Chrysler 2015 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212 2015 | ANNUAL REPORT

Consolidated

Financial Statements

Notes to the Consolidated

Financial Statements

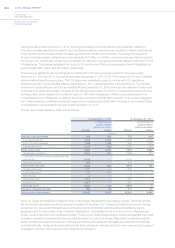

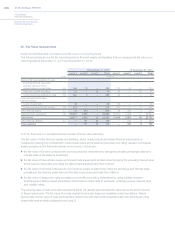

On May 14, 2015, FCA US prepaid its 2019 Notes with an aggregate principal amount outstanding of U.S.$2,875

million (€2,518 million) at a price equal to the principal amount of the notes redeemed, plus accrued and unpaid

interest to the date of redemption and a “make-whole” premium calculated in accordance with the terms of the

indenture. The redemption payment of U.S.$3.1 billion (€2.7 billion) was made with cash on hand at FCA US. In

connection with the redemption, a charge of €51 million, which consisted of the “make-whole” premium and the write-

off of the remaining unamortized debt issuance costs partially offset by the write-off of the remaining unamortized debt

premium, was recorded as a loss on extinguishment of debt within Net financial expenses in the Consolidated Income

Statement during the year ended December 31, 2015.

On December 21, 2015, FCA US prepaid its 2021 Notes with an aggregate principal amount outstanding of

U.S.$3,080 million (€2,833 million) at a price equal to the principal amount of the notes redeemed, plus accrued and

unpaid interest to the date of redemption and a “make-whole” premium calculated in accordance with the terms

of the indenture. The redemption payment of U.S.$3.3 billion (€3.0 billion) was made with cash on hand at FCA

US. In connection with the redemption, a charge of €117 million, which consisted of the “make-whole” premium

and the write-off of the remaining unamortized debt issuance costs partially offset by the write-off of the remaining

unamortized debt premium, was recorded as a loss on extinguishment of debt within Net financial expenses in the

Consolidated Income Statement during the year ended December 31, 2015.

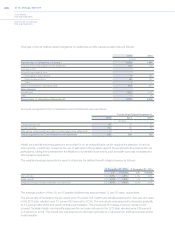

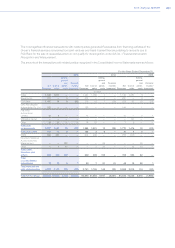

Notes issued by FCA

In April 2015, FCA issued U.S.$1.5 billion (€1.4 billion) principal amount of 4.5 percent unsecured senior debt

securities due April 15, 2020 (the “Initial 2020 Notes”) and U.S.$1.5 billion (€1.4 billion) principal amount of 5.25

percent unsecured senior debt securities due April 15, 2023 (the “Initial 2023 Notes”) at an issue price of 100 percent

of their principal amount. The Initial 2020 Notes and the Initial 2023 Notes, collectively referred to as “the Initial Notes”,

rank pari passu in right of payment with respect to all of FCA’s existing and future senior unsecured indebtedness and

senior in right of payment to any of FCA’s future subordinated indebtedness and existing indebtedness, which is by its

terms subordinated in right of payment to the Initial Notes.

On June 17, 2015, subject to the terms and conditions set forth in our prospectus, we commenced an offer to

exchange up to U.S.$1.5 billion (€1.4 billion) aggregate principal amount of new 4.5 percent unsecured senior debt

securities due 2020 (“2020 Notes”), for any and all of our outstanding Initial 2020 Notes issued on April 14, 2015, and

up to U.S.$1.5 billion (€1.4 billion) aggregate principal amount of new 5.25 percent unsecured senior debt securities

due 2023 (“2023 Notes”), for any and all of our outstanding Initial 2023 Notes issued on April 14, 2015. The 2020

Notes and the 2023 Notes, collectively referred to as “the Notes”, were identical in all material respects to the Initial

Notes, except that the Notes did not contain restrictions on transfer. The exchange offer expired on July 23, 2015.

Substantially all of the Initial Notes were tendered for the Notes.

The Notes impose covenants on FCA including: (i)negative pledge clauses which require that, in case any security

interest upon assets of FCA is granted in connection with other notes or debt securities having the same ranking,

such security should be equally and ratably extended to the outstanding Notes; (ii)pari passu clauses, under which

the Notes rank and will rank pari passu with all other present and future unsubordinated and unsecured obligations

of FCA; (iii)periodic disclosure obligations; (iv)cross-default clauses which require immediate repayment of the Notes

under certain events of default on other financial instruments issued by FCA’s main entities; and (v)other clauses that

are generally applicable to securities of a similar type. A breach of these covenants may require the early repayment of

the Notes. As of December 31, 2015, FCA was in compliance with the covenants of the Notes.

FCA used the net proceeds from the offering of the Notes for general corporate purposes and the refinancing of a

portion of the outstanding Secured Senior Notes. Debt issuance costs, arrangement fees and other direct costs were

split evenly across the 2020 Notes and the 2023 Notes, were recorded as a reduction in the carrying value of the

Notes and are amortized using the effective interest rate method over the respective life of the Notes. Interest on the

2020 Notes and the 2023 Notes is payable semi-annually in April and October.