Chrysler 2015 Annual Report Download - page 283

Download and view the complete annual report

Please find page 283 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

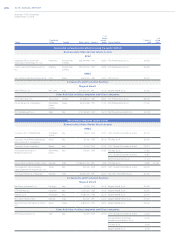

2015 | ANNUAL REPORT 283

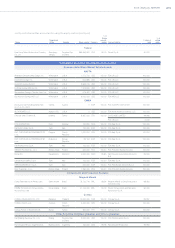

Risk

Our audit response

Valuation of non-current assets with definite and indefinite useful lives

At December 31, 2015 the recorded amount of goodwill and

other intangible assets with indefinite useful lives was €14,790

million; the majority of these assets relate to the NAFTA

segment. Non-current assets with definite useful lives include

property, plant and equipment, intangible assets and assets held

for sale. Intangible assets with definite useful lives mainly

consist of capitalized development costs related to the EMEA

and NAFTA segments.

The Company reviews the carrying amounts of these

non-current assets annually or more frequently when impairment

indicators are present. Estimating the recoverable amount of the

assets requires critical management judgment including

estimates of future sales, gross margins, operating costs,

terminal value growth rates, capital expenditures and the

discount rate and the assumptions inherent in those estimates.

The annual impairment test is significant to our audit because

the assessment process is complex and requires significant

judgment.

The Company disclosed the nature and value of the assumptions

used in the impairment analyses in note 10.

We designed our audit procedures to be responsive to

this risk. We obtained an understanding of the

impairment assessment processes and evaluated the

design and tested the effectiveness of controls in this

area relevant to our audit. Our focus included

evaluating the work of the management specialists

used for the valuation, evaluating and testing key

assumptions used in the valuation including projected

future income and earnings, performing sensitivity

analyses, and testing the allocation of the assets,

liabilities, revenues and expenses.

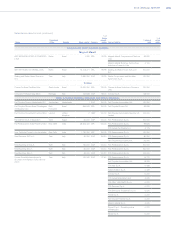

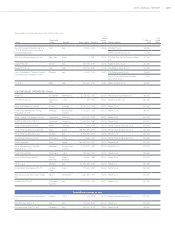

Risk

Our audit response

Income taxes -recoverability of deferred tax assets

At December 31, 2015, the Group had deferred tax assets on

deductible temporary differences of €9,606 million which were

recognized and €533 million which were not recognized. At the

same date the Group also had deferred tax assets on tax losses

carried forward of €3,717 million which were recognized and

€2,650 million which were not recognized. The analysis of the

recognition and recoverability of the deferred tax assets was

significant to our audit because the amounts are material, the

assessment process is complex and judgmental and is based on

assumptions that are affected by expected future market or

economic conditions.

The disclosures in relation to income taxes are included in note

7.

We obtained an understanding of the income taxes

process, and evaluated the design and tested the

effectiveness of controls in this area relevant to our

audit. We performed substantive audit procedures on

the recognition of deferred tax balances based on

different local tax regulations, and on the analysis of

the recoverability of the deferred tax assets based on

the estimated future taxable income, on which we

performed our audit procedures, principally by

performing sensitivity analyses and evaluating and

testing the key assumptions used to determine the

amounts recognized.