Chrysler 2015 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

236 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

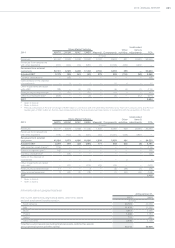

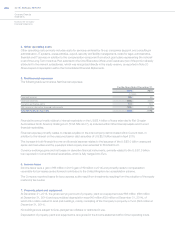

Quantitative information on foreign currency exchange rate risk

The Group is exposed to risk resulting from changes in foreign currency exchange rates, which can affect its earnings

and equity. In particular:

where a Group company incurs costs in a currency different from that of its revenues, any change in exchange rates

can affect the operating results of that company.

the principal exchange rates to which the Group is exposed are:

EUR/U.S.$, relating to sales in U.S.$ made by Italian companies (in particular, companies belonging to the

Maserati segment) and to sales and purchases in Euro made by FCA US;

U.S.$/CAD, primarily relating to FCA US’s Canadian manufacturing operations;

CNY, in relation to sales in China originating from FCA US and from Italian companies (in particular, companies

belonging to the Maserati segment);

GBP, AUD, MXN, CHF, ARS and VEF in relation to sales in the UK, Australian, Mexican, Swiss, Argentinean and

Venezuelan markets;

PLN and TRY, relating to manufacturing costs incurred in Poland and Turkey;

JPY mainly in relation to purchase of parts from Japanese suppliers and sales of vehicles in Japan;

U.S.$/BRL, EUR/BRL, relating to Brazilian manufacturing operations and the related import and export flows.

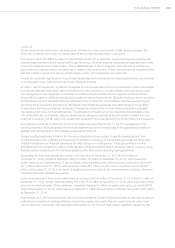

The Group’s policy is to use derivative financial instruments to hedge a percentage of certain exposures subject to

foreign currency exchange rate risk for the upcoming 12 months (including such risk before or beyond that date where

it is deemed appropriate in relation to the characteristics of the business) and to hedge the exposure resulting from

firm commitments unless not deemed appropriate.

Group companies may have trade receivables or payables denominated in a currency different from their respective

functional currency. In addition, in a limited number of cases, it may be convenient from an economic point of view, or

it may be required under local market conditions, for Group companies to obtain financing or use funds in a currency

different from their respective functional currency. Changes in exchange rates may result in exchange gains or losses

arising from these situations. The Group’s policy is to hedge, whenever deemed appropriate, the exposure resulting

from receivables, payables and securities denominated in foreign currencies different from the respective Group

companies’ functional currency.

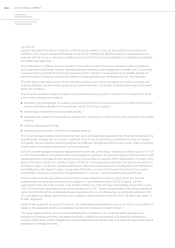

Certain of the Group’s companies are located in countries which are outside of the Eurozone, in particular the U.S.,

Brazil, Canada, Poland, Serbia, Turkey, Mexico, Argentina, the Czech Republic, India, China and South Africa. As

the Group’s reporting currency is the Euro, the income statements of those entities that have a reporting currency

other than the Euro, are translated into Euro using the average exchange rate for the period. In addition, the monetary

assets and liabilities of these consolidated companies are translated into Euro at the period-end foreign exchange

rate. The effects of these changes in foreign exchange rates are recognized directly in the Cumulative Translation

Adjustments reserve included in Other comprehensive income/(losses). Changes in exchange rates may lead to

effects on the translated balances of revenues, costs and monetary assets and liabilities reported in Euro, even when

corresponding items are unchanged in the respective local currency of these companies.

The Group monitors its principal exposure to conversion exchange risk, although there was no specific hedging in this

respect at the balance sheet dates.

There have been no substantial changes in 2015 in the nature or structure of exposure to foreign currency exchange

rate risk or in the Group’s hedging policies.

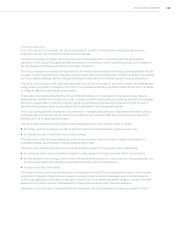

The potential loss in fair value of derivative financial instruments held for foreign currency exchange rate risk

management (currency swaps/forwards, cross-currency interest rate and currency swaps) at December31, 2015

resulting from a hypothetical 10.0 percent change in the exchange rates would have been approximately €1,490

million (€1,402 million at December31, 2014).