Chrysler 2015 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

208 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

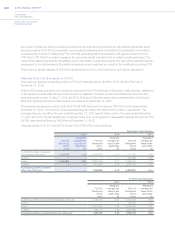

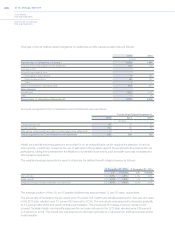

The discount rates used for the measurement of the Italian TFR obligation are based on yields of high-quality (AA

rated) fixed income securities for which the timing and amounts of maturities match the timing and amounts of the

projected benefit payments. For this plan, the single weighted average discount rate that reflects the estimated timing

and amount of the scheme future benefit payments for 2015 is equal to 1.6 percent (1.7 percent in 2014). The average

duration of the Italian TFR is approximately 7 years. Retirement or employee leaving rates are developed to reflect

actual and projected Group experience and law requirements for retirement in Italy.

Other provisions for employees and liabilities for share-based payments

At December31, 2015, Other provisions for employees and liabilities for share-based payments consisted of other

long term benefits obligations for €384 million (€376 million at December31, 2014), representing the expected

obligation for benefits, which include a bonus for tenure at the Company and long term disability benefits granted to

certain employees.

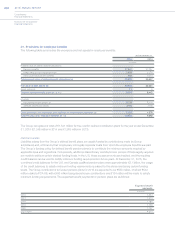

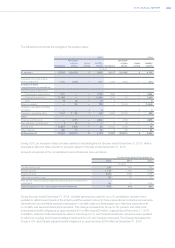

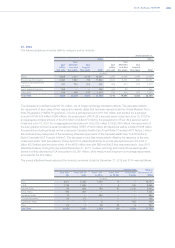

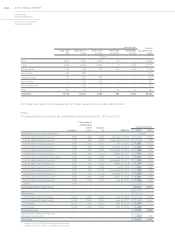

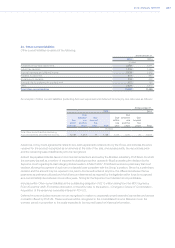

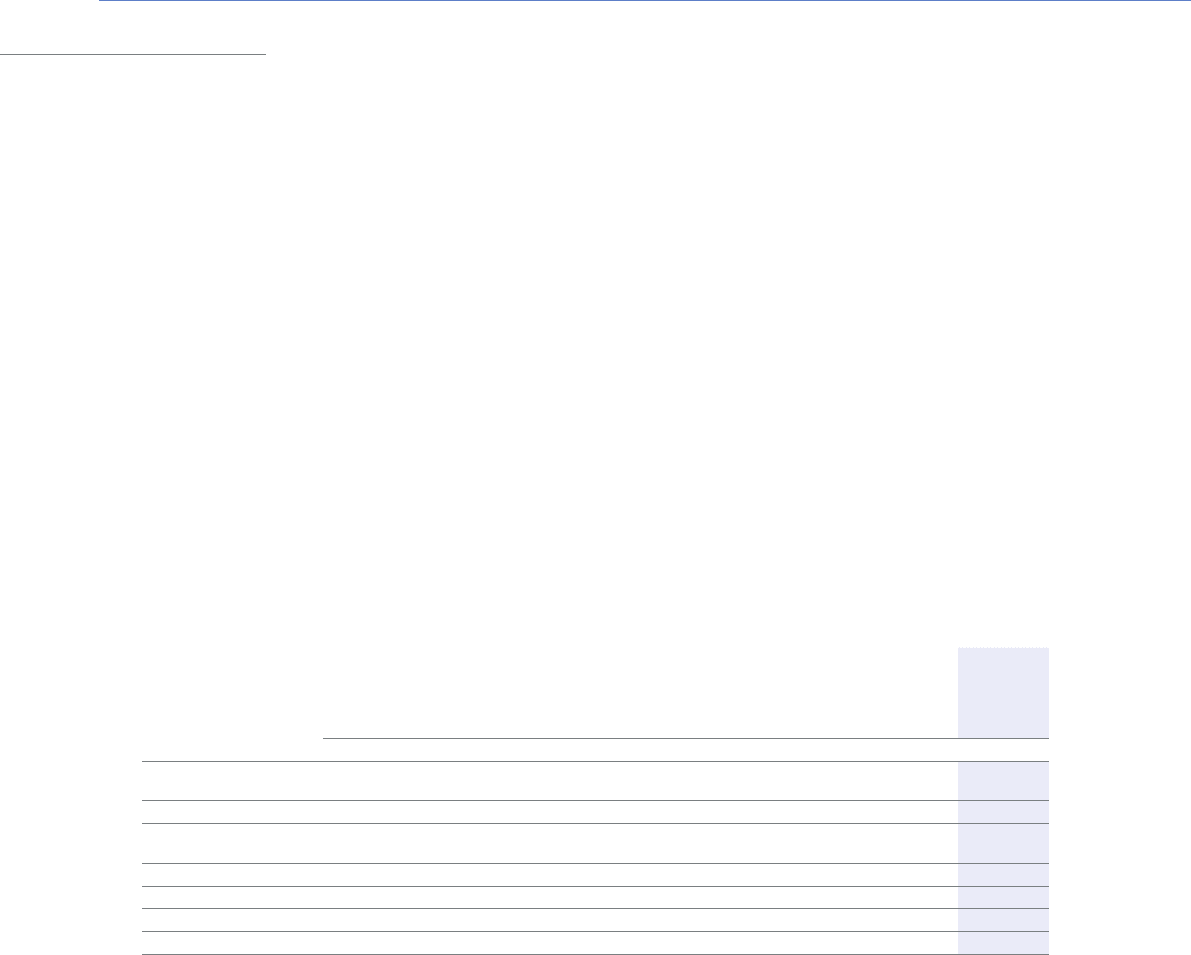

22. Other provisions

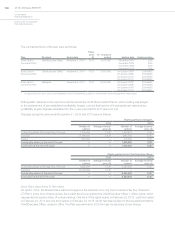

Changes in Other provisions were as follows:

At

December

31,

2014

Additional

provisions Settlements

Unused

amounts

Translation

differences

Transfer to

Liabilities

held for

distribution

Changes in

the scope of

consolidation

and other

changes

At

December

31,

2015

(€ million)

Product warranty and

recall campaigns provision 4,845 4,710 (3,303) — 325 (80) (26) 6,471

