Chrysler 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT

Table of contents

-

Page 1

2015 ANNUAL REPORT -

Page 2

-

Page 3

... | ANNUAL REPORT Table of contents 3 Table of contents Board of Directors and Auditors ...5 Letter from the Chairman and the CEO ...7 Certain Defined Terms ...9 Selected Financial Data ...10 Creating Value for Our Shareholders ...13 Risk Factors ...14 Overview ...31 Our Business Plan ...34 Company... -

Page 4

-

Page 5

2015 | ANNUAL REPORT Board of Directors and Auditors 5 Board of Directors and Auditors BOARD OF DIRECTORS Chairman John Elkann(3) Chief Executive Officer Sergio Marchionne Directors... Young Accountants LLP (1) (2) (3) Member of the Audit Committee. Member of the Compensation Committee. Member of ... -

Page 6

6 2015 | ANNUAL REPORT -

Page 7

... at the beginning of January, the Group begins 2016 operations with net industrial debt of â,¬5 billion, down from the â,¬7.7 billion at year-end 2014. In order to further fund the capital requirements of the Group's five-year business plan, the Board of Directors has decided not to recommend... -

Page 8

... of hours to serve the community in the various locations where we operate. In addition, the Group committed more than â,¬22 million to local communities around the world. A pioneer and leader in natural gas vehicles for 15 years, FCA recently revealed the Chrysler Pacifica Hybrid, the industry... -

Page 9

2015 | ANNUAL REPORT Certain Defined Terms 9 Certain Defined Terms In this report, unless otherwise specified, the terms "we," "our," "us," the "Group," "Fiat Group," the "Company" and "FCA" refer to Fiat Chrysler Automobiles N.V., together with its subsidiaries and its predecessor prior to the ... -

Page 10

... FCA for the years ended December 31, 2015, 2014 and 2013, included elsewhere in this report; and the Consolidated Financial Statements of FCA for the year ended December 31, 2012 and the Fiat Group for the year ended December 31, 2011, which are not included in this report. This data should be read... -

Page 11

... year that generally relates to earnings of the previous year. In accordance with the resolution adopted by the shareholders' meeting on April 4, 2012, Fiat's preference and savings shares were mandatorily converted into ordinary shares. Numbers from Form F-1 filed with U.S. Securities Exchange... -

Page 12

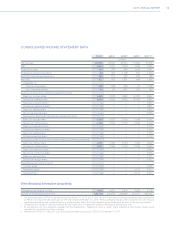

...| ANNUAL REPORT Selected Financial Data CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA At December 31, 2015(1) Cash and cash equivalents Total assets Debt Total equity Equity attributable to owners of the parent Non-controlling interests Share capital Shares issued (in thousands of shares): Fiat... -

Page 13

...management and professional development of employees promotion of safe working conditions and respect for human rights mutually beneficial relationships with business partners and local communities reducing impacts from manufacturing and non-manufacturing processes on the environment. The Group uses... -

Page 14

... Business, Strategy and Operations Our profitability depends on reaching certain minimum vehicle sales volumes. If our vehicle sales deteriorate, particularly sales of our pickup trucks, larger utility vehicles and minivans, our results of operations and financial condition will suffer. Our success... -

Page 15

... in January 2016 (our "Business Plan") require us to make significant investments, including the expansion of several brands that we believe to have global appeal into new markets. Most notably, these strategies include expanding global sales of the Jeep brand through localized production in Asia... -

Page 16

... region. These markets are all highly competitive in terms of product quality, innovation, pricing, fuel economy, reliability, safety, customer service and financial services offered, and many of our competitors are better capitalized with larger market shares. In addition, global vehicle production... -

Page 17

... to find adequate replacements or to attract, retain and incentivize senior executives, other key employees or new qualified personnel our business, financial condition and results of operations may suffer. We may be subject to more intensive competition if other manufacturers pursue consolidations... -

Page 18

... defined benefit plans, as well as the investment strategy for the plans, we are required to make various assumptions, including an expected rate of return on plan assets and a discount rate used to measure the obligations under defined benefit pension plans. Interest rate increases generally will... -

Page 19

... or lease our vehicles. As a result, our vehicle sales and market share may suffer, which would adversely affect our financial condition and results of operations. Vehicle sales depend heavily on affordable interest rates for vehicle financing. In certain regions, including NAFTA, financing for new... -

Page 20

20 2015 | ANNUAL REPORT Risk Factors Our current credit rating is below investment grade and any further deterioration may significantly affect our funding and prospects. Our ability to access the capital markets or other forms of financing and the related costs depend, among other things, on our ... -

Page 21

...in our credit agreements and other debt. We continuously monitor and evaluate changes in our internal controls over financial reporting. In support of our drive toward common global systems, we have extended our finance, procurement, and capital project and investment management systems to new areas... -

Page 22

... on our business, reputation, financial condition and results of operations. In addition to supporting our operations, we use our systems to collect and store confidential and sensitive data, including information about our business, our customers and our employees. As our technology continues to... -

Page 23

... vehicles for the Chinese market, expanding the portfolio of Jeep sport utility vehicles ("SUVs") currently available to Chinese consumers as imports. We have also entered into a joint venture with TATA Motors Limited for the production of certain of our vehicles, engines and transmissions in India... -

Page 24

... for our industrial activities and for providing financing to our dealers and customers. Moreover, liquidity for industrial activities is also principally invested in variable-rate or short-term financial instruments. Our financial services businesses normally operate a matching policy to offset... -

Page 25

... a Dutch public company with limited liability (naamloze vennootschap). Our corporate affairs are governed by our articles of association and by the laws governing companies incorporated in the Netherlands. The rights of shareholders and the responsibilities of members of our board of directors may... -

Page 26

... activities. A full or 75 percent exemption may also be available for some non-trading finance profits. Although we do not expect the U.K.'s CFC rules to have a material adverse impact on our financial position, the effect of the new CFC rules on us is not yet certain. We will continue to monitor... -

Page 27

... could have important consequences on our operations and financial results, including: we may not be able to secure additional funds for working capital, capital expenditures, debt service requirements or general corporate purposes; we may need to use a portion of our projected future cash... -

Page 28

.... In connection with our capital planning to support the Business Plan, we have announced our intention to eliminate existing contractual terms limiting the free flow of capital among Group companies, including through prepayment, refinancing and/or amendment of the outstanding FCA US senior credit... -

Page 29

...in our common shares and adversely affect their trading price. The loyalty voting structure may make it more difficult for shareholders to acquire a controlling interest, change our management or strategy or otherwise exercise influence over us, and the market price of our common shares may be lower... -

Page 30

30 2015 | ANNUAL REPORT Risk Factors There may be potential Passive Foreign Investment Company tax considerations for U.S. Shareholders. Shares of our stock held by a U.S. holder would be stock of a passive foreign investment company ("PFIC") for U.S. federal income tax purposes with respect to a ... -

Page 31

...Dodge, Fiat, Fiat Professional, Jeep, Lancia and Ram brands and the SRT performance vehicle designation. We support our vehicle sales by after-sales services and parts worldwide using the Mopar brand for mass market vehicles. We make available retail and dealer financing, leasing and rental services... -

Page 32

... company of the Group with its principal executive offices in the United Kingdom. On June 15, 2014, the Board of Directors of Fiat approved the terms of a cross-border legal merger of Fiat, the parent of the Group, into its 100 percent owned direct subsidiary, FCA, (the "Merger"). Fiat shareholders... -

