Chrysler 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 51

Adjusted EBIT

Adjusted EBIT is calculated as EBIT excluding: gains/(losses) on the disposal of investments, restructuring,

impairments, asset write-offs and other unusual income/(expenses) that are considered rare or discrete events that

are infrequent in nature. Adjusted EBIT is used for internal reporting to assess performance and as part of the Group’s

forecasting, budgeting and decision making processes as it provides additional transparency of the Group’s core

operations. We believe this measure allows management to view operating trends, perform analytical comparisons

and benchmark performance between periods and among our segments. We also believe that Adjusted EBIT

provides useful information to investors as it is a common performance measure to compare results or estimate

valuations across companies in our industry. Refer to the section —Results of Operations below for further discussion

and refer to Note 29 within the Consolidated Financial Statements included elsewhere in this report for a reconciliation

of Adjusted EBIT to EBIT, which is the most directly comparable measure included in our Consolidated Income

Statement. Adjusted EBIT should not be considered as a substitute for net profit/(loss), cash flow or other methods of

analyzing our results as reported under EU-IFRS.

Constant Currency Information

The discussion within —Results of Operations includes information about our results at constant exchange rates

(“CER”), which is calculated by applying the prior-year average exchange rates to current financial data expressed in

local currency in which the relevant financial statements are denominated (see —Significant Accounting Policies in the

Consolidated Financial Statements included elsewhere in this report for information on the exchange rates applied).

Although we do not believe that this non-GAAP measure is a substitute for GAAP measures, we do believe that such

results excluding the impact of currency fluctuations year-on-year, provide additional useful information to investors

regarding the operating performance and trends in our business on a local currency basis.

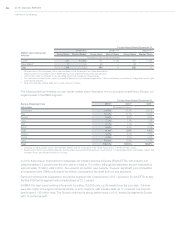

Results of Operations

Consolidated Results of Operations – 2015 compared to 2014 and 2014 compared to 2013

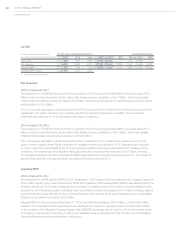

The following is a discussion of the results of operations for the year ended December31, 2015 as compared to

the year ended December31, 2014 and for the year ended December31, 2014 as compared to the year ended

December31, 2013. The discussion of certain line items (Cost of sales, Selling, general and administrative costs and

Research and development costs) includes a presentation of such line items as a percentage of Net revenues for the

respective periods presented as well as constant exchange rates, to facilitate year-on-year comparisons.

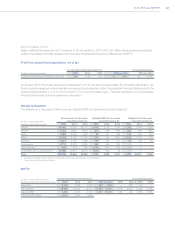

For the Years Ended December 31,

(€ million) 2015 2014 2013

Net revenues 110,595 93,640 84,530

Cost of sales 97,620 81,592 73,038

Selling, general and administrative costs 7,728 6,947 6,615

Research and development costs 2,864 2,334 2,275

Result from investments 143 131 84

Gains on disposal of investments —12 8

Restructuring costs 53 50 28

Other income/(expenses) 152 (26) (28)

EBIT 2,625 2,834 2,638

Net financial expenses 2,366 2,051 1,989

Profit before taxes 259 783 649

Tax expense/(income) 166 424 (1,059)

Net profit from continuing operations 93 359 1,708

Profit from discontinued operations, net of tax 284 273 243

Net profit 377 632 1,951

Net profit attributable to:

Owners of the parent 334 568 904

Non-controlling interests 43 64 1,047