Chrysler 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 59

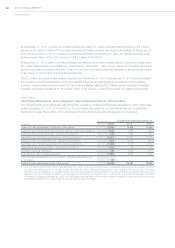

On July 24, 2015, FCA US entered into the Consent Order with NHTSA, which resolved the issues raised by NHTSA

with respect to FCA US’s execution of 23 recall campaigns in NHTSA’s Special Order issued to FCA US on May 22,

2015 and further addressed at a NHTSA public hearing held on July 2, 2015. Pursuant to the Consent Order, FCA US

made a U.S.$70 million (€63 million) cash payment to NHTSA in September 2015 and will spend U.S.$20 million (€18

million) on industry and consumer outreach activities and incentives to enhance certain recall and service campaign

completion rates. For the year ended December31, 2015, the total €81 million charge was excluded from Adjusted

EBIT. An additional U.S.$15 million (€14 million) payment will be payable by FCA US if it fails to comply with certain

terms of the Consent Order.

FCA US also agreed under the Consent Order to offer, as an alternative remedy, to repurchase vehicles subject to

three recall campaigns that had not already been remedied as of the date of the Consent Order at a price equal to

the original purchase price less a reasonable allowance for depreciation plus ten percent. In addition, FCA US offered

consumer incentives to encourage owners of vehicles subject to the structural reinforcement campaign to participate

in the campaign. All premiums paid to repurchase vehicles in the three recall campaigns and customer incentives

will be applied as credits to the U.S.$20 million (€18 million) that FCA US has agreed to spend on industry outreach

amounts under the Consent Order.

Although such amounts may exceed U.S.$20 million (€18 million), FCA US does not expect the net cost of providing

these additional alternatives will be material to its financial position, liquidity or results of operations. The Consent

Order will remain in place for three years subject to NHTSA’s right to extend for an additional year in the event of FCA

US’s noncompliance with the Consent Order.

Following admission of deficiencies in FCA US’s reporting to NHTSA pursuant to the TREAD Act, an amendment to

the Consent Order was issued in December 2015 whereby a penalty of U.S.$70 million (€63 million) was imposed. The

penalty, which was recorded within Other income/(expenses) and excluded from Adjusted EBIT for the year ended

December 31, 2015, was paid on January 6, 2016.

For the year ended December31, 2015, a total of €104 million of income related to the favorable settlements of legal

matters to which we were the plaintiff has been excluded from Adjusted EBIT.

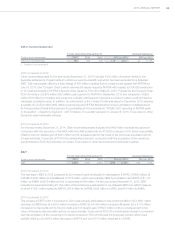

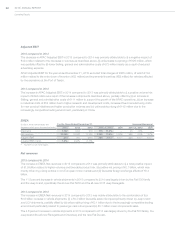

2014 compared to 2013

The decrease in NAFTA Adjusted EBIT in 2014 compared to 2013 was primarily attributable to (i) increased industrial

costs of €1,549 million, (ii) a €29 million increase in Selling, general and administrative costs largely attributable to

higher advertising costs to support new vehicle launches, including the all-new 2014 Jeep Cherokee and the all-new

2015 Chrysler 200, which was partially offset by (iii) the favorable volume/mix impact of €1,129 million, driven by

the increase in shipments described above, and (iv) favorable net pricing of €411 million primarily due to pricing for

enhanced content, partially offset by incentive spending on certain vehicles in the portfolio.

The increase in industrial costs was attributable to an increase in warranty costs of approximately €800 million which

included the effects of certain recall campaigns, an increase in base material costs of €978 million mainly related to

higher base material costs associated with vehicles and components and content enhancements on new models as

well as €262 million in higher research and development costs and depreciation and amortization.

For the year ended December 31, 2014, Adjusted EBIT excluded the €495 million charge recorded in connection with

the execution of the MOU with the UAW entered into by FCA US in January 2014.