Page 33

2015 | ANNUAL REPORT 33 As the spin-off of Ferrari N.V. was highly probable after the approval was obtained at the extraordinary general meeting of FCA shareholders and since it was available for immediate distribution, the Ferrari segment met the criteria to be classified as a disposal group held... -

Page 34

... the globalization of Jeep and Alfa Romeo; volume growth; continued platform convergence and focus on cost efficiencies, as well as enhancing margins and strengthening our capital structure. We presented an update to our Business Plan in January 2016 in order to address intervening market changes... -

Page 35

...upgrades from the prior model. Our Industry Designing, engineering, manufacturing, distributing and selling vehicles require significant investments in product design, engineering, research and development, technology, tooling, machinery and equipment, facilities and marketing in order to meet both... -

Page 36

..., driving experience and style. Historically, manufacturers relied heavily upon dealer, retail and fleet incentives, including cash rebates, option package discounts, guaranteed depreciation programs, and subsidized or subvented financing or leasing programs to compete for vehicle sales. Since 2009... -

Page 37

...Maserati global luxury brand segment and a global Components segment. Our four regional mass-market vehicle reportable segments deal with the design, engineering, development, manufacturing, distribution and sale of passenger cars, light commercial vehicles and related parts and services in specific... -

Page 38

..., tax, insurance, purchasing, information technology, facility management and security for the Group as well as CNH Industrial N.V. ("CNHI"), manage central treasury activities and operate in media and publishing. Mass-Market Vehicle Brands We design, engineer, develop, manufacture, distribute and... -

Page 39

... heavy-duty pickup trucks, as well as light commercial vehicles. In addition, the Mopar brand provides a full line of service parts and accessories for our mass-market vehicles worldwide. As of December 31, 2015, we had 51 parts distribution centers throughout the world to support our customer care... -

Page 40

40 2015 | ANNUAL REPORT Overview of Our Business Vehicle Sales Overview We are the seventh largest automotive OEM in the world based on worldwide new vehicle sales for the year ended December 31, 2015. We compete with other large OEMs to attract vehicle sales and market share. Many of these OEMs ... -

Page 41

... vehicles in operation, improved consumer access to affordably priced financing and higher prices of used vehicles, contributed to the strong recovery. Our vehicle line-up in the NAFTA segment leverages the brand recognition of the Chrysler, Dodge, Jeep and Ram brands to offer cars, utility vehicles... -

Page 42

... customer acquisitions of new and used vehicles at dealerships, financing for commercial and fleet customers, and ancillary services. In addition, SCUSA offers dealers construction loans, real estate loans, working capital loans and revolving lines of credit. The SCUSA Agreement has a ten year term... -

Page 43

... LATAM segment. In addition, the all-new Jeep Renegade continued its growth trend reaching 29.7 percent segment market share in Brazil in the fourth quarter of 2015 and was named the "2016 Car of the Year" in Brazil during the annual automotive industry award ceremony hosted by Autoesporte magazine... -

Page 44

... commissions in connection with each vehicle financing above a certain threshold. This agreement applies only to our retail customers purchasing Fiat branded vehicles only. In July 2015, FCA Fiat Chrysler Automoveis Brasil ("FCA Brasil") and Banco Fidis signed a ten-year partnership contract with... -

Page 45

... European Free Trade Association (other than Italy, Germany, UK, France, and Spain). ** Market share not included in Other EMEA because our presence is less than one percent. (1) Certain fleet sales accounted for as operating leases are included in vehicle sales. (2) Our estimated market share data... -

Page 46

46 2015 | ANNUAL REPORT Overview of Our Business For the Years Ended December 31, EMEA Light Commercial Vehicles Europe* Other EMEA** Total * ** (1) (2) 2015(1),(2),(3) Group Sales 217 77 294 Market Share 11.3% - - Group Sales 197 68 265 2014(1),(2),(3) Market Share 11.5% - - Group Sales 182 68 ... -

Page 47

... by a number of contracts (typically, we enter into one agreement per brand of vehicles to be sold), and the dealer can sell those vehicles through one or more points of sale. In those markets, points of sale tend to be physically small and carry limited inventory. In Europe, we sell our vehicles... -

Page 48

... Maserati dealers as of December 31, 2015, that is separate from our mass-market vehicle distribution network. FCA Bank provides access to retail customer financing for Maserati brand vehicles in Europe. In other regions, we rely on local agreements with financial services providers for financing of... -

Page 49

...business line is dedicated to the production of engine and transmission components for automobiles, motorbikes and light commercial vehicles and has a global presence due to its own research and development centers, applied research centers and production plants. The Electronic Systems business line... -

Page 50

... rental services in support of the mass-market vehicle brands in certain geographical segments and for Maserati. Net Industrial Debt (i.e., Net Debt of industrial activities) is management's primary measure for analyzing our financial leverage and capital structure and is one of the key targets used... -

Page 51

...December 31, 2013. The discussion of certain line items (Cost of sales, Selling, general and administrative costs and Research and development costs) includes a presentation of such line items as a percentage of Net revenues for the respective periods presented as well as constant exchange rates, to... -

Page 52

... other services from numerous suppliers which we use to manufacture our vehicles, parts and accessories. These purchases generally account for approximately 80 percent of total Cost of sales. Fluctuations in Cost of sales are primarily related to the number of our vehicles we produce and ship, along... -

Page 53

...the APAC and NAFTA segments to support the growth of the business in their respective markets. In addition, advertising expenses increased within the NAFTA segment for new product launches, including the all-new 2014 Jeep Cherokee and the all-new 2015 Chrysler 200. There were additional increases in... -

Page 54

... of capitalized development costs in 2014 compared to 2013 was attributable to the launch of new products, and in particular related to the NAFTA segment, driven by the all-new 2014 Jeep Cherokee, which began shipping to dealers in late October 2013, and the all-new 2015 Chrysler 200, which... -

Page 55

2015 | ANNUAL REPORT 55 Other income/(expenses) For the Years Ended December 31, (â,¬ million, except percentages) Increase/(decrease) 2015 vs. 2014 178 n.m.(1) 2014 vs. 2013 (2) (7.1)% 2015 152 2014 (26) 2013 (28) Other income/(expenses) (1) Number is not meaningful. 2015 compared to 2014 ... -

Page 56

... as Profit before taxes for the year ended December 31, 2014 included the non-taxable gain related to the fair value remeasurement of the previously exercised options in connection with the acquisition of the remaining equity interest of FCA US previously not owned. The effective tax rate increased... -

Page 57

...primarily related to tax loss carry forwards and temporary differences in NAFTA. Proï¬t from discontinued operations, net of tax For the Years Ended December 31, (â,¬ million, except percentages) Increase/(decrease) 2015 vs. 2014 11 4.0% 2014 vs. 2013 30 12.3% 2015 284 2014 273 2013 243 Profit... -

Page 58

... for the Group's vehicles, including the all-new 2014 Jeep Cherokee, Ram pickups and the Jeep Grand Cherokee. These increases were partially offset by a reduction in the prior model year Chrysler 200 and Dodge Avenger shipments due to their discontinued production in the first quarter of 2014 in... -

Page 59

... of â,¬978 million mainly related to higher base material costs associated with vehicles and components and content enhancements on new models as well as â,¬262 million in higher research and development costs and depreciation and amortization. For the year ended December 31, 2014, Adjusted EBIT... -

Page 60

... in 2014 compared to 2013 reflected the weaker demand in the region's main markets, where Brazil continued the negative market trend started in 2012, Argentina was impacted by import restrictions and additional tax on more expensive vehicles and Venezuela suffered from weaker trading conditions. The... -

