Chrysler 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 165

Concurrent with the closing of the acquisition under the Equity Purchase Agreement, FCA US and UAW executed

and delivered a contractually binding and legally enforceable Memorandum of Understanding (“MOU”) to supplement

FCA US’s existing collective bargaining agreement. Under the MOU, the UAW committed to (i)use the best efforts

to cooperate in the continued roll-out of FCA US’s World Class Manufacturing (“WCM”) programs, (ii)to actively

participate in benchmarking efforts associated with implementation of WCM programs across all FCA’s manufacturing

sites to ensure objective competitive assessments of operational performance and provide a framework for the proper

application of WCM principles, and (iii)to actively assist in the achievement of FCA US’s long-term business plan. In

consideration for these legally enforceable commitments, FCA US agreed to make payments to a UAW-organized

independent VEBA Trust totaling U.S.$700 million (€518 million at the transaction date) to be paid in four equal annual

installments. Considering FCA US’s non-performance risk over the payment period as of the transaction date and its

unsecured nature, this payment obligation had a fair value of U.S.$672 million (€497 million) as of the transaction date.

The Group considered the terms and conditions set forth in the above mentioned agreements and accounted for

the Equity Purchase Agreement and the MOU as a single commercial transaction with multiple elements. As such,

the fair value of the consideration paid discussed above, which amounts to U.S.$4,624 million (€3,411 million at the

transaction date), including the fair value of the previously exercised disputed options, was allocated to the elements

obtained by the Group. Due to the unique nature and inherent judgment involved in determining the fair value of

the UAW’s commitments under the MOU, a residual value methodology was used to determine the portion of the

consideration paid attributable to the UAW’s commitments as follows:

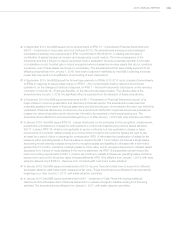

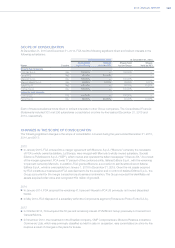

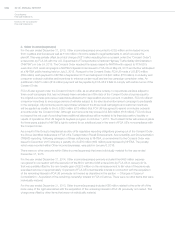

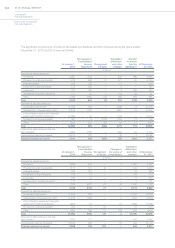

January 21, 2014

(€ million)

Special distribution from FCA US 1,404

Cash payment from FCA NA 1,287

Fair value of the previously exercised options 223

Fair value of financial commitments under the MOU 497

Fair value of total consideration paid 3,411

Less the fair value of an approximately 41.5 percent non-controlling ownership interest in FCA US (2,916)

Consideration allocated to the UAW’s commitments 495

The fair value of the 41.5 percent non-controlling ownership interest in FCA US acquired by FCA from the VEBA Trust

(which includes the approximately 10 percent pursuant to the settlement of the previously exercised options discussed

above) was determined using the valuation methodology discussed above.

The residual of the fair value of the consideration paid of U.S.$670 million (€495 million) was allocated to the UAW’s

contractually binding and legally enforceable commitments to FCA US under the MOU.

