year ended December 31, 2015, net cash used in financing activities was €3,128 million and was primarily the

result of (i) the prepayment of the FCA US Secured Senior Notes and the repayment at maturity of two notes issued

under the GMTN Programme as described in more detail in Note 23 for a total of €7,241 million, (ii) the repayment of

medium-term borrowings for a total of €4,412 million, which were partially offset by (iii) net proceeds of €866 million

from the Ferrari IPO as discussed in the section —Principal Activities above, (iv) proceeds from the issuance of the

Notes by FCA for a total of €2,840 million as described in more detail in Note 23, (v) 3,061 million provided by new

medium-term borrowings and (vi) net proceeds from the €2.0 billion Ferrari Bridge Loan and Ferrari Term Loan, which

are reflected within cash flows used in financing activities - discontinued operations in the Consolidated Statement of

Cash Flows.

For the year ended December 31, 2014, net cash provided by financing activities was €2,137 million and was primarily

the result of (i) the net proceeds from the issuance of the Mandatory Convertible Securities as described in more

detail in Note 19, (ii) the proceeds from note issuances and new medium term borrowings as discussed in Note 23,

which were partially offset by (iii) the cash payment to the VEBA Trust for the acquisition of the remaining 41.5 percent

ownership interest in FCA US (see section —Changes in the Scope of Consolidation - Acquisition of the Remaining

Ownership Interest in FCA US above), (iv) the repayment of medium-term borrowings for a total of €5,834 million,

mainly related to the prepayment of all amounts under the VEBA Trust Note amounting to approximately U.S.$5 billion

(€3.6 billion), including accrued and unpaid interest, and repayment of medium term borrowings primarily in Brazil, (v)

the repayment at maturity of notes issued under the GMTN Programme, as discussed in Note 23 and (vi) the net cash

disbursement in connection with the Merger (see section —Principal Activities - The FCA Merger above).

For the year ended December 31, 2013, net cash provided by financing activities was €3,136 million and was primarily

the result of (i) the proceeds from issuances relating to notes issued as part of the GMTN Programme, which were

partially offset by (ii) the repayment at maturity of notes issued under the GMTN Programme and the repayment at

maturity of medium-term borrowings.

The Group, including Ferrari, paid interest of €2,087 million, €2,054 million and €1,832 million and received interest of

€469 million, €441 million and €398 million during the years ended December 31, 2015, 2014 and 2013, respectively.

Amounts indicated are also inclusive of interest rate differentials paid or received on interest rate derivatives.

The Group, including Ferrari, made income tax payments, net of refunds, totaling €664 million, €542 million and €429

million during the years ended December 31, 2015, 2014 and 2013, respectively.