Page 61

...2014 compared to 2013 was primarily attributable to an increase in shipments and improved vehicle mix. The 35.0 percent increase in shipments in 2014 compared to 2013 was largely supported by shipments to China and Australia, driven by the Jeep Grand Cherokee, Dodge Journey and the all-new 2014 Jeep... -

Page 62

... Jeep brand, specifically the all-new Fiat 500X and the all-new 2015 Jeep Renegade. 2014 compared to 2013 The increase in EMEA Net revenues in 2014 compared to 2013 was mainly attributable to the combination of (i) a â,¬0.6 billion increase in vehicle shipments, (ii) a â,¬0.3 billion favorable sales... -

Page 63

... success of the Fiat 500 family and Jeep brand and (ii) a â,¬101 million impact from positive net pricing, which was partially offset by (iii) a â,¬91 million increase in Selling, general and administration costs primarily relating to marketing spending to support the all-new Fiat 500X and Jeep... -

Page 64

64 2015 | ANNUAL REPORT Operating Results Adjusted EBIT 2015 compared to 2014 The decrease in Maserati Adjusted EBIT in 2015 compared to 2014 was due to lower volumes as described above, unfavorable mix and an increase in industrial costs related to start-up costs for the all-new Levante, which is... -

Page 65

...EBIT in 2015 compared to 2014 was primarily attributable to favorable foreign exchange rate effects and industrial efficiencies. 2014 compared to 2013 Magneti Marelli The increase in Magneti Marelli Adjusted EBIT in 2014 compared to 2013 mainly reflected higher volumes as well as the benefit of cost... -

Page 66

... (ii) principal and interest payments under our financial obligations and (iii) pension and employee benefit payments. We make capital investments in the regions in which we operate primarily related to initiatives to introduce new products, enhance manufacturing efficiency, improve capacity and for... -

Page 67

.../long-term dedicated credit lines available to fund scheduled investments at December 31, 2015 (â,¬0.9 billion was undrawn at December 31, 2014 and â,¬1.8 billion was undrawn at December 31, 2013) and the undisbursed â,¬0.4 billion on the Mexico Bank Loan (as defined below) at December 31, 2015... -

Page 68

... â,¬0.4 billion Mexico Bank Loan (defined in Capital Market - Bank Debt - Other below), which is for working capital and general corporate purposes, and the â,¬0.3 billion of undrawn committed credit lines available to the operating entities of the Group for the funding of scheduled investments. The... -

Page 69

... due to an increase in retail incentives as well as an increase in dealer stock levels to support increased sales volumes in NAFTA, and a â,¬210 million increase in employees benefits mainly related to U.S. and Canada pension plan as the impact of lower discount rates was not fully offset by the... -

Page 70

... of: (i) â,¬8,819 million of capital expenditures, including â,¬2,504 million of capitalized development costs that supported investments in existing and future products. Capital expenditures primarily related to the mass-market vehicle operations in NAFTA and EMEA, investment in Alfa Romeo and the... -

Page 71

... costs and personnel related expenses relating to engineering, design and development focused on content enhancement of existing vehicles, new models and powertrain programs in NAFTA and EMEA. The remaining capital expenditures primarily related to the mass-market vehicle operations in NAFTA and... -

Page 72

... in March 2015, proceeds from the â,¬600 million loan granted by EIB and SACE (refer to the section -Capital Market below) and other financing transactions, primarily in Brazil; (vi) net proceeds from the Ferrari IPO as discussed in more detail in the section -History and Development of the Company... -

Page 73

... in order to fund our investments and research and development costs in Europe and (c) â,¬595 million (U.S.$790 million) related to the amendments and re-pricings in 2013 of the U.S.$3.0 billion tranche B term loan which matures May 24, 2017 and the revolving credit facility that matures in May 2016... -

Page 74

... Group companies, but do not however, provide financing to third parties. Financial services includes companies that provide retail and dealer financing, leasing and rental services in support of the mass-market vehicle brands in certain geographical segments and for the Maserati global luxury... -

Page 75

2015 | ANNUAL REPORT 75 Change in Net Industrial Debt As described in the section -Non-GAAP Financial Measures above, Net Industrial Debt is management's primary measure for analyzing our financial leverage and capital structure and is one of the key targets used to measure our performance. The ... -

Page 76

... 2015 | ANNUAL REPORT Operating Results Capital Market At December 31, 2015 and December 31, 2014, capital market debt mainly related to notes issued under the GMTN Programme, the financial liability component of the mandatory convertible securities, and short and medium-term marketable financial... -

Page 77

..., depend upon market conditions, the Group's financial situation and other factors which could affect such decisions. Changes in notes issued under the GMTN Programme during 2015 were due to the: repayment at maturity of two notes that had been issued by Fiat Chrysler Finance Europe S.A, one with... -

Page 78

...) relating to a number of financing arrangements with certain Brazilian development banks, primarily used to support capital expenditures, including those in our Pernambuco plant (approximately â,¬1.2 billion at December 31, 2015 and at December 31, 2014), as well as to fund the financial services... -

Page 79

... of "borrowing base" to "covered debt" (as defined in the Senior Credit Agreements), as well as a minimum liquidity of U.S.$3.0 billion (â,¬2.8 billion). Furthermore, the Senior Credit Agreements contain a number of events of default related to: (i) failure to make payments when due; (ii) failure to... -

Page 80

... to support the Group's automotive research, development and production plans for 2015 to 2017 which includes studies for efficient vehicle technologies for vehicle safety and new vehicle architectures. The three-year loan due July 2018 provided by the EIB, which is also 50 percent guaranteed by... -

Page 81

... of its obligations for postretirement health care benefits for National Automobile, Aerospace, Transportation and General Workers Union of Canada, or CAW (now part of Unifor), which represented employees, retirees and dependents. During the year ended December 31, 2015, FCA US's Canadian subsidiary... -

Page 82

82 2015 | ANNUAL REPORT Subsequent Events Subsequent Events and 2016 Guidance Subsequent Events The Group has evaluated subsequent events through February 29, 2016, which is the date the financial statements were authorized for issuance. Ferrari Spin-off The transactions to separate Ferrari N.V. ... -

Page 83

...production in second half of 2016 APAC profitability improving in second half of 2016 as Jeep manufacturing localization in China completed Maserati performance improving in second half of 2016 following Levante launch Capital expenditures in line with 2015 February 29, 2016 The Board of Directors... -

Page 84

... | ANNUAL REPORT Major Shareholders Major Shareholders Exor is the largest shareholder of FCA through its 29.15 percent shareholding interest in our issued common shares (as of February 26, 2016). In December 2014, Exor also purchased an aggregate notional amount of mandatory convertible securities... -

Page 85

... Compensation Committee. On certain key industrial matters the Board of Directors is advised by the Group Executive Council (the "GEC"): the GEC is an operational decision-making body of the Company's group (the "Group"), which is responsible for reviewing the operating performance of the businesses... -

Page 86

... Engineering University of Turin (Italy). While at university, he gained work experience in various companies of the Fiat Group in the UK and Poland (manufacturing) as well as in France (sales and marketing). He started his professional career in 2001 at General Electric as a member of the Corporate... -

Page 87

... December 2011 from Goldman Sachs International, where he was most recently a Managing Director and the Chief Operating Officer. Mr. Earle was also Chief Executive of Goldman Sachs International Bank and his other responsibilities included co-Chairmanship of the firm's Global Commitments and Capital... -

Page 88

88 2015 | ANNUAL REPORT Corporate Governance Valerie Mars (non-executive director) - Valerie Mars serves as Senior Vice President & Head of Corporate Development for Mars, Incorporated, a $35 billion diversified food business, operating in over 120 countries and one of the largest privately held ... -

