Chrysler 2015 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

220 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

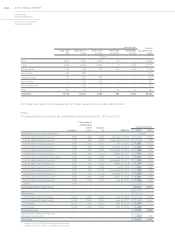

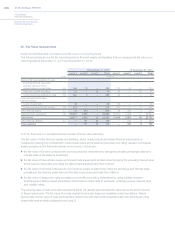

The fair values of Receivables from financing activities, which are categorized within Level 3 of the fair value hierarchy,

have been estimated with discounted cash flows models. The most significant inputs used for this measurement

are market discount rates that reflect conditions applied in various reference markets on receivables with similar

characteristics, adjusted in order to take into account the credit risk of the counterparties.

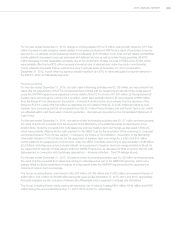

Notes that are traded in active markets for which close or last trade pricing is available are classified within Level 1 of

the fair value hierarchy. Notes for which such prices are not available (such as the FCA US Secured Senior Notes that

were prepaid in 2015 (Note 23)), are valued at the last available price or based on quotes received from independent

pricing services or from dealers who trade in such securities and are categorized as Level 2. At December31, 2015,

€14,113 million and €7 million of notes were classified within Level1 and Level2, respectively. At December31, 2014,

€13,433 million and €5,361 million of notes were classified within Level1 and Level2, respectively.

The fair value of Other debt included in Level 2 of the fair value hierarchy has been estimated using discounted

cash flow models. The main inputs used are year-end market interest rates, adjusted for market expectations of the

Group’s non-performance risk implied in quoted prices of traded securities issued by the Group and existing credit

derivatives on Group liabilities. The fair value of the debt that requires significant adjustments using unobservable

inputs is categorized in Level 3 of the fair value hierarchy. At December31, 2015, €12,099 million and €1,975 million of

Other Debt was classified within Level2 and Level3, respectively. At December31, 2014, €13,144 million and €2,541

million of Other Debt was classified within Level2 and Level3, respectively.

26. Related party transactions

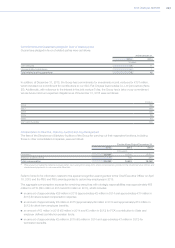

Pursuant to IAS 24 - Related Party Disclosures, the related parties of the Group are entities and individuals capable

of exercising control, joint control or significant influence over the Group and its subsidiaries. Related parties include

companies belonging to Exor S.p.A. (the largest shareholder of FCA through its 29.16 percent common shares

shareholding interest and 44.27 percent voting power at December 31, 2015) who also purchased U.S.$886 million

(€730 million at December 31, 2014) in aggregate notional amount of Mandatory Convertible Securities that were issued

in December 2014 (Note 19). Related parties also include CNHI and other unconsolidated subsidiaries, associates or

joint ventures of the Group. In addition, members of the FCA Board of Directors, Board of Statutory Auditors (through the

date of the Merger) and executives with strategic responsibilities and their families are also considered related parties.

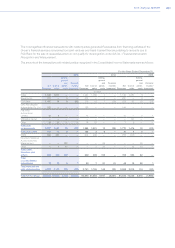

The Group carries out transactions with unconsolidated subsidiaries, joint ventures, associates and other related

parties, on commercial terms that are normal in the respective markets, considering the characteristics of the goods or

services involved. Transactions carried out by the Group with unconsolidated subsidiaries, joint ventures, associates

and other related parties are primarily of a commercial nature, which have had an effect on revenues, cost of sales,

and trade receivables and payables; these transactions primarily relate to:

the sale of motor vehicles to the joint ventures Tofas and FCA Bank leasing and renting subsidiaries;

the sale of engines, other components and production systems and the purchase of commercial vehicles with the

joint operation Sevel S.p.A.;

the sale of engines, other components and production systems to companies of CNHI;

the purchase of vehicles, the provision of services and the sale of goods with the joint operation Fiat India

Automobiles Private Limited;

the provision of services and the sale of goods to the joint venture GAC Fiat Chrysler Automobiles Co. Ltd;

the provision of services (accounting, payroll, tax administration, information technology, purchasing and security) to

the companies of CNHI;

the purchase of commercial vehicles from the joint venture Tofas;

the purchase of commercial vehicles under contract manufacturing agreement from CNHI; and

the purchase of engines from the VM Motori group during the first half of 2013.