Chrysler 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 75

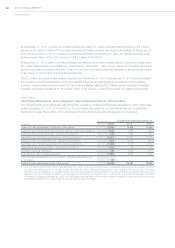

Change in Net Industrial Debt

As described in the section —Non-GAAP Financial Measures above, Net Industrial Debt is management’s primary

measure for analyzing our financial leverage and capital structure and is one of the key targets used to measure our

performance. The following section sets forth an explanation of the changes in our Net Industrial Debt during 2015,

2014 and 2013.

2015

In 2015, Net Industrial Debt decreased by €2,605 million from €7,654 million at December31, 2014, which included

Ferrari’s Net Industrial Debt to €5,049 million at December31, 2015, which excluded Ferrari’s Net Industrial Debt of

€963 million. The reduction in Net Industrial Debt during the year was primarily driven by:

(i) cash flow from industrial operating activities of €9,703 million which represents the majority of the consolidated

cash flow from operating activities of €9,751 million (refer to the section —Cash Flows above for an explanation of

the drivers in consolidated cash flows from operating activities);

(ii) net cash proceeds from the Ferrari IPO of €866 million;

(iii) the payment to non-controlling interests for €280 million in connection with the Ferrari IPO and in preparation

for the spin-off of the remaining common shares of Ferrari N.V. owned by FCA (refer to the section —Principal

Activities within our Consolidated Financial Statements included elsewhere in this report);

(iv) positive translation exchange differences of €734 million, primarily reflecting the effect of the devaluation of

Brazilian Real when converting the Brazilian companies’ net industrial debt to Euro;

These items were partially offset by:

(v) investments in industrial activities of €8,816 million representing investments in property, plant and equipment and

intangible assets, acquisition and capital increases in joint ventures, associates and unconsolidated subsidiaries for

€268 million and cash used in industrial investing activities of discontinued operations of €372 million.

2014

In 2014, Net Industrial Debt increased by €640million, from €7,014million at December31, 2013 to €7,654million at

December31, 2014, which included Ferrari Net Industrial Debt. The movements in Net Industrial Debt were primarily

driven by:

(i) payments for the acquisition of the remaining 41.5 percent interest in FCA US previously not owned, inclusive of

the previously exercised options on approximately 10 percent of FCA US’s membership interest, of €2,691 million

(U.S.$3,650 million);

(ii) investments in industrial activities of €8,119 million representing investments in property, plant and equipment and

intangible assets (including Ferrari);

The increases noted above were partially offset by the reductions in Net Industrial Debt primarily driven by:

(iii) the issuance of the mandatory convertible securities due 2016 of €1,910 million (net proceeds of €2,245 million

net of the liability component of €335 million) and the net proceeds from the offering of 100 million common shares

of €849 million, net of the exercise of cash exit rights in connection with the Merger for a net aggregate cash

disbursement of €417 million; and

(iv) cash flow from industrial operating activities of €8,017 million which represented the consolidated cash flow

from operating activities of €8,169million, net of the cash flows from operating activities attributable to financial

services. For an explanation of the drivers in consolidated cash flows from operating activities, refer to the section

—Cash Flows above.