Page 89

... CEO of UAL Corporation and United Airlines Inc. Mr. Wolf's career in the aviation industry began in 1966 with American Airlines, where he rose to the position of Vice President. He joined Pan American World Airways as a Senior Vice President in 1981 and became President and Chief Operating Officer... -

Page 90

... of the Company's financial statements, including any published interim reports (ii) the Company's policy on tax planning, (iii) the Company's financing, (iv) the Company's applications of information and communication technology, (v) the systems of internal controls that management and the Board of... -

Page 91

2015 | ANNUAL REPORT 91 The Compensation Committee The Compensation Committee is responsible for, among other things, assisting and advising the Board of Directors in: (i) determining executive compensation consistent with the Company's remuneration policy, (ii) reviewing and approving the ... -

Page 92

... of the Company, including affiliates of a significant shareholder (such conflict, a "Related-Party Conflict"), it being understood that currently Exor S.p.A. would be considered a significant shareholder. The Directors shall inform the Board of Directors through the Senior Non-executive Director or... -

Page 93

... a majority of the directors, executive directors or board members or executive officers of such shareholder or to direct the casting of a majority or more of the voting rights at meetings of the board of directors, governing body or executive committee of such shareholder has been transferred to... -

Page 94

... within six months after the close of the financial year. Furthermore, general meetings of shareholders shall be held in the case referred to in Section 2:108a of the Dutch Civil Code as often as the Board of Directors, the Chairman or the Chief Executive Officer deems it necessary to hold them or... -

Page 95

... change in the corporate governance structure of the Company; and h) any matters decided upon by the person(s) convening the meeting and any matters placed on the agenda with due observance of applicable Dutch law. The Board of Directors shall provide the general meeting of shareholders with all... -

Page 96

... 2015 | ANNUAL REPORT Corporate Governance For each general meeting of shareholders, the Board of Directors may decide that shareholders shall be entitled to attend, address and exercise voting rights at such meeting through the use of electronic means of communication, provided that shareholders... -

Page 97

... consent of the Company. The Board of Directors has also been designated as the authorized body to limit or exclude the rights of pre-emption of shareholders in connection with the authority of the Board of Directors to issue common shares and grant rights to subscribe for common shares as referred... -

Page 98

...). The FCA Group has specific Guidelines relating to: the Environment, Health and Safety, Business Ethics and Anti-corruption, Suppliers, Human Resource Management, Respect of Human Rights, Conflicts of Interest, Community Investment, Data Privacy, Use of IT and Communications Equipment, Antitrust... -

Page 99

2015 | ANNUAL REPORT 99 Insider Trading Policy On October 10, 2014 the Fiat Investments's Board of Directors adopted an insider trading policy setting forth guidelines and recommendations to all Directors, officers and employees of the Group with respect to transactions in the Company's securities... -

Page 100

... the Dutch Corporate Governance Code, because pursuant to the Articles of Association the term of office of Directors is approximately one year, such period expiring on the day the first annual general meeting of shareholders is held in the following calendar year. This approach is in line with the... -

Page 101

... our business and the markets in which we compete. By managing the associated risks, we achieve the proper balance between growth and return goals and related risks, allowing us to strive to secure performance and profitability targets as well as enhance stakeholder value. Risk Management Framework... -

Page 102

... Product (Global and Regional) and Commercial Committees. The Product Committee oversees capital investment, engineering and product development, while the Commercial Committee oversees matters related to sales and marketing. Both committees include executive managers from each of the Companies... -

Page 103

... effective bench strength in key positions and properly plan and prepare for changes in key management. Commercial and Industrial Policies Our ability to manage product positioning strategy (competitive pricing consistent with margin targets, discount levels, etc.) as well as cost factors consistent... -

Page 104

..., or lost vehicle sales, resulting from product recalls could materially adversely affect our financial condition and results of operations. Moreover, if we face consumer complaints, or we receive information from vehicle rating services that calls into question the safety or reliability of one of... -

Page 105

... the operation of our internal information technology systems or the electronic control systems contained in our vehicles could damage our reputation, disrupt our business and adversely impact our ability to compete. Current or Planned Improvements in the Overall Risk Management System We... -

Page 106

106 2015 | ANNUAL REPORT Corporate Governance IN CONTROL STATEMENT Internal Control System The Board of Directors is responsible for designing, implementing and maintaining internal controls, including proper accounting records and other management information suitable for running the business. ... -

Page 107

... THE ANNUAL REPORT The Board of Directors is responsible for preparing the Annual Report, inclusive of the Consolidated and Statutory Financial Statements and Report on Operations, in accordance with Dutch law and International Financial Reporting Standards as issued by the International Accounting... -

Page 108

108 2015 | ANNUAL REPORT A Responsible Company A Responsible Company 1 Sustainability Governance and Commitment to Stakeholders All areas of the Group have a role in addressing the goals and challenges of sustainability. The sustainability management process is based on a model of shared ... -

Page 109

...fuels Vehicle CO2 emissions Investment in research and innovation Emissions from operations Employee health and safety Responsible use of water Business integrity, ethical standards Alternative propulsion system and respect of human rights Waste management and disposal Prevention and management of... -

Page 110

...ANNUAL REPORT A Responsible Company Research and Innovation The Group's global research and innovation activities work to develop solutions for sustainable mobility by improving efficiency, reducing fuel consumption and emissions, and introducing product enhancements related to safety and connected... -

Page 111

... system have been offered with the Share&Drive car-sharing service. The success of the initiative can be seen in the numbers: 6,700 rentals with approximately 26,000 hours of use, representing more than 270,000 km traveled. 5 A total of 81 vehicles: 71 natural gas/biomethane Fiat 500Ls and 10 Fiat... -

Page 112

..., are the main channels of communication between customers and the Company. There are 26 Contact Centers worldwide, with roughly 1,400 agents handling nearly 16 million customer contacts per year. The CCCs offer a variety of services including information, complaint management and, in some locations... -

Page 113

... the Group's continued commitment to the long-term stability of the workforce. Employee turnover FCA worldwide Employees at December 31, 2014 New Hires Departures Change in scope of operations Employees at December 31, 2015 228,690 33,984 (28,493) 440 234,621 Management and Development Recognizing... -

Page 114

... million in 2011-2015. In addition to safety in the workplace, the Group has numerous initiatives to promote the health and well-being of employees and their families. Industrial Relations Collective Bargaining In 2015, collective bargaining made it possible to reach trade union agreements for the... -

Page 115

... two-tier wage structure by means of a combination of fixed and variable compensation; investment in the workforce to recognize and reward employees for their engagement and commitment to achieving Company business objectives, including World Class Manufacturing; work rules strengthened, enabling... -

Page 116

...2015 | ANNUAL REPORT A Responsible Company Energy Consumption and Emissions The Group is continuously researching solutions that will enable further reductions in greenhouse gas emissions and the use of fossil fuels. Over time, this has generated significant savings in energy-related costs. In 2015... -

Page 117

... community development, education, the environment and basic social needs. During 2015, Group employees around the world volunteered many thousands of hours during work time. FCA has set long-term targets to advance education and training among youth, with a particular focus on programs designed... -

Page 118

... started in China • New Fiat Tipo compact sedan launched in EMEA • Production of New Fiat Toro mid-size pickup truck began at the new Pernambuco plant Continued enhancement of risk management, utilizing the Company's Enterprise Risk Management model Excluding Ferrari, Net industrial debt... -