Sales incentives 3,695 12,711 (11,472) (20) 282 — — 5,196

Legal proceedings and

disputes 575 103 (89) (29) (30) (47) 17 500

Commercial risks 381 288 (207) (31) 6 (9) (107) 321

Restructuring provision 131 32 (42) (20) 3 — (5) 99

Other risks 1,153 342 (157) (119) 43 (10) (47) 1,205

Total Other provisions 10,780 18,186 (15,270) (219) 629 (146) (168) 13,792

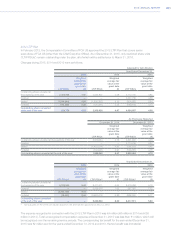

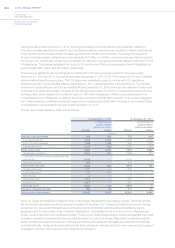

Product warranty and recall campaigns provision at December 31, 2015 included the change in estimate for estimated

future recall campaign costs for the U.S. and Canada of €761 million related to vehicles sold in periods prior to the

third quarter of 2015 as well as additional warranty costs in the second half of 2015 related to the increase in the

accrual rate per vehicle. Translation differences primarily related to the foreign currency translation from U.S.$ to Euro.

None of the provisions within the total Legal proceedings and disputes provision are individually significant. As

described within the section —Use of Estimates above, a provision for legal proceedings is recognized when it is

deemed probable that the proceedings will result in an outflow of resources.

Commercial risks arise in connection with the sale of products and services such as maintenance contracts. An

accrual is recorded when the expected costs to complete the services under these contracts exceed the revenues

expected to be realized.

Other risks include, among other items: provisions for disputes with suppliers related to supply contracts or other

matters that are not subject to legal proceedings, provisions for product liabilities arising from personal injuries

including wrongful death and potential exemplary or punitive damages alleged to be the result of product defects,

disputes with other parties relating to contracts or other matters not subject to legal proceedings and management’s

best estimate of the Group’s probable environmental obligations which also includes costs related to claims on

environmental matters.