Chrysler 2015 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 205

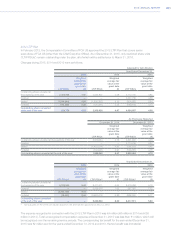

The investment strategies and objectives for pension assets primarily in the U.S. and Canada reflect a balance of liability-

hedging and return-seeking investment considerations. The investment objectives are to minimize the volatility of the

value of the pension assets relative to the pension liabilities and to ensure assets are sufficient to pay plan obligations.

The objective of minimizing the volatility of assets relative to liabilities is addressed primarily through asset diversification,

partial asset–liability matching and hedging. Assets are broadly diversified across many asset classes to achieve risk–

adjusted returns that, in total, lower asset volatility relative to the liabilities. Additionally, in order to minimize pension asset

volatility relative to the pension liabilities, a portion of the pension plan assets are allocated to fixed income securities. The

Group policy for these plans ensures actual allocations are in line with target allocations as appropriate.

Assets are actively managed, primarily, by external investment managers. Investment managers are not permitted

to invest outside of the asset class or strategy for which they have been appointed. The Group uses investment

guidelines to ensure investment managers invest solely within the mandated investment strategy. Certain investment

managers use derivative financial instruments to mitigate the risk of changes in interest rates and foreign currencies

impacting the fair values of certain investments. Derivative financial instruments may also be used in place of physical

securities when it is more cost effective and/or efficient to do so. Plan assets do not include shares of FCA or

properties occupied by Group companies, with the possible exception of comingled investment vehicles where FCA

does not control the investment guidelines.

Sources of potential risk in the pension plan assets measurements relate to market risk, interest rate risk and operating

risk. Market risk is mitigated by diversification strategies and as a result, there are no significant concentrations of risk in

terms of sector, industry, geography, market capitalization, or counterparty. Interest rate risk is mitigated by partial asset–

liability matching. The fixed income target asset allocation partially matches the bond–like and long–dated nature of the

pension liabilities. Interest rate increases generally will result in a decline in the fair value of the investments in fixed income

securities and the present value of the obligations. Conversely, interest rate decreases generally will increase the fair value

of the investments in fixed income securities and the present value of the obligations.

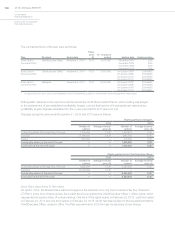

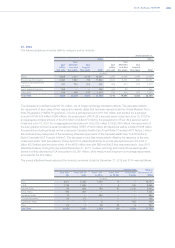

The weighted average assumptions used to determine the defined benefit obligations were as follows:

At December 31, 2015 At December 31, 2014

U.S. Canada UK U.S. Canada UK

Discount rate 4.5% 4.0% 3.8% 4.0% 3.8% 4.0%

Future salary increase rate —% 3.5% 2.9% —% 3.5% 3.0%

The average duration of the U.S. and Canadian liabilities was approximately 11 and 13 years, respectively. The

average duration of the UK pension liabilities was approximately 20 years.

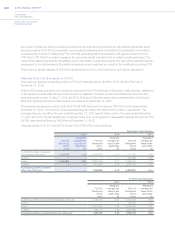

Health care and life insurance plans

Liabilities arising from these plans comprise obligations for retiree health care and life insurance granted to employees

and to retirees in the U.S. and Canada by FCA US companies. Upon retirement from the Group, these employees may

become eligible for continuation of certain benefits. Benefits and eligibility rules may be modified periodically. These

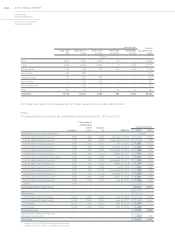

plans are unfunded. The expected benefit payments for unfunded health care and life insurance plans are as follows:

Expected

benefitpayments

(€ million)

2016 139

2017 139

2018 139

2019 139

2020 139

2021-2025 716