Page 119

... with our core business and leadership values. FCA's compensation philosophy, as set forth in the Remuneration Policy, aims to provide compensation to its Executive Directors as outlined below. Alignment with FCA's strategy Pay for performance Competitiveness Long-term shareholder value creation... -

Page 120

120 2015 | ANNUAL REPORT Remuneration of Directors Peer Group Development In 2014, our Compensation Committee reviewed our potential peer companies, which are companies operating in similar industries with whom we are most likely to exchange talent at the executive level. The Compensation ... -

Page 121

... our position as an industry leader. We support a shared, one-company mindset of performance and accountability to deliver on business objectives. In 2015, our CEO's compensation consisted of both fixed and variable pay elements. In keeping with our philosophy of long-term shareholder value creation... -

Page 122

...reached using the compensation program benchmarking and peer group review process described above. The Company believes that paying our Executive Directors at or above these benchmarks is appropriate to retain them throughout the business cycle. 2015 Base Salary The Company does not guarantee annual... -

Page 123

...ANNUAL REPORT 123 Short-Term Incentives The primary objective of short-term variable incentives is to focus on the business priorities for the current year. The CEO's variable incentive is based on achieving short-term (annual) financial and other designated objectives proposed by the Compensation... -

Page 124

... target. *** Net industrial debt is defined as ending absolute balance. The annual bonus target incentive for the CEO is 100 percent of the U.S.$4 million annual base salary, which is below market, based on the average of our U. S. and European peers. This positioning further reinforces the value... -

Page 125

... over the long-term. Equity Incentive Plan On October 29, 2014, in connection with the formation of FCA and the presentation of the 2014-2018 business plan, the Board of Directors approved a new Long Term Incentive ("LTI") program, covering the five year performance period, under the Fiat Chrysler... -

Page 126

... an equal number of Fiat S.p.A. ordinary shares. The rights vested ratably over three years subject to the requirement that the CEO remained in office. On February 22, 2015, the final third vested. On May 7, 2015, the FCA US LLC Board approved a valuation and unit freeze for the Directors' RSUs, as... -

Page 127

2015 | ANNUAL REPORT 127 Other Benefits We offer customary perquisites to our CEO and Chairman. The Executive Directors may also be entitled to usual and customary fringe benefits such as personal use of aircraft, company car and driver, personal/home security, medical insurance, accident and ... -

Page 128

128 2015 | ANNUAL REPORT Remuneration of Directors Recoupment of Incentive Compensation (clawback policy) The Board is dedicated to maintaining and enhancing a culture focused on integrity and accountability. The Company's EIP defines the terms and conditions for any subsequent long term incentive... -

Page 129

2015 | ANNUAL REPORT 129 Implementation of Remuneration Policy in 2016 If, and to the extent, any changes to 2016 remuneration are made, those changes will be in line with the approved policy. Directors' Compensation The following table summarizes the remuneration paid to the members of the Board... -

Page 130

... | ANNUAL REPORT Remuneration of Directors Share Plans Granted to Directors The following table gives an overview of the share plans held by the Chief Executive Officer and other Board Members. FV on Grant Date(1) Grant Date January 1, 2015 FCA Stock grants 2009 FCA US RSUs 2012 FCA US RSUs 2013... -

Page 131

2015 | ANNUAL REPORT 131 Executive Officers' Compensation The aggregate amount of compensation paid to or accrued for executive officers that held office during 2015 was approximately â,¬27 million, including â,¬3.3 million of pensions and similar benefits paid or set aside by us. The aggregate ... -

Page 132

-

Page 133

..., general and administrative costs _____ 4. Research and development costs _____ 5. Other income/(expenses) _____ 6. Net financial expenses _____ 7. Tax expense/(benefit) _____ 8. Other information by nature _____ 9. Earnings per share _____ 10. Goodwill and intangible assets with indefinite useful... -

Page 134

... disposal of investments Restructuring costs Other income/(expenses) EBIT Net financial expenses Profit before taxes Tax expense/(benefit) Net profit from continuing operations Profit from discontinued operations, net of tax Net profit Net profit attributable to: Owners of the parent Non-controlling... -

Page 135

... Years Ended December 31, 2015, 2014 and 2013 For the Years Ended December 31, 2015 Note (â,¬ million) 2014 632 2013 1,951 Net profit (A) Items that will not be reclassified to the Consolidated Income Statement in subsequent periods: Gains/(losses) on remeasurement of defined benefit plans Share... -

Page 136

...a buy-back commitment Trade receivables Receivables from financing activities Current tax receivables Other current assets Current financial assets: Current investments Current securities Other financial assets Cash and cash equivalents Assets held for sale Assets held for distribution Total Current... -

Page 137

... offering of 10 percent of Ferrari N.V. Issuance of Mandatory Convertible Securities and other share issuances Cash Exit Rights following the merger of Fiat into FCA Exercise of stock options Distributions paid Distribution of certain tax obligations Acquisition of non-controlling interests Capital... -

Page 138

... At December 31, 2013 Capital increase Merger of Fiat into FCA Mandatory Convertible Securities Exit Rights Dividends distributed Share-based payments Net profit Other comprehensive income/(loss) Distribution for tax withholding obligations on behalf of NCI Purchase of shares in subsidiaries from... -

Page 139

... principal executive offices in the United Kingdom. Fiat Chrysler Automobiles N.V. was incorporated as a public limited liability company (naamloze vennootschap) under the laws of the Netherlands on April 1, 2014 under the name Fiat Investments N.V. On June 15, 2014, the Board of Directors of Fiat... -

Page 140

... have been excluded from the Group's continuing operations and are presented as a single line item within the Consolidated Income Statements for the years ended December 31, 2015, 2014 and 2013. In order to present the financial effects of a discontinued operation, revenues and expenses arising from... -

Page 141

.... Corporate Information The Group and its subsidiaries, among which the most significant is FCA US LLC ("FCA US"), together with its subsidiaries, are engaged in the design, engineering, manufacturing, distribution and sale of automobiles and light commercial vehicles, engines, transmission systems... -

Page 142

...funding to both industrial and financial services companies in the Group as the need arises. This financial services structure within the Group does not allow the separation of financial liabilities funding the financial services operations (whose assets are reported within current assets) and those... -

Page 143

2015 | ANNUAL REPORT 143 Reclassifications Certain prior year amounts have been reclassified to conform to the current year presentation. For the year ended December 31, 2015, the Group is no longer presenting the separate line item Other unusual income/(expenses) within the Consolidated Income ... -

Page 144

... over those policies. Joint ventures and associates are accounted for using the equity method of accounting from the date joint control and significant influence is obtained. On acquisition of the investment, any excess of the cost of the investment and the Group's share of the net fair value of the... -

Page 145

2015 | ANNUAL REPORT 145 Interests in other companies Interests in other companies are measured at fair value. Investments in equity investments that do not have a quoted market price in an active market and whose fair value cannot be reliably measured are recognized at cost. For investments ... -

Page 146

... production and related components, engines and production systems are recognized as an asset if both of the following conditions under IAS 38 - Intangible assets are met: that development costs can be measured reliably and that the technical feasibility of the product, volumes and pricing support... -

Page 147

...lease payments. The corresponding liability to the lessor is included in the Consolidated Statement of Financial Position within Debt. During years ended December 31, 2015, 2014 and 2013, the assets were depreciated on a straight-line basis over their estimated useful lives using the following rates... -

Page 148

... convertible into cash and are subject to an insignificant risk of changes in value. Money market funds consist of investments in high quality, short-term, diversified financial instruments which can generally be liquidated on demand. Current securities include short-term or marketable securities... -

