Chrysler 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 159

Mortality rates. Mortality rates are developed using our plan-specific populations, recent mortality information

published by recognized experts in this field and other data where appropriate to reflect actual and projected

plan experience.

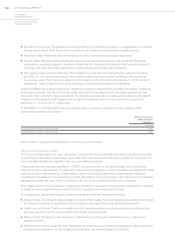

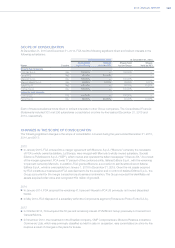

At December31, 2015, the effect of the indicated decreases or increases in the key factors affecting the health

care, life insurance plans and severance indemnity in Italy (trattamento di fine rapporto or “TFR”), holding all other

assumptions constant, is shown below:

Effectonhealth

careandlife

insurancedefined

benefit obligation

EffectontheTFR

obligation

(€ million)

10 basis point / (100 basis point for TFR) decrease in discount rate 32 41

10 basis point / (100 basis point for TFR) increase in discount rate (31) (38)

100 basis point decrease in health care cost trend rate (129) —

100 basis point increase in health care cost trend rate 157 —

Refer to Note 21 for additional information on the Group’s Other post-employment benefits.

Recoverability of non-current assets with definite useful lives

Non-current assets with definite useful lives include Property, plant and equipment, Intangible assets and Assets

held for sale. Intangible assets with definite useful lives mainly consist of capitalized development costs related to the

NAFTA and EMEA segments. The Group periodically reviews the carrying amount of non-current assets with definite

useful lives when events or circumstances indicate that an asset may be impaired.

During the year ended December 31, 2015, impairment losses totaling €713 million were recognized. The most

significant component of this impairment loss related to the decision taken by the Group during the fourth quarter of

2015 to realign a portion of its manufacturing capacity in the NAFTA region, as part of the plan to improve NAFTA

margins and to better meet market demand for Ram pickup trucks and Jeep vehicles within the Group’s existing plant

infrastructure. The approval of this plan was deemed to be an indicator of impairment for certain of our vehicle platform

cash generating units (“CGUs”) due to the significant changes to the extent to which the assets are expected to be

used. The impairment test compared the carrying amount of the assets included in the respective CGUs (comprising

property, plant and equipment and capitalized development costs) to their value in use, which was determined not

to be materially different from their fair value, and was determined using a discounted cash flow methodology. The

value in use of the CGUs, which was based primarily on unobservable inputs, was determined using pre-tax estimated

future cash flows attributable to the CGU that were discounted using a pre-tax discount rate reflecting current market

assessments of the time value of money and the risks specific to the CGUs. As a result of completing the impairment

test, it was determined that the carrying amount of the CGUs exceeded their value in use and an impairment charge

of €598 million was recorded for the year ended December 31, 2015, of which €422 million related to tangible asset

impairments and €176 million related to the impairment of capitalized development costs.

Due to impairment indicators existing in 2014 and 2013, primarily related to losses incurred in EMEA due to weak

demand for vehicles and strong competition as well as changes in product strategy, impairment tests relating to the

recoverability of CGUs in EMEA were performed. The impairment tests compared the carrying amount of the assets

allocated to the CGUs (comprising property, plant and equipment and capitalized development costs) to their value

in use using pre-tax estimated future cash flows based on the Group’s 2014-2018 business plan presented on

May 6, 2014, which were discounted to their present value using a pre-tax discount rate reflecting current market

assessments of the time value of money and the risks specific to the CGUs. The impairment test, which reflected

the Group’s available knowledge as to the expected future development of the business, markets and automotive

industry, confirmed that the value in use of the CGUs in EMEA was greater than the carrying value at December

31, 2014 and as a result, no impairment losses were recognized in 2014. For the year ended December31, 2013,

total impairment charges of €116 million relating to CGUs in EMEA were recognized of which €61 million related to

capitalized development costs (Note 4) and €55 million related to property, plant and equipment.