Chrysler 2015 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 195

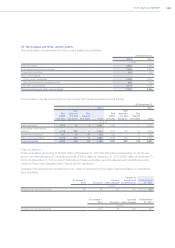

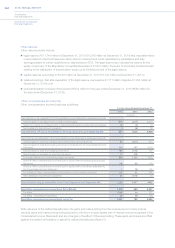

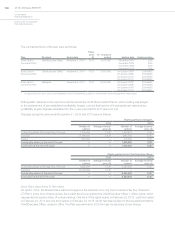

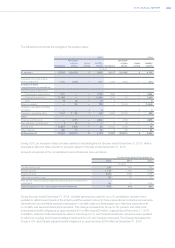

The following table summarizes the tax effect relating to Other comprehensive income/(loss):

For the Years Ended December 31,

2015 2014 2013

Pre-tax

balance

Tax

income/

(expense)

Net

balance

Pre-tax

balance

Tax

income/

(expense)

Net

balance

Pre-tax

balance

Tax

income/

(expense)

Net

balance

(€ million)

Gains/(losses) on

remeasurement of defined

benefit plans 679 (201) 478 (327) 28 (299) 2,679 237 2,916

Gains/(losses) on cash flow

hedging instruments 186 (48) 138 (144) 26 (118) 107 (10) 97

Gains/(losses) on available-

for-sale financial assets 11 — 11 (24) — (24) 4 — 4

Exchange gains/(losses)

on translating foreign

operations 928 — 928 1,255 — 1,255 (708) — (708)

Share of Other

comprehensive income/(loss)

for equity method investees (19) — (19) 47 — 47 (95) — (95)

Items relating to

discontinued operations 25 (4) 21 (127) 48 (79) 40 (15) 25

Total Other comprehensive

income/(loss) 1,810 (253) 1,557 680 102 782 2,027 212 2,239

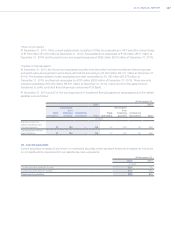

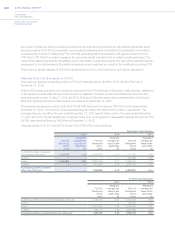

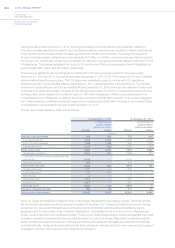

Policies and processes for managing capital

The objectives identified by the Group for managing capital are to create value for shareholders as a whole, safeguard

business continuity and support the growth of the Group. As a result, the Group endeavors to maintain an adequate

level of capital that at the same time enables it to obtain a satisfactory economic return for its shareholders and

guarantee economic access to external sources of funds, including by means of achieving an adequate credit rating.

The Group constantly monitors the ratio between debt and equity, particularly the level of net debt and the generation

of cash from its industrial activities. In order to reach these objectives, the Group continues to aim for improvement in

the profitability of its operations. Furthermore, the Group may sell part of its assets to reduce the level of its debt, while

the Board of Directors may make proposals to FCA shareholders in the general meeting to reduce or increase share

capital or, where permitted by law, to distribute reserves. The Group may also make purchases of treasury shares,

without exceeding the limits authorized by FCA shareholders in the general meeting, under the same logic of creating

value, compatible with the objectives of achieving financial equilibrium and an improvement in the Group’s rating.

For 2015, the Board of Directors has not recommended a dividend payment on FCA common shares in order to

further fund capital requirements of the Group’s business plan.

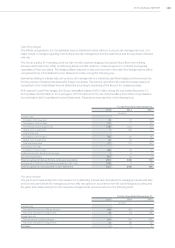

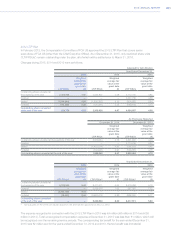

The FCA loyalty voting structure

The purpose of the loyalty voting structure is to reward long-term ownership of FCA common shares and to promote

stability of the FCA shareholder base by granting long-term FCA shareholders with special voting shares to which

one voting right is attached additional to the one granted by each FCA common share that they hold. In connection

with the Merger, FCA issued 408,941,767 special voting shares, with a nominal value of €0.01 each, to those eligible

shareholders of Fiat who had elected to participate in the loyalty voting structure upon completion of the Merger in

addition to FCA common shares. In addition, an FCA shareholder may at any time elect to participate in the loyalty

voting structure by requesting that FCA register all or some of the number of FCA common shares held by such

FCA shareholder in the Loyalty Register. Only a minimal dividend accrues to the special voting shares allocated to a

separate special dividend reserve, and they shall not carry any entitlement to any other reserve of FCA. Having only

immaterial economics entitlements, the special voting shares do not impact earnings per share.