Page 149

2015 | ANNUAL REPORT 149 Derivative financial instruments Derivative financial instruments are used for economic hedging purposes in order to reduce currency, interest rate and market price risks (primarily related to commodities and securities). In accordance with IAS 39 - Financial Instruments: ... -

Page 150

... parts and other supplies based on their expected future use and realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and the estimated costs for sale and distribution. The measurement of production systems... -

Page 151

...estimated costs of sales incentive programs include incentives offered to dealers and retail customers, and granting of retail financing at a significant discount to market interest rates. These costs are recognized at the time of the sale of the vehicle. New vehicle sales with a buy-back commitment... -

Page 152

...of the loan (fair value plus transaction costs) and the proceeds received, and it is accounted for in accordance with the policies used for the recognition of government grants. Taxes Income taxes include all taxes based on the taxable profits of the Group. Current and deferred taxes are recognized... -

Page 153

... and commodity forwards, swaps and option contracts, which are valued using models or other valuation methodologies. These models are primarily industry-standard models that consider various assumptions, including quoted forward prices for similar instruments in active markets, quoted prices for... -

Page 154

...accounting in specific cases. The Group adopted the IASB's Annual Improvements to IFRSs 2010 - 2012 Cycle and Annual Improvements to IFRSs 2011-2013 Cycle. The most important topics addressed in these amendments are, among others, the definition of vesting conditions in IFRS 2 - Share-based payments... -

Page 155

...-current assets held for sale and discontinued operations, on the changes of method of disposal, on IFRS 7 - Financial Instruments: Disclosures on the servicing contracts, on the IAS 19 - Employee Benefits, on the discount rate determination. The effective date of the amendments is January 1, 2016... -

Page 156

156 2015 | ANNUAL REPORT Consolidated Financial Statements Notes to the Consolidated Financial Statements SEGMENT REPORTING The Group's four regional mass-market vehicle operating segments deal with the design, engineering, development, manufacturing, distribution and sale of passenger cars, light... -

Page 157

... used in developing the required estimates include the following key factors: Discount rates. Our discount rates are based on yields of high-quality (AA-rated) fixed income investments for which the timing and amounts of maturities match the timing and amounts of the projected benefit payments... -

Page 158

... developing the required estimates include the following key factors: Discount rates. Our discount rates are based on yields of high-quality (AA-rated) fixed income investments for which the timing and amounts of maturities match the timing and amounts of the projected benefit payments. Health care... -

Page 159

... costs) to their value in use using pre-tax estimated future cash flows based on the Group's 2014-2018 business plan presented on May 6, 2014, which were discounted to their present value using a pre-tax discount rate reflecting current market assessments of the time value of money and the risks... -

Page 160

... which incorporates a long-term growth rate assumption of 2 percent. Post-tax cash flows have been discounted using a post-tax discount rate which reflects the current market assessment of the time value of money for the period being considered and the risks specific to the operating segment under... -

Page 161

... the financing arrangement, or both. Sales incentive programs are generally brand, model and region specific for a defined period of time. Multiple factors are used in estimating the future incentive expense by vehicle line including the current incentive programs in the market, planned promotional... -

Page 162

..., dealer, supplier and other contractual relationships, intellectual property rights, product warranties and environmental matters. Some of these proceedings allege defects in specific component parts or systems (including airbags, seats, seat belts, brakes, ball joints, transmissions, engines and... -

Page 163

... owned from General Motors. In November 2013, the investment in the Brazilian company, CMP Componentes e Modulos Plasticos Industria e Commercio Ltda, which was previously classified as held for sale on acquisition, was consolidated on a line-by-line basis as a result of changes in the plans for its... -

Page 164

... 31, 2013), was the best point estimate of fair value. The IPO value range was determined using earnings multiples observed in the market for publicly traded U.S.-based automotive companies. This fully distributed value was then reduced by approximately 15 percent for the expected discount that... -

Page 165

... the transaction date and its unsecured nature, this payment obligation had a fair value of U.S.$672 million (â,¬497 million) as of the transaction date. The Group considered the terms and conditions set forth in the above mentioned agreements and accounted for the Equity Purchase Agreement and the... -

Page 166

...to the VEBA Trust on January 21, 2016. The Equity Purchase Agreement also provided for a tax distribution from FCA US to its members under the terms of FCA US 's Limited Liability Company Operating Agreement (as amended from time to time, the "LLC Operating Agreement") in the amount of approximately... -

Page 167

2015 | ANNUAL REPORT 167 1. Net revenues Net revenues were as follows: For the Years Ended December 31, 2015 (â,¬ million) 2014 2013 Revenues from: Sales of goods Services provided Contract revenues Interest income of financial services activities Lease installments from assets sold with a buy-... -

Page 168

... during the years ended December 31, 2015, 2014 and 2013, respectively. As part of the plan to improve margins in NAFTA, the Group will realign a portion of its manufacturing capacity in the region to better meet market demand for Ram pickup trucks and Jeep vehicles within the Group's existing plant... -

Page 169

... no future economic benefit. As a result of new product strategies and the streamlining of architectures and related production platforms associated with the Group, the operations to which specific capitalized development costs belonged were redesigned during the year ended December 31, 2014. As no... -

Page 170

... remedied as of the date of the Consent Order at a price equal to the original purchase price less a reasonable allowance for depreciation plus ten percent. In addition, FCA US offered consumer incentives to encourage owners of vehicles subject to the structural reinforcement campaign to participate... -

Page 171

... securities Total Financial income Total Financial income relating to: Industrial companies (A) Financial services companies (reported within Net revenues) Financial expenses: Interest expense and other financial expenses: Interest expense on notes Interest expense on borrowings from bank Commission... -

Page 172

...summarizes Tax expense/(benefit): For the Years Ended December 31, 2015 (â,¬ million) 2014 557 (147) 14 424 2013 486 (1,563) 18 (1,059) Current tax expense Deferred tax (income)/expense Taxes relating to prior periods Total Tax expense/(benefit) 445 (277) (2) 166 The applicable tax rate used to... -

Page 173

... | ANNUAL REPORT 173 The effective tax rate of 46.4 percent in 2014 increased to 54.4 percent in 2015 as a result of the decrease in Profit before tax and the relative increased impact of losses before tax in jurisdictions in which a tax benefit is not recorded on tax losses. In 2013, the Group... -

Page 174

...doubtful accounts Other Total Deferred tax liabilities arising on: Accelerated depreciation Capitalization of development costs Other Intangible assets and Intangible assets with indefinite useful lives Provision for employee benefits Other Total Deferred tax asset arising on tax loss carry-forwards... -

Page 175

2015 | ANNUAL REPORT 175 The decision to recognize deferred tax assets is made for each company in the Group by critically assessing whether conditions exist for the future recoverability of such assets by taking into account recent forecasts from budgets and plans. Despite a tax loss in the Group... -

Page 176

... costs that were capitalized mainly in connection with product development activities. For the year ended December 31, 2015, FCA, including Ferrari, had an average number of employees of 236,559 (231,613 employees in 2014 and 223,658 employees in 2013). 9. Earnings per share Basic earnings per... -

Page 177

...share for the years ended December 31, 2015, 2014 and 2013: For the Years Ended December 31, 2015 Net profit attributable to owners of the parent Weighted average number of shares outstanding Number of shares deployable for share-based compensation Dilutive effect of Mandatory Convertible Securities... -

Page 178

... exchange effects in 2015 and in 2014 amounted to â,¬1,510 million and â,¬1,572 million, respectively, and arose mainly from changes in the U.S.$/Euro rate. Brands Brands are composed of the Chrysler, Jeep, Dodge, Ram and Mopar brands which resulted from the acquisition of FCA US. These rights... -

