Chrysler 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

2015 | ANNUAL REPORT 125

Long-Term Incentives

Long-term incentive compensation is a critical component of our executive compensation program. This

compensation component is designed to motivate and reward long-term stockholder value creation and the

attainment of Company performance goals, to retain top talent and create an ownership alignment with shareholders.

Long-term incentives are an important retention tool that management and the Compensation Committee use to align

the financial interests of executives and other key contributors with sustained shareholder value creation. We believe

the compensation for Executive Directors should be aligned with the interests of our shareholders.

FCA’s long-term variable incentives consists of a share-based incentive plan that links a portion of the variable

component to the achievement of pre-established performance targets consistent with the Company’s strategic

horizon. These awards increase the link between behavior, realized compensation and shareholder interests, by

delivering greater value to the CEO as shareholder value increases. Long term incentive awards are intended to

motivate our executives to achieve significant returns for our shareholders over the long-term.

Equity Incentive Plan

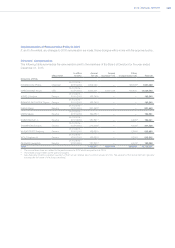

On October 29, 2014, in connection with the formation of FCA and the presentation of the 2014-2018 business plan,

the Board of Directors approved a new Long Term Incentive (“LTI”) program, covering the five year performance

period, under the Fiat Chrysler Automobiles N.V. Equity Incentive Plan (“EIP”), consistent with the Company’s strategic

horizon and under which equity awards can be granted to eligible individuals. The award vesting under the program is

conditional on meeting two independent metrics, Adjusted net profit and Relative TSR weighted equally at target. The

awards have three vesting opportunities, one-third after 2014-2016 results, one-third after 2014-2017 results, and the

final third after the full 2014-2018 results. The Adjusted net profit component payout begins at 80 percent of target

achievement and has a maximum payout at 100 percent of target.

The Relative TSR component has partial vesting if ranked seventh or better among an industry specific peer group of

eleven, including the Company, and a maximum pay-out of 150 percent, if ranked first among the eleven peers. Listed

below is the Relative TSR peer group.

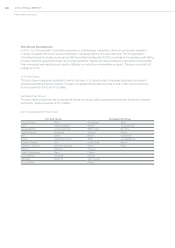

2014-2018 Performance Cycle Relative TSR Metric Peers

Volkswagen AG Toyota Motor Daimler AG General Motors

Ford Motor Honda Motor BMW AG Hyundai Motor

PSA Peugeot Citroen Renault SA

The Company’s target setting process for the incentive plans is built on the foundation of our rigorous business

planning process which is determined by the overall business environment, industry and competitive market factors,

and Company-wide business goals. Moreover, the targets are in line with the external forward looking guidance that

we provide to analysts and investors.

Performance Cycle: 2014 - 2018 (Five Year Performance Period)

Performance Metric Weight Vesting Threshold Achievement Target Achievement

Adjusted net profit 50%

1/3, 1/3, 1/3 after 3,4,5 years’

cumulative results 80% of target 100% of target

Relative TSR 50%

1/3, 1/3, 1/3 after 3,4,5 years’

cumulative results

Rank seventh or better among

11 peers Rank fourth among 11 peers