Chrysler 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

139

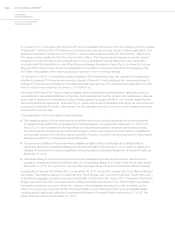

Notes to the Consolidated Financial Statements

At December31, 2015 and 2014

PRINCIPAL ACTIVITIES

The FCA Merger

On January 29, 2014, the Board of Directors of Fiat S.p.A. (“Fiat”) approved a proposed corporate reorganization

resulting in the formation of Fiat Chrysler Automobiles N.V. and decided to establish Fiat Chrysler Automobiles N.V.,

organized in the Netherlands, as the parent of the Group with its principal executive offices in the United Kingdom. Fiat

Chrysler Automobiles N.V. was incorporated as a public limited liability company (naamloze vennootschap) under the

laws of the Netherlands on April 1, 2014 under the name Fiat Investments N.V.

On June 15, 2014, the Board of Directors of Fiat approved the terms of a cross-border legal merger of Fiat into its 100

percent owned direct subsidiary Fiat Investments N.V. (the “Merger”), subject to several conditions precedent.

Fiat Chrysler Automobiles N.V. was incorporated with issued share capital of €200,000, which was composed of

20,000,000 common shares having a nominal value of €0.01 each. Share capital increased to €350,000 on May 13,

2014. Fiat shareholders voted and approved the Merger at their extraordinary general meeting held on August 1, 2014

and after this approval, Fiat shareholders not voting in favor of the Merger were entitled to exercise cash exit rights (the

“Cash Exit Rights”) by August 20, 2014, which were exercised for a net aggregate cash disbursement of €417 million.

The Merger, which took the form of a reverse merger, became effective on October 12, 2014 and resulted in Fiat

Investments N.V. being the surviving entity and was renamed Fiat Chrysler Automobiles N.V. (“FCA NV”). The Merger

was recognized in FCA NV’s Consolidated Financial Statements from January 1, 2014 and FCA NV, as successor

of Fiat, was deemed to be the parent company. As the Merger is a transaction in which all of the combining entities

are controlled ultimately by the same party both before and after the reverse merger, and based on the fact that

the control is not transitory, the transition was deemed to be a combination of entities under common control and

therefore outside the scope of IFRS 3R - Business Combinations and IFRIC 17 - Distributions of Non-cash Assets

to Owners. As a result, the Merger was accounted for without adjusting the carrying amounts of assets and liabilities

involved in the transaction and did not have an accounting impact on the Consolidated Financial Statements.

Unless otherwise specified, the terms “Group”, “FCA Group”, “Company” and “FCA”, refer to FCA, together with its

subsidiaries and its predecessor prior to the completion of the Merger, or any one or more of them, as the context may

require. Any references to “Fiat” refer solely to Fiat S.p.A., the predecessor of FCA NV prior to the Merger.

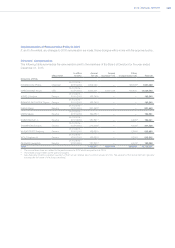

Ferrari Spin-off and Discontinued Operations

On October 26, 2015, Ferrari N.V., a subsidiary of FCA, completed its initial public offering (“IPO”) in which FCA sold

10 percent of Ferrari N.V. common shares (“Ferrari IPO”) and received net proceeds of approximately €0.9 billion,

which resulted in FCA owning 80 percent of Ferrari N.V. common shares, Piero Ferrari owning 10 percent of common

shares and public shareholders owning the remaining 10 percent of common shares. The Ferrari IPO was accounted

for as an equity transaction with the effect on Equity attributable to owners of the parent as follows:

At October 26, 2015

(€ million)

Consideration received 866

Less: Carrying amount of equity interest sold (7)

Effect on Equity attributable to owners of the parent 873