Page 179

... vehicles, new models and powertrain programs, as well as the investment for the development of Alfa Romeo vehicles. Of the â,¬223 million impairment losses and asset write-offs in 2015, â,¬176 million related to the impairment of capitalized development costs that had no future economic benefit... -

Page 180

... exchange gains of â,¬298 million in 2015 and â,¬482 million in 2014 primarily related to foreign currency translation of the U.S.$ to the Euro. Refer to Note 4 for information about the write-down of certain capitalized development costs. 12. Property, plant and equipment Industrial buildings... -

Page 181

... The net carrying amount of assets leased under finance lease agreements for FCA US was â,¬470 million and â,¬414 million at December 31, 2015 and 2014, respectively. Property, plant and equipment of the Group (excluding FCA US) reported as pledged as security for debt are summarized as follows: At... -

Page 182

.... Under the agreement, FCA Bank will continue to benefit from the financial support of the Crédit Agricole Group while continuing to strengthen its position as an active player in the securitization and debt markets. FCA Bank provides retail and dealer financing and long-term rental services in the... -

Page 183

...amounts for the Group's share in all individually immaterial joint ventures and associates that are accounted for using the equity method were as follows: For the Years Ended December 31, 2015 (â,¬ million) 2014 2013 Joint Ventures: Profit from continuing operations Net profit Other comprehensive... -

Page 184

... recognized within Cost of sales during the years ended December 31, 2015 and 2014 was â,¬653 million and â,¬436 million, respectively. The amount due from customers for contract work relates to the design and production of industrial automation systems and related products for the automotive sector... -

Page 185

2015 | ANNUAL REPORT 185 15. Receivables and Other current assets The composition of receivables and other current assets was as follows: At December 31, 2015 (â,¬ million) 2014 2,564 3,843 328 2,246 515 2,761 9,496 Trade receivables Receivables from financing activities Current tax receivables ... -

Page 186

... Receivables from financing activities mainly relate to the business of financial services companies fully consolidated by the Group and are summarized as follows. At December 31, 2015 (â,¬ million) 2014 2,313 1,039 349 142 3,843 Dealer financing Retail financing Finance leases Other Total... -

Page 187

... short-term or marketable securities which represent temporary investments, but which do not satisfy all the requirements to be classified as cash equivalents. At December 31, 2015 (â,¬ million) 2014 30 180 210 Current securities available-for-sale Current securities held-for-trading Total current... -

Page 188

...financial liabilities These line items mainly consist of fair value measurement of derivative financial instruments. They also include some collateral deposits (held in connection with derivative transactions and debt obligations). At December 31, Positive fair value Fair value hedges: Interest rate... -

Page 189

... reported in the following lines: For the Years Ended December 31, 2015 (â,¬ million) 2014 2013 Currency risk Increase in Net revenues Decrease in Cost of sales Net financial (expenses)/income Result from investments Interest rate risk Increase in Cost of sales Result from investments Financial... -

Page 190

... and international banking institutions, and money market instruments. Cash at banks included bank deposits which may be used exclusively by Group companies entitled to perform specific operations (cash with a pre-determined use) amounting to â,¬3 million at December 31, 2015 and 2014. The Group has... -

Page 191

...were purchased by Fiat shareholders and 53,916,397 Fiat shares were canceled. FCA was the surviving entity and all Fiat ordinary shares outstanding as of the Merger date (1,167,181,255 ordinary shares) were canceled and exchanged. FCA allotted one new FCA common share (each having a nominal value of... -

Page 192

... remaining coupon payments on the Mandatory Convertible Securities discounted at the Treasury Yield rate. Early Conversion at Option of the Holder: holders have the option to convert their Mandatory Convertible Securities early and receive the Minimum Number of Shares, subject to limitations around... -

Page 193

... value through profit and loss. Subsequently, the financial liability related to the coupon payments is accounted for at amortized cost using the effective interest method. The financial liabilities related to the embedded derivative features are remeasured to their fair value at each reporting date... -

Page 194

... Mandatory Convertible Securities of â,¬1,910 million. Pursuant to Dutch law, limitations exist relating to the distribution of shareholders' equity up to the total amount of the legal reserve; capital reserves amounting to â,¬3,805 million at December 31, 2015 (â,¬3,742 million at December 31, 2014... -

Page 195

... of achieving financial equilibrium and an improvement in the Group's rating. For 2015, the Board of Directors has not recommended a dividend payment on FCA common shares in order to further fund capital requirements of the Group's business plan. The FCA loyalty voting structure The purpose... -

Page 196

...2015 was â,¬16.52 (U.S.$18.35), which was calculated using a Monte Carlo simulation model. The key assumptions utilized to calculate the grant date fair values for the PSU TSR awards issued are summarized below: Key assumptions Grant Date Stock Price Expected volatility Dividend yield Risk-free rate... -

Page 197

... year ended December 31, 2015 related to this grant. Stock option plans linked to Fiat and CNHI ordinary shares On July 26, 2004, the Board of Directors granted the Chief Executive Officer, as a part of his variable compensation in that position, options to purchase 10,670,000 Fiat ordinary shares... -

Page 198

... the year Stock Grant plans linked to Fiat shares On April 4, 2012, the Shareholders resolved to approve the adoption of a Long Term Incentive Plan (the "Retention LTI Plan"), in the form of stock grants. As a result, the Group granted the Chief Executive Officer 7 million rights, which represented... -

Page 199

...US Directors' RSU Plan") and the FCA US 2012 Long-Term Incentive Plan ("2012 LTIP Plan"). There are no units outstanding under the FCA US Restricted Stock Unit Plan or the FCA US Deferred Phantom Share Plan. Compensation expense for those plans during the years ended December 31, 2015, 2014 and 2013... -

Page 200

... compensation expense for both the FCA US RSU plan and the Directors' RSU Plan at December 31, 2015. Changes during 2015, 2014 and 2013 for the FCA US RSU Plan were as follows: Adjusted for Anti-Dilution 2015 FCA US Restricted Stock Units Outstanding shares unvested at the beginning of the year... -

Page 201

...ANNUAL REPORT 201 2012 LTIP Plan In February 2012, the Compensation Committee of FCA US approved the 2012 LTIP Plan that covers senior executives of FCA US (other than the Chief Executive Officer). As of December 31, 2015, only restricted share units ("LTIP RSUs") remain outstanding under the plan... -

Page 202

... Consolidated Financial Statements 21. Provisions for employee benefits The following table summarizes the provisions and net assets for employee benefits: At December 31, 2015 (â,¬ million) 2014 Present value of defined benefit obligations: Pension benefits Health care and life insurance plans... -

Page 203

... in discount rates resulted in actuarial losses for the year ended December 31, 2014. Amounts recognized in the Consolidated Income Statement were as follows: For the Years Ended December 31, 2015 (â,¬ million) 2014 184 1,089 (878) 62 17 474 2013 292 1,026 (768) 42 (162) 430 Current service cost... -

Page 204

204 2015 | ANNUAL REPORT Consolidated Financial Statements Notes to the Consolidated Financial Statements During the year ended December 31, 2014, following the release of new standards by the Canadian Institute of Actuaries, mortality assumptions used for our Canadian benefit plan valuations were... -

Page 205

... or properties occupied by Group companies, with the possible exception of comingled investment vehicles where FCA does not control the investment guidelines. Sources of potential risk in the pension plan assets measurements relate to market risk, interest rate risk and operating risk. Market risk... -

