Chrysler 2015 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

204 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

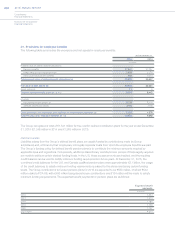

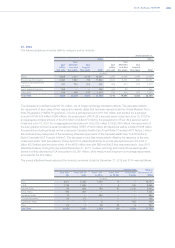

During the year ended December 31, 2014, following the release of new standards by the Canadian Institute of

Actuaries, mortality assumptions used for our Canadian benefit plan valuations were updated to reflect recent trends

in the industry and the revised outlook for future generational mortality improvements. The change increased the

Group’s Canadian pension obligations by approximately €41 million. In addition, retirement rate assumptions used for

the Group’s U.S. benefit plan valuations were updated to reflect an ongoing trend towards delayed retirement for FCA

US employees. The change decreased the Group’s U.S. pension and other post-employment benefit obligations by

approximately €261 million and €40 million, respectively.

There were no significant plan amendments or curtailments to the Group’s pension plans for the years ended

December 31, 2015 and 2014. During the year ended December 31, 2013, FCA US amended its U.S. and Canadian

salaried defined benefit pension plans. The U.S. plans were amended in order to comply with U.S. regulations,

cease the accrual of future benefits effective December31, 2013, and enhance the retirement factors. The Canada

amendment ceased the accrual of future benefits effective December31, 2014, enhanced the retirement factors and

continued to consider future salary increases for the affected employees. An interim re-measurement was performed

for these plans, which resulted in a curtailment gain of €166 million recognized in Other income/(expenses) in the

Consolidated Income Statement. In addition, the Group recognized a €509 million reduction to its pension obligation,

a €7 million reduction to defined benefit plan assets and a corresponding €502 million increase in accumulated Other

comprehensive income/(loss) for the year ended December 31, 2013.

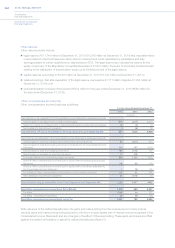

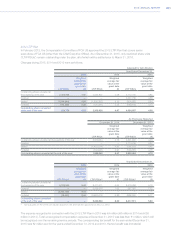

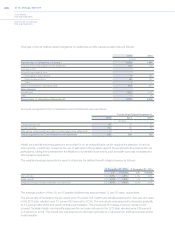

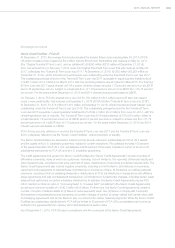

The fair value of plan assets by class was as follows:

At December 31, 2015 At December 31, 2014

Amount

ofwhichhavea

quotedmarket

priceinanactive

market Amount

ofwhichhavea

quotedmarket

priceinanactive

market

(€ million)

Cash and cash equivalents 589 512 713 614

U.S. equity securities 2,209 2,208 2,406 2,338

Non-U.S. equity securities 1,388 1,388 1,495 1,463

Commingled funds 2,025 164 2,009 186

Equity instruments 5,622 3,760 5,910 3,987

Government securities 2,610 852 2,948 780

Corporate bonds (including Convertible and high

yield bonds) 6,028 — 6,104 4

Other fixed income 928 7 892 7

Fixed income securities 9,566 859 9,944 791

Private equity funds 1,787 — 1,648 —

Commingled funds 137 117 5 5

Mutual funds 3 — 4 —

Real estate funds 1,502 — 1,395 —

Hedge funds 2,607 — 1,841 —

Investment funds 6,036 117 4,893 5

Insurance contracts and other 602 49 771 91

Total fair value of plan assets 22,415 5,297 22,231 5,488

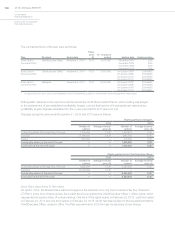

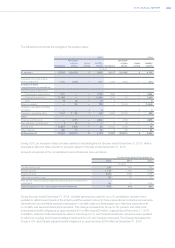

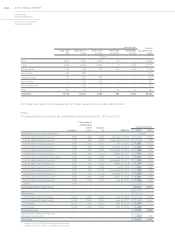

Non-U.S. Equity securities are invested broadly in developed international and emerging markets. Debt instruments

are fixed income securities which are primarily comprised of long-term U.S. Treasury and global government bonds,

as well as U.S., developed international and emerging market companies’ debt securities diversified by sector,

geography and through a wide range of market capitalization. Commingled funds include common collective trust

funds, mutual funds and other investment entities. Private equity funds include those in limited partnerships that invest

primarily in operating companies that are not publicly traded on a stock exchange. Real estate investments include

those in limited partnerships that invest in various commercial and residential real estate projects both domestically

and internationally. Hedge fund investments include those seeking to maximize absolute return using a broad range of

strategies to enhance returns and provide additional diversification.