Chrysler 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 67

Long-term liquidity requirements may involve some level of debt refinancing as outstanding debt becomes due or

we are required to make principal payments. Although we believe that our current level of total available liquidity is

sufficient to meet our short-term and long-term liquidity requirements, we regularly evaluate opportunities to improve

our liquidity position in order to enhance financial flexibility and to achieve and maintain a liquidity and capital position

consistent with that of other companies in our industry.

However, any actual or perceived limitations of our liquidity may limit the ability or willingness of counterparties,

including dealers, consumers, suppliers, lenders and financial service providers, to do business with us, or require us

to restrict additional amounts of cash to provide collateral security for our obligations. Our liquidity levels are subject to

a number of risks and uncertainties, including those described in the section —Risk Factors.

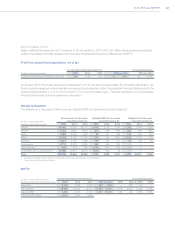

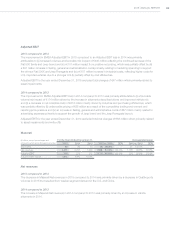

Total Available Liquidity

The following table summarizes our total available liquidity:

As of December 31,

(€ million) 2015(1) 2014 2013

Cash, cash equivalent and current securities(2) 21,144 23,050 19,702

Undrawn committed credit lines(3) 3,413 3,171 3,043

Total available liquidity(4) 24,557 26,221 22,745

(1) The assets of the Ferrari segment have been classified as Assets held for distribution within the Consolidated Statement of Financial Position

at December 31, 2015. These assets as well as the undrawn revolving credit facility of €500 million of Ferrari are not included in the figures

presented.

(2) Current securities comprise of short term or marketable securities which represent temporary investments but do not satisfy all the requirements

to be classified as cash equivalents as they may not be able to be readily converted into cash, or they are subject to significant risk of change

in value (even if they are short-term in nature or marketable).

(3) Excludes the undrawn €0.3 billion medium/long-term dedicated credit lines available to fund scheduled investments at December31, 2015 (€0.9

billion was undrawn at December31, 2014 and €1.8 billion was undrawn at December 31, 2013) and the undisbursed €0.4 billion on the Mexico

Bank Loan (as defined below) at December31, 2015, which can be drawn subject to meeting the preconditions for additional disbursements.

(4) The majority of our liquidity is available to our treasury operations in Europe, U.S. (subject to the restrictions on FCA US distributions as

described above), and Brazil; however, liquidity is also available to certain subsidiaries which operate in other areas. Cash held in such

countries may be subject to restrictions on transfer depending on the foreign jurisdictions in which these subsidiaries operate. Based on our

review of such transfer restrictions in the countries in which we operate and maintain material cash balances, we do not believe such transfer

restrictions have an adverse impact on the Group’s ability to meet its liquidity requirements at the dates presented above.

Our liquidity is principally denominated in U.S.Dollar and in Euro. Out of the total €21.1 billion of cash, cash

equivalents and current securities available at December31, 2015 (€23.0 billion at December31, 2014, €19.7 billion

at December31, 2013), €12.6 billion, or 59.7 percent were denominated in U.S.$ (€10.6 billion, or 46.0 percent, at

December31, 2014, €8.3 billion, or 42.1 percent, at December 31, 2013) and €3.4 billion, or 16.1 percent, were

denominated in Euro (€6.2 billion, or 27.0 percent, at December31, 2014, €6.1 billion, or 31.0 percent, at December

31, 2013). Liquidity available in Brazil and denominated in Brazilian Real accounted for €1.2 billion or 5.6 percent at

December31, 2015 (€1.6 billion or 7.0 percent, at December31, 2014, €1.5 billion, or 7.6 percent, at December 31,

2013), with the remainder being distributed in various countries and denominated in the relevant local currencies.

In June 2015, FCA entered into a new €5.0 billion syndicated revolving credit facility (“RCF”) for general corporate

purposes and the working capital needs of the Group. The RCF replaced and expanded the €2.1 billion three-year

revolving credit facility entered into by FCA on June 21, 2013 and replaced the U.S.$1.3 billion five-year revolving

credit facility of FCA US (“FCA US RCF”) that was scheduled to expire on May 24, 2016. On November 25, 2015, FCA

US terminated its undrawn FCA US RCF. The RCF is available in two tranches and as of December 31, 2015, the first

tranche of €2.5 billion was available and was undrawn. The first tranche matures in July 2018 and has two extension

options (1-year and 11-months, respectively) which are exercisable on the first and second anniversary of signing.

The second tranche, which consists of an additional €2.5 billion, matures in June 2020 and will be available upon the

elimination of the restrictions under certain of FCA US’s financing documentation on the provision of guarantees and

payment of dividends by FCA US for the benefit of the rest of the Group (refer to the section —Capital Market - Senior

Credit Facilities - FCA US below). The covenants of the RCF include financial covenants (Net Debt/Adjusted Earnings

Before Interest, Depreciation and Amortization (“Adjusted EBITDA”) and Adjusted EBITDA/Net Interest ratios related to

industrial activities) and negative pledge, pari passu, cross default and change of control clauses. The failure to comply

with these covenants, and in certain cases if not suitably remedied, can lead to the requirement of early repayment of

any outstanding amounts. At December 31, 2015, FCA was in compliance with the covenants of the RCF.