Chrysler 2015 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

230 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

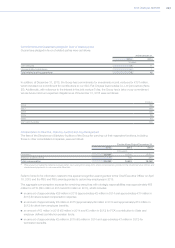

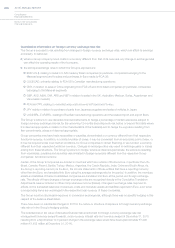

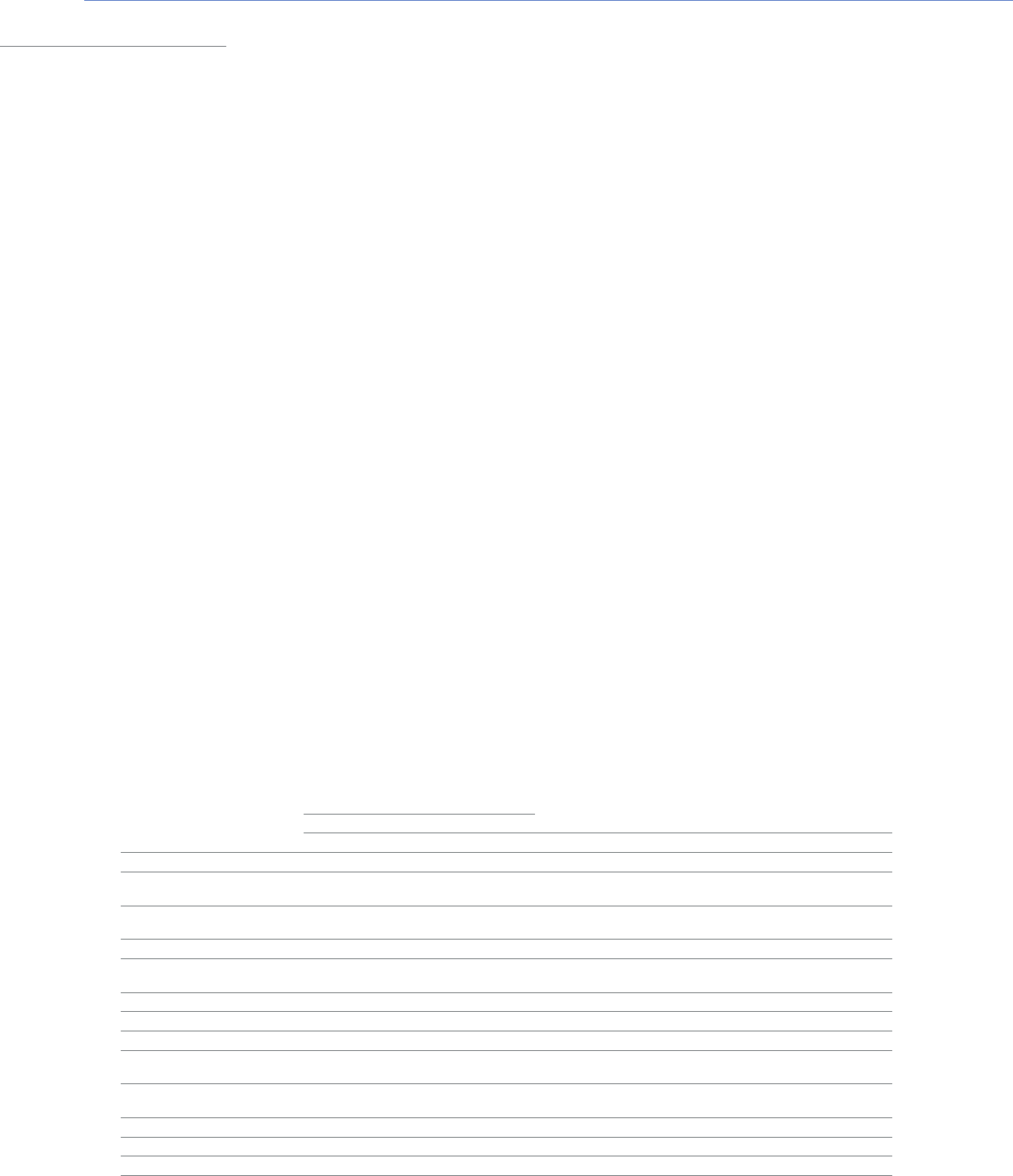

29. Segment reporting

The reportable segments, as described in the section —Segment reporting above, reflect the operating segments of the

Group that are regularly reviewed by the Chief Executive Officer, who is the “chief operating decision maker”, for making

strategic decisions, allocating resources and assessing performance, and that exceed the quantitative threshold provided

in IFRS 8 - Operating Segments, or whose information is considered useful for the users of the financial statements.

