Chrysler 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

2015 | ANNUAL REPORT 147

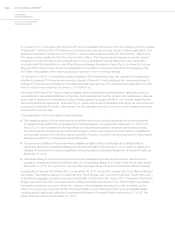

Assets held under finance leases, which provide the Group with substantially all the risks and rewards of ownership, are

recognized as assets of the Group at their fair value or, if lower, at the present value of the minimum lease payments. The

corresponding liability to the lessor is included in the Consolidated Statement of Financial Position within Debt.

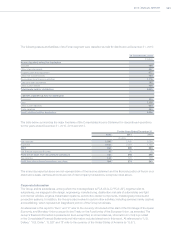

During years ended December31, 2015, 2014 and 2013, the assets were depreciated on a straight-line basis over

their estimated useful lives using the following rates:

Depreciationrates

Buildings 3%-8%

Plant, machinery and equipment 3%-33%

Other assets 5%-33%

Leases under which the lessor retains substantially all the risks and rewards of ownership of the leased assets are

classified as operating leases. Operating lease expenditures are expensed on a straight-line basis over the lease terms.

Borrowing costs

Borrowing costs that are directly attributable to the acquisition, construction or production of property, plant or

equipment or an intangible asset that is deemed to be a qualifying asset as defined in IAS 23 - Borrowing Costs are

capitalized. The amount of borrowing costs eligible for capitalization corresponds to the actual borrowing costs incurred

during the period less any investment income on the temporary investment of any borrowed funds not yet used. The

amount of borrowing costs capitalized at December31, 2015 and 2014 was €286 million and €256 million, respectively.

Impairment of assets

At the end of each reporting period, the Group assesses whether there is any indication that its intangible assets

(including capitalized development costs) and its property, plant and equipment may be impaired.

If indications of impairment are present, the carrying amount of the asset is reduced to its recoverable amount which

is the higher of fair value less costs to sell and its value in use. The recoverable amount is determined for the individual

asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or

groups of assets, in which case the asset is tested as part of the cash-generating unit (“CGU”) to which the asset

belongs. A CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent

of the cash inflows from other assets or groups of assets. In assessing the value in use of an asset or CGU, the

estimated future cash flows are discounted to their present value using a discount rate that reflects current market

assessments of the time value of money and the risks specific to the asset or CGU. An impairment loss is recognized if

the recoverable amount is lower than the carrying amount.

When an impairment loss for assets, other than Goodwill, no longer exists or has decreased, the carrying amount of the

asset or CGU is increased to the revised estimate of its recoverable amount, but not in excess of the carrying amount that

would have been recorded had no impairment loss been recognized. The reversal of an impairment loss is recognized in

the Consolidated Income Statement. Refer to the section —Use of Estimates below for additional information.