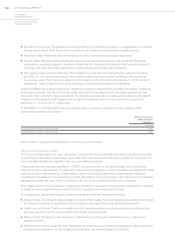

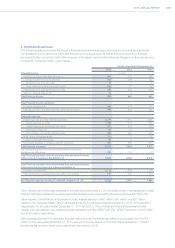

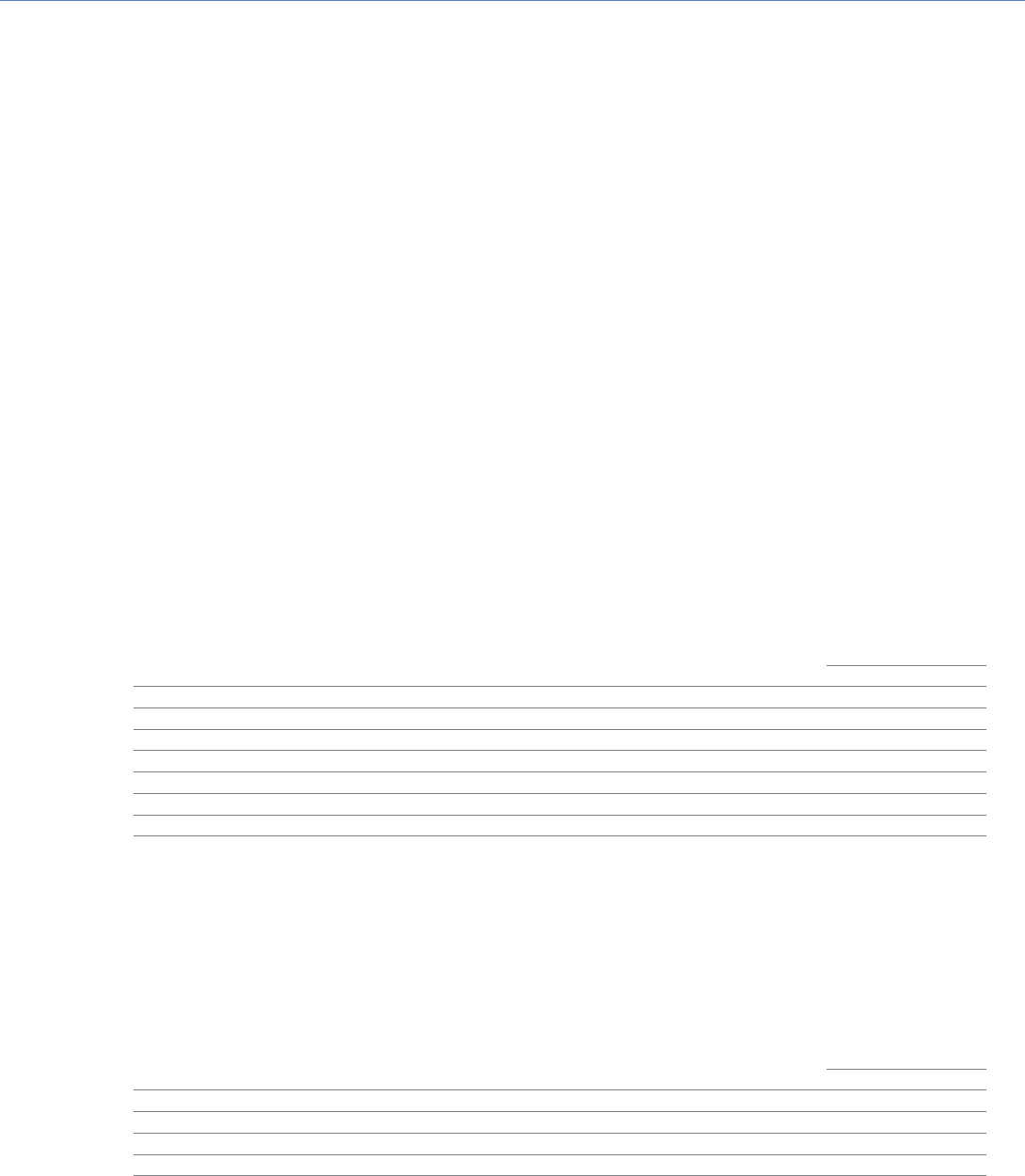

The effects of changes in ownership interests in FCA US were as follows:

January 21, 2014

(€million)

Carrying amount of non-controlling interest acquired 3,976

Less consideration allocated to the acquisition of the non-controlling interest (2,916)

Additional net deferred tax assets 251

Effect on the equity attributable to owners of the parent 1,311

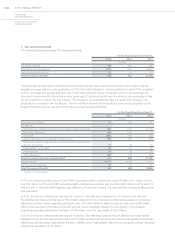

In accordance with IFRS 10 – Consolidated Financial Statements, equity reserves were adjusted to reflect the change

in the ownership interest in FCA US through a corresponding adjustment to Equity attributable to the parent. As the

transaction described above resulted in the elimination of the non-controlling interest in FCA US, all items of Other

comprehensive income/(loss) previously attributed to the non-controlling interest were recognized in equity reserves.