Chrysler 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 145

Interests in other companies

Interests in other companies are measured at fair value. Investments in equity investments that do not have a

quoted market price in an active market and whose fair value cannot be reliably measured are recognized at cost.

For investments classified as available-for-sale, financial assets gains or losses arising from changes in fair value are

recognized in Other comprehensive income/(loss) until the assets are sold or are impaired; at that time, the cumulative

Other comprehensive income/(loss) is recognized in the Consolidated Income Statement. Interests in other companies

for which fair value is not available are stated at cost less any impairment losses.

Dividends received are included in Other income/(expenses) from investments.

Assets held for sale, Assets held for distribution and Discontinued operations

Pursuant to IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations, non-current assets and disposal

groups are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather

than through continuing use. This condition is regarded as met only when the asset (or disposal group) is available for

immediate sale in its present condition subject only to terms that are usual and customary for sales of such asset (or

disposal group) and the sale is highly probable, with the sale occurring within one year from the date of classification.

Non-current assets (and disposal groups) classified as held for sale are measured at the lower of their carrying amount

and fair value less costs to sell and are presented separately in the Consolidated Statement of Financial Position. Non-

current assets (and disposal groups) are not classified as held for sale within the comparative period presented for the

Consolidated Statement of Financial Position.

A discontinued operation is a component of the Group that either has been disposed of or is classified as held for

sale and:

represents either a separate major line of business or a geographical area of operations;

is part of a single coordinated plan to dispose of a separate major line of business or geographical area of

operations; or

is a subsidiary acquired exclusively with a view to resale and the disposal involves loss of control.

Classification as a discontinued operation occurs upon disposal or when the asset (or disposal group) meets the

criteria to be classified as held for sale, if earlier. When the asset (or disposal group) is classified as a discontinued

operation, the comparative information is reclassified within the Consolidated Income Statements as if the asset (or

disposal group) had been discontinued from the start of the earliest comparative period presented.

The classification, presentation and measurement requirements of IFRS 5-Non-current Assets Held for Sale and

Discontinued Operations also apply to an asset (or disposal group) that is classified as held for distribution to owners,

whereby there must be commitment to the distribution, the asset (or disposal group) must be available for immediate

distribution and the distribution must be highly probable.

Foreign currency

The functional currency of the Group’s entities is the currency of their respective primary economic environment.

In individual companies, transactions in foreign currencies are recorded at the exchange rate prevailing at the

date of the transaction. Monetary assets and liabilities denominated in foreign currencies at the balance sheet

date are translated at the exchange rate prevailing at that date. Exchange differences arising on the settlement of

monetary items, or on reporting monetary items at rates different from those initially recorded, are recognized in the

Consolidated Income Statement.

All assets and liabilities of foreign consolidated companies with a functional currency other than the Euro are translated

using the closing rates at the date of the Consolidated Statement of Financial Position. Income and expenses are

translated into Euro at the average exchange rate for the period. Translation differences resulting from the application

of this method are classified as Other comprehensive income/(loss) until the disposal of the subsidiary. Average

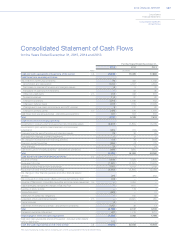

exchange rates for the period are used to translate the cash flows of foreign subsidiaries in preparing the Consolidated

Statement of Cash Flows.