Chrysler 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 2015 | ANNUAL REPORT

Overview of Our Business

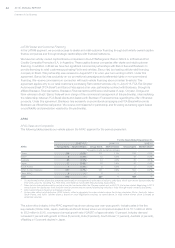

NAFTA Segment Mass-Market Dealer and Customer Financing

In the NAFTA segment, we do not have a captive finance company or joint venture and instead rely upon independent

financial service providers, primarily our strategic relationship with Santander Consumer USA Inc., or SCUSA, to

provide financing for dealers and retail customers in the U.S. Prior to the agreement with SCUSA, we principally relied

on Ally Financial Inc., or Ally, for dealer and retail financing and support. Additionally, we have arrangements with a

number of financial institutions to provide a variety of dealer and retail customer financing programs in Canada.

In February 2013, we entered into a private label financing agreement with SCUSA, or the SCUSA Agreement, under

which SCUSA provides a wide range of wholesale and retail financial services to our dealers and retail customers

in the U.S., under the Chrysler Capital brand name. The financial services include credit lines to finance dealers’

acquisition of vehicles and other products that we sell or distribute, retail loans and leases to finance retail customer

acquisitions of new and used vehicles at dealerships, financing for commercial and fleet customers, and ancillary

services. In addition, SCUSA offers dealers construction loans, real estate loans, working capital loans and revolving

lines of credit.

The SCUSA Agreement has a ten year term from February 2013, subject to early termination in certain circumstances,

including the failure by a party to comply with certain of its ongoing obligations under the SCUSA Agreement. In

accordance with the terms of the agreement, SCUSA provided us an upfront, nonrefundable payment in May 2013

which is being amortized over ten years.

Under the SCUSA Agreement, SCUSA has certain rights, including limited exclusivity to participate in specified

minimum percentages of certain retail financing rate subvention programs. SCUSA’s exclusivity rights are subject to

SCUSA maintaining price competitiveness based on market benchmark rates to be determined through a steering

committee process as well as minimum approval rates.

The SCUSA Agreement replaced an auto finance relationship with Ally, which was terminated in 2013. As of

December31, 2015, Ally was providing wholesale lines of credit to approximately 37.5 percent of our dealers in the

U.S. For the year ended December 31, 2015, we estimate that approximately 85 percent of the vehicles purchased

by our U.S. retail customers were financed or leased through our dealer network, of which approximately 50 percent

were financed or leased through Ally and SCUSA.

In December 2015, FCA Mexico entered into a ten year private label financing agreement with FC Financial, S.A De

C.V., Sofom, E.R., Grupo Financiaro Inbursa (“FC Financial”), a wholly owned subsidiary of Banco Inbursa, under

which FC Financial provides a wide range of wholesale and retail financial services to our dealers and retail customers

under the FCA Financial Mexico brand name. The wholesale repurchase obligation under the new agreement will be

limited to wholesale purchases in case of actual or constructive termination of a dealer’s franchise agreement.

LATAM

LATAM Sales and Competition

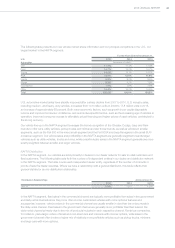

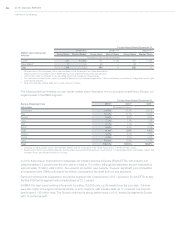

The following table presents our mass-market vehicle sales and market share in the LATAM segment for the periods

presented:

For the Years Ended December 31,

2015(1) 2014(1) 2013(1)

LATAM GroupSales MarketShare GroupSales MarketShare GroupSales MarketShare

Thousands of units (except percentages)

Brazil 483 19.5% 706 21.2% 771 21.5%

Argentina 74 11.9% 88 13.4% 111 12.0%

Other LATAM 27 2.7% 37 3.0% 51 3.6%

Total 584 14.2% 830 16.0% 933 15.8%

(1) Our estimated market share data presented are based on management’s estimates of industry sales data, which use certain data provided

by third-party sources, including IHS Global Insight, National Organization of Automotive Vehicles Distribution and Association of Automotive

Producers.