Chrysler 2015 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 | ANNUAL REPORT 229

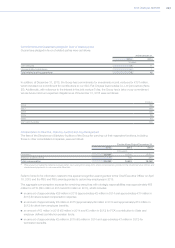

Contingent liabilities

Contingent liabilities estimated by the Group for which no provisions have been recognized since an outflow of

resources is not considered to be probable and contingent liabilities for which a reliable estimate can be made

amounted to approximately €70 million and €100 million at December31, 2015 and 2014, respectively. Furthermore,

contingent assets and expected reimbursement in connection with these contingent liabilities for approximately €8

million and €10 million at December31, 2015 and 2014, respectively, have been estimated but not recognized. The

Group will recognize the related amounts when it is probable that an outflow of resources embodying economic

benefits will be required to settle obligations and the amounts can be reliably estimated.

Furthermore, in connection with significant asset divestitures carried out in prior years, the Group provided indemnities

to purchasers with the maximum amount of potential liability under these contracts generally capped at a percentage

of the purchase price. These liabilities refer principally to potential liabilities arising from possible breaches of

representations and warranties provided in the contracts and, in certain instances, environmental or tax matters,

generally for a limited period of time. Potential obligations with respect to these indemnities were approximately €240

million at December31, 2015 and 2014. At December31, 2015 and 2014, a total of €50 million and €58 million,

respectively, within Other provisions, has been recognized related to these obligations. The Group has provided

certain other indemnifications that do not limit potential payment and as such, it was not possible to estimate the

maximum amount of potential future payments that could result from claims made under these indemnities.

Litigation

On July 9, 2012, a lawsuit was filed against FCA US in the Superior Court of Decatur County, Georgia, U.S. (“the

Court”), with respect to a March 2012 fatality in a rear-impact collision involving a 1999 Jeep Grand Cherokee.

Plaintiffs alleged that the manufacturer had acted in a reckless and wanton fashion when it designed and sold the

vehicle due to the placement of the fuel tank behind the rear axle and had breached a duty to warn of the alleged

danger. On April 2, 2015, a jury found in favor of the plaintiffs and the trial court entered a judgment against FCA US in

the amount of U.S.$148.5 million (€138 million). On July 24, 2015, the Court issued a remittitur reducing the judgment

against FCA US to U.S.$40 million (€36 million).

FCA US believes the jury verdict was not supported by the evidence or the law. FCA US maintains that the 1999 Jeep

Grand Cherokee is not defective, and its fuel system does not pose an unreasonable risk to motor vehicle safety. The

vehicle met or exceeded all applicable Federal Motor Vehicle Safety Standards, including the standard governing fuel

system integrity. Furthermore, FCA US submitted extensive data to NHTSA validating that the vehicle performs as well

as, or better than, peer vehicles in impact studies, and nothing revealed in the trial altered this data. During the trial,

however, FCA US was not allowed to introduce all the data previously provided to NHTSA, which demonstrated that

the vehicle’s fuel system is not defective.

On August 10, 2015, FCA US filed a notice of appeal with the Georgia Court of Appeals. While a decision by an

appellate court could affirm the judgment, FCA US believes it is more likely that the verdict will be overturned, that

a new trial will be ordered or that the amount of the judgment will be further modified. FCA US does not, therefore,

believe a loss is probable at the present time. The amount of the possible loss cannot reasonably be estimated at this

time given that FCA US is in the early stages of what could be a lengthy appellate process, and the range of possible

outcomes is between zero (as the verdict could be overturned or the award could be reduced to an immaterial

amount) and the current judgment of U.S.$40 million (€36 million).