Chrysler 2015 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 197

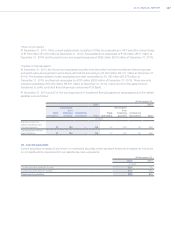

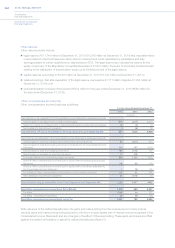

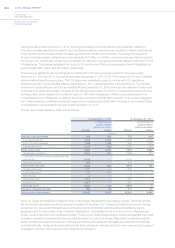

Restricted Share Units

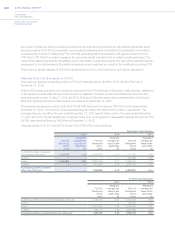

During the year ended December31, 2015, FCA awarded 5,196,550 Restricted Share Units (“RSU awards”) to certain

key employees of the Company which represent the right to receive FCA shares. These shares will vest in three equal

tranches in February of 2017, 2018 and 2019. None of the outstanding RSU awards were forfeited and none of the

outstanding RSU awards had vested as of December31, 2015.

Total expense for the PSU awards and RSU awards of approximately €54 million was recorded for the year ended

December31, 2015. As of December31, 2015, the Group had unrecognized compensation expense related to the

non-vested PSU awards and RSU awards of approximately €178 million based on current forfeiture assumptions,

which will be recognized over a weighted-average period of 2.2 years. The corresponding tax benefit for the year

ended December 31, 2015 was €7 million.

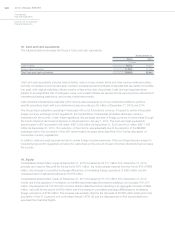

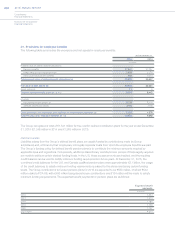

Chief Executive Officer - Special Recognition Award

On April 16, 2015, Shareholders of FCA approved a grant of 1,620,000 common shares to the Chief Executive

Officer, which vested immediately. This grant was for recognition of the Chief Executive Officer’s vision and guidance

in the formation of Fiat Chrysler Automobiles N.V., which created significant value for the Company, its shareholders,

stakeholders and employees. The weighted-average fair value of the shares at the grant date was €15.21

(U.S.$16.29), measured using FCA’s share price on the grant date. A one-time charge of €24.6 million was recorded

within Selling, general and administrative costs during the year ended December31, 2015 related to this grant.

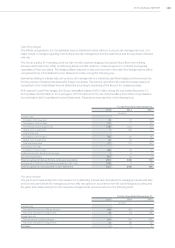

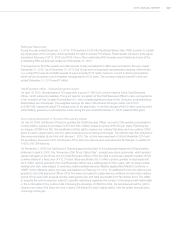

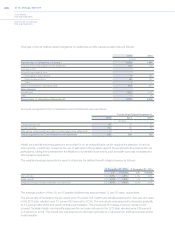

Stock option plans linked to Fiat and CNHI ordinary shares

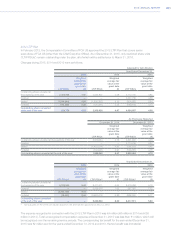

On July26, 2004, the Board of Directors granted the Chief Executive Officer, as a part of his variable compensation

in that position, options to purchase 10,670,000 Fiat ordinary shares at a price of €6.583per share. Following the

de-merger of CNHI from Fiat, the beneficiary had the right to receive one ordinary Fiat share and one ordinary CNHI

share for each original option, with the option exercise price remaining unchanged. The options were fully vested and

they were exercisable at any time until January1, 2016. The options were exercised in total in November 2014 and

the beneficiary received 10,670,000 shares of FCA since the options were exercised after the Merger, in addition to

10,670,000 CNHI shares.

On November3, 2006, the Fiat Board of Directors approved (subject to the subsequent approval of Shareholders

obtained on April5, 2007), the “November 2006 Stock Option Plan”, an eight year stock option plan, which granted

certain managers of the Group and the Chief Executive Officer of Fiat the right to purchase a specific number of Fiat

ordinary shares at a fixed price of €13.37 each. More specifically, the 10 million options granted to employees and

the 5 million options granted to the Chief Executive Officer had a vesting period of four years, with an equal number

vesting each year, were subject to achieving certain predetermined profitability targets (Non-Market Conditions or

“NMC”) in the reference period and were exercisable from February 18, 2011. An additional 5,000,000 options were

granted to the Chief Executive Officer of Fiat that were not subject to performance conditions but also had a vesting

period of four years with an equal number vesting each year and were exercisable from November 2010. The ability

to exercise the options was also subject to specific restrictions regarding the duration of the employment relationship

or the continuation of the position held. Following the demerger of CNHI from Fiat, the beneficiaries had the right to

receive one ordinary Fiat share and one ordinary CNHI share for each original option, with the option exercise price

remaining unchanged.