Chrysler 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288

|

|

2015 | ANNUAL REPORT 119

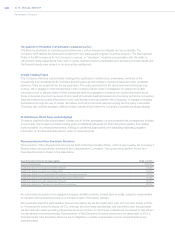

As referenced in the above highlights, the Company’s 2015 performance was strong with regard to both actual

financial results and strategic initiatives.

Worldwide shipments of 4.6 million units in 2015 reflected the continued global expansion of the Jeep brand, which

achieved an all-time record of 1.3 million worldwide shipments.

In 2015, Net revenues increased 18 percent from 2014 to €110.6 billion. Adjusted EBIT increased 43 percent from

2014 to €4.8 billion, with NAFTA more than doubling and EMEA returning to profitability one year ahead of plan. Our

Adjusted net profit of €2.0 billion in 2015 was nearly double compared to 2014.

In 2015, Net industrial debt decreased by €2,605 million to €5,049 million at December31, 2015.

In May 2014, we presented an ambitious 5-year business plan and we have successfully achieved the plan targets

in both 2014 and 2015. While there were some changes in trading conditions compared to our plan expectations,

notably the negative market in Brazil, we acted quickly and decisively to address these changes and as a result, we

have revised upwards our original financial targets in 2018, despite the spin-off of Ferrari.

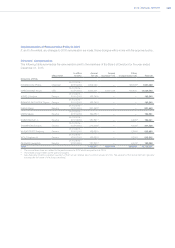

Remuneration Principles

The guiding principle of our Remuneration Policy is to provide a compensation structure that allows FCA to attract

and retain the most highly qualified executive talent and to motivate such executives to achieve business and financial

goals that create value for shareholders in a manner consistent with our core business and leadership values. FCA’s

compensation philosophy, as set forth in the Remuneration Policy, aims to provide compensation to its Executive

Directors as outlined below.

Alignment with FCA’s strategy • Executive Director’s compensation should be strongly linked to the achievement of

targets that are seen as indicators of the execution of the Company’s strategy.

Pay for performance • Executive Director’s compensation reinforces our performance driven culture and

meritocracy and the majority of pay is linked directly to the Company’s performance

through variable pay instruments.

Competitiveness • Compensation should be set in a manner such that it attracts, retains and motivates

expert leaders and highly qualified executives and is competitive against the

comparable market

Long-term shareholder value creation • Executive Director’s compensation should reflect alignment with interests of

shareholders.

Compliance • Decisions should be made in the context of the Company’s business objectives and

the Board should ensure compliance with applicable laws and corporate governance

requirements when designing and implementing policies and plans.

Risk Prudence • The compensation structure must avoid incentives that would encourage

unnecessary or excessive risks that could threaten the Company’s value.