Transactions among mass-market vehicle segments generally are presented on a “where-sold” basis, which reflects

the profit/(loss) on the ultimate sale to the external customer within the segment. This presentation generally eliminates

the effect of the legal entity transfer price within the segments. Revenues of the other segments, aside from the mass-

market vehicle segments, are those directly generated by or attributable to the segment as the result of its usual

business activities and include revenues from transactions with third parties as well as those arising from transactions

with segments, recognized at normal market prices.

Other activities include the results of the activities and businesses that are not operating segments under IFRS 8 - Operating

Segments. In addition, Unallocated items and adjustments include consolidation adjustments and eliminations in addition

to financial income and expense and income taxes that are not attributable to the performance of the segments as they do

not fall under the scope of their operational responsibilities. As a result, such items and adjustments, which primarily arise

from the management of treasury assets and liabilities by the treasuries of FCA and FCA US that work independently and

separately within the Group, are subject to separate assessment by the chief operating decision maker.

Adjusted Earnings Before Interest and Taxes (“Adjusted EBIT”) is the measure used by the chief operating decision

maker to assess performance, allocate resources to the Group’s operating segments and to view operating trends,

perform analytical comparisons and benchmark performance between periods and among the segments. Adjusted EBIT

is calculated as EBIT excluding: gains/(losses) on the disposal of investments, restructuring, impairments, asset write-offs

and other unusual income/(expenses) that are considered rare or discrete events that are infrequent in nature. See below

for a reconciliation of Adjusted EBIT to EBIT, which is the most directly comparable measure included in our Consolidated

Income Statement. Operating assets are not included in the data reviewed by the chief operating decision maker, and as

a result and as permitted by IFRS 8 - Operating Segments, the related information is not provided.

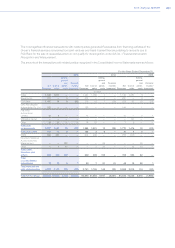

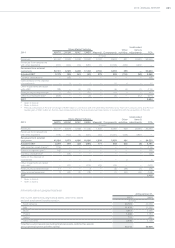

The following tables summarize selected financial information by segment for the years ended December 31, 2015,

2014 and 2013:

Mass-Market Vehicles

Maserati Components

Other

activities

Unallocated

items &

adjustments FCA2015 NAFTA LATAM APAC EMEA

(€ million)

Revenues 69,992 6,431 4,885 20,350 2,411 9,770 844 (4,088) 110,595

Revenues from transactions

with other segments (1) (194) (25) (304) (13) (3,095) (456) 4,088 —

Revenues from external

customers 69,991 6,237 4,860 20,046 2,398 6,675 388 — 110,595

Adjusted EBIT 4,450 (87) 52 213 105 395 (150) (184) 4,794

Change in estimate for future

recall campaign costs(1) (761) — — — — — — — (761)

Tianjin (China) port explosions(2) — — (142) — — — — — (142)

NAFTA capacity realignment(3) (834) — — — — — — — (834)

Currency devaluations(1) — (163) — — — — — — (163)

NHTSA Consent Order and

Amendment(4) (144) — — — — — — — (144)

Other impairments and asset

write offs — (16) (22) (46) (3) (20) — (11) (118)

Restructuring (costs)/reversal 11 (40) — — — (23) (2) 1 (53)

Other income/(expenses) 97 — (41) (1) — (8) 1 (2) 46

EBIT 2,625

(1) Refer to Note 2;

(2) Adjustment relates to the write-down of inventory (€53 million) and incremental incentives (€89 million) for vehicles affected by the explosions

at the Port of Tianjin in August 2015;

(3) Refer to Notes 2 and 4;

(4) Refer to Note 5