Chrysler 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

60 2015 | ANNUAL REPORT

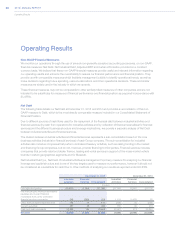

Operating Results

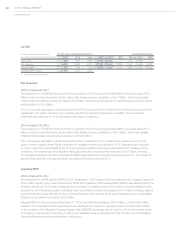

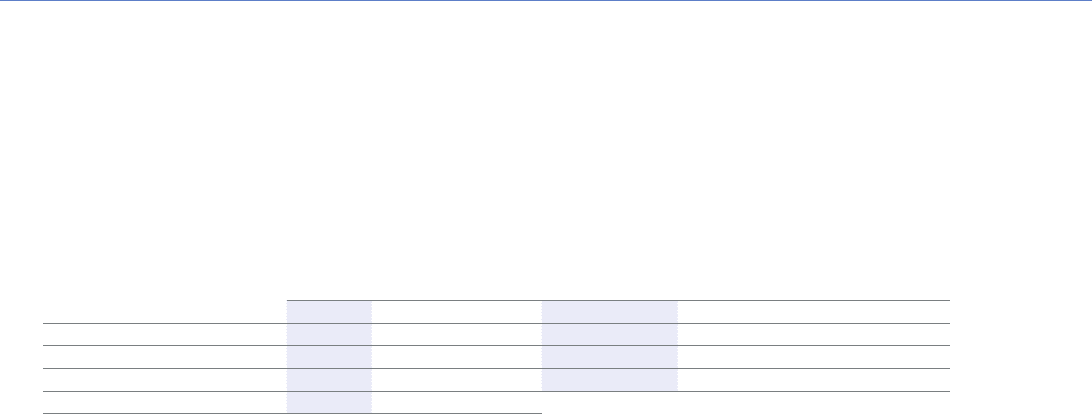

LATAM

(€ million, except percentages and

shipments which are in thousands of units)

For the Years Ended December 31, Increase/(decrease)

2015 2014 2013 2015 vs. 2014 CER 2014 vs. 2013 CER

Shipments 553 827 950 (274) (33.1)% — (123) (12.9)% —

Net revenues 6,431 8,629 9,973 (2,198) (25.5)% (17.8)% (1,344) (13.5)% (6.9)%

Adjusted EBIT (87) 289 619 (376) n.m.(1) n.m.(1) (330) (53.3)% (45.1)%

Adjusted EBIT margin (1.4)% 3.3% 6.2%

(1) Number is not meaningful.

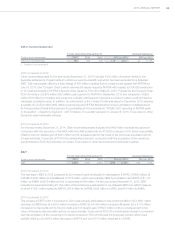

Net revenues

2015 compared to 2014

The decrease in LATAM Net revenues in 2015 compared to 2014 was primarily attributable to (i) a decrease of €2.3

billion driven by lower shipments and (ii) unfavorable foreign currency translation of €0.7 billion, which was partially

offset by (iii) a favorable product mix impact of €0.5 billion driven by the all-new 2015 Jeep Renegade and (iv) positive

pricing actions of €0.3 billion.

The 33.1 percent decrease in vehicle shipments in 2015 compared to 2014 reflected the continued macroeconomic

weakness in the region resulting in poor trading conditions in Brazil and Argentina. In addition, the decrease in

shipments also was due to continued import restrictions in Argentina.

2014 compared to 2013

The decrease in LATAM Net revenues in 2014 compared to 2013 was primarily attributable to (i) a decrease of €1.2

billion driven by lower shipments and (ii) unfavorable foreign currency translation of €0.7 billion, which was partially

offset by (iii) favorable net pricing and vehicle mix of €0.6 billion.

The 12.9 percent decrease in vehicle shipments in 2014 compared to 2013 reflected the weaker demand in the

region’s main markets, where Brazil continued the negative market trend started in 2012, Argentina was impacted

by import restrictions and additional tax on more expensive vehicles and Venezuela suffered from weaker trading

conditions. The weakening of the Brazilian Real against the Euro impacted Net revenues by €0.6 billion, whereby

the average exchange rate used to translate Brazilian Real balances for the year ended December 31, 2014 was 8.9

percent lower than the average exchange rate used for the same period in 2013.

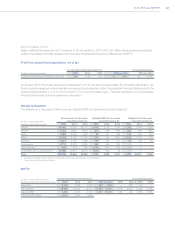

Adjusted EBIT

2015 compared to 2014

The decrease in LATAM Adjusted EBIT in 2015 compared to 2014 was primarily attributable to (i) a negative impact of

€344 million resulting from lower shipments in Brazil and Argentina, which was partially offset by favorable product mix

driven by the all-new 2015 Jeep Renegade, (ii) an increase in industrial costs of €216 million primarily relating to start-

up costs for the Pernambuco plant and higher input cost inflation and (iii) an increase of €125 million in Selling, general

and administrative costs primarily for the commercial launch of the all-new 2015 Jeep Renegade, which was partially

offset by (iv) favorable net pricing of €279 million.

Adjusted EBIT for the year ended December31, 2015 excluded total charges of €219 million, of which €83 million

related to the devaluation of the Argentinian Peso resulting from changes in monetary policy and €80 million related

to the adoption of the Marginal Currency System (the “SIMADI”) exchange rate at June 30, 2015 and the write-down

of inventory in Venezuela to the lower of cost or net realizable value as described in Note 30 within our Consolidated

Financial Statements included elsewhere in this report.