Page 206

... liabilities was approximately 13 and 16 years, respectively. The annual rate of increase in the per capita cost of covered U.S. health care benefits assumed for next year and used in the 2015 plan valuation was 7.0 percent (6.5 percent in 2014). The annual rate was assumed to decrease gradually to... -

Page 207

... follows: 2015 (â,¬ million) 2014 1,023 31 Present value of obligations at January 1, Included in the Consolidated Income Statement: Included in OCI: Actuarial (gains)/losses from: Demographic assumptions Financial assumptions Other Effect of movements in exchange rates Other: Benefits paid Change... -

Page 208

208 2015 | ANNUAL REPORT Consolidated Financial Statements Notes to the Consolidated Financial Statements The discount rates used for the measurement of the Italian TFR obligation are based on yields of high-quality (AA rated) fixed income securities for which the timing and amounts of maturities ... -

Page 209

2015 | ANNUAL REPORT 209 23. Debt The following table summarizes debt by category and by maturity: At December 31, 2015 Due within one year Notes Borrowings from banks Payables represented by securities Asset-backed financing Other debt Total Debt 2,689 3,364 490 206 619 7,368 Due between one and ... -

Page 210

... rate and currency risk, refer to Note 31. Notes The following table summarizes the outstanding notes at December 31, 2015 and 2014: Face value of outstanding notes Currency Global Medium Term Note Programme: Fiat Chrysler Finance Europe S.A.(1) Fiat Chrysler Finance Europe S.A.(2) Fiat Chrysler... -

Page 211

... market conditions, the Group's financial situation and other factors which could affect such decisions. Changes in notes issued under the GMTN Programme during the year ended December 31, 2015 were due to the: repayment at maturity of two notes that had been issued by Fiat Chrysler Finance Europe... -

Page 212

... subordinated in right of payment to the Initial Notes. On June 17, 2015, subject to the terms and conditions set forth in our prospectus, we commenced an offer to exchange up to U.S.$1.5 billion (â,¬1.4 billion) aggregate principal amount of new 4.5 percent unsecured senior debt securities due 2020... -

Page 213

2015 | ANNUAL REPORT 213 Borrowings from banks Senior Credit Facilities - FCA US At December 31, 2015, Borrowings from banks included the tranche B term loan maturing May 24, 2017 of FCA US which consists of the original U.S.$3.0 billion tranche B term loan (â,¬2.8 billion) that matures on May 24,... -

Page 214

... to support the Group's automotive research, development and production plans for 2015 to 2017 which includes studies for efficient vehicle technologies for vehicle safety and new vehicle architectures. The three-year loan due July 2018 provided by EIB, which is also 50 percent guaranteed by... -

Page 215

... the effective date of the loan agreement. The proceeds of this transaction were used to prepay all amounts outstanding under the Mexican development bank credit facilities amounting to approximately â,¬414 million. In connection with the prepayment of the Mexican development bank credit facilities... -

Page 216

...of Financial Position within Current receivables and other current assets (Note 15). At December 31, 2015 the Group's assets include current receivables to settle Asset-backed financing of â,¬206 million (â,¬469 million at December 31, 2014). Debt secured by assets At December 31, 2015, debt secured... -

Page 217

... 31, 2015 (â,¬ million) 2014 2,571 1,495 2,992 932 338 252 2,915 11,495 Advances on buy-back agreements Indirect tax payables Accrued expenses and deferred income Payables to personnel Social security payables Amounts due to customers for contract work Other Total Other current liabilities 2,492... -

Page 218

... into consideration market parameters at the balance sheet date and using valuation techniques widely accepted in the financial business environment. In particular: the fair value of forward contracts and currency swaps is determined by taking the prevailing exchange rates and interest rates at the... -

Page 219

2015 | ANNUAL REPORT 219 The following table provides a reconciliation of the changes in items measured at fair value and categorized as Level 3 at December 31, 2015 and December 31, 2014: Other non-current securities At January 1, 2014 Gains/(losses) recognized in Consolidated Income Statement ... -

Page 220

... using discounted cash flow models. The main inputs used are year-end market interest rates, adjusted for market expectations of the Group's non-performance risk implied in quoted prices of traded securities issued by the Group and existing credit derivatives on Group liabilities. The fair value... -

Page 221

2015 | ANNUAL REPORT 221 The most significant financial transactions with related parties generated Receivables from financing activities of the Group's financial services companies from joint ventures and Asset-backed financing relating to amounts due to FCA Bank for the sale of receivables which... -

Page 222

... Non-financial assets and liabilities originating from related party transactions were as follows: At December 31, Other current assets - 3 - 1 - - 4 - 26 - 26 2 32 3,078 2015 Other current Trade liabilities receivables (â,¬ million) Trade receivables Tofas FCA Bank GAC Fiat Chrysler Automobiles... -

Page 223

... of Fiat Total compensation (a) 2014 (â,¬ thousand) 2013 18,912 230 19,142 38,488 - 38,488 14,305 186 14,491 This amount includes the notional compensation cost arising from long-term share compensation granted to the Chief Executive Officer and share based payments to non-executive Directors... -

Page 224

... other current assets and liabilities reflecting the net payment of taxes and deferred expenses, which were partially offset by (iv) â,¬1,571 million increase in trade payables, mainly related to increased production levels in EMEA. For the year ended December 31, 2014, change in working capital of... -

Page 225

2015 | ANNUAL REPORT 225 For the year ended December 31, 2013, change in working capital of â,¬1,378 million was primarily driven by (i) â,¬1,322 million increase in trade payables, mainly related to increased production in NAFTA as a result of increased consumer demand for our vehicles, and ... -

Page 226

... of new and used vehicles at independent dealerships, financing for commercial and fleet customers, and ancillary services. In addition, SCUSA offers dealers construction loans, real estate loans, working capital loans and revolving lines of credit. The SCUSA Agreement has a ten-year term from... -

Page 227

... 31, 2015 were as follows: (â,¬ million) 2016 2017 2018 2019 2020 2021 and thereafter 420 426 365 214 176 108 Operating lease contracts The Group has operating lease contracts for the right to use industrial buildings and equipment with an average term of 10-20 years and 3-5 years, respectively... -

Page 228

..., quality and profitability targets established in the 2015-2018 period of the 2014-2018 business plan developed in May 2014 by adding two variable additional elements to base pay: an annual bonus calculated on the basis of production efficiencies achieved and the plant's World Class Manufacturing... -

Page 229

... can be reliably estimated. Furthermore, in connection with significant asset divestitures carried out in prior years, the Group provided indemnities to purchasers with the maximum amount of potential liability under these contracts generally capped at a percentage of the purchase price. These... -

Page 230

... chief operating decision maker, and as a result and as permitted by IFRS 8 - Operating Segments, the related information is not provided. The following tables summarize selected financial information by segment for the years ended December 31, 2015, 2014 and 2013: Mass-Market Vehicles 2015 Revenues... -

Page 231

... exercised options in connection with the acquisition of FCA US 2013 Revenues Revenues from transactions with other segments Revenues from external customers Adjusted EBIT Jeep voluntary recall charge(1) Pension curtailment gain(1) Currency devaluations(1) Gains on the disposal of investments Other... -

Page 232

... access to the credit market and to financial instruments in general; financial market risk (principally relating to exchange rates, interest rates and commodity prices), since the Group operates at an international level in different currencies and uses financial instruments which generate interest... -

Page 233

... credit granted. These guarantees are further strengthened where possible by reserve of title clauses on financed vehicle sales to the sales network made by Group financial service companies and on vehicles assigned under finance and operating lease agreements. Receivables for financing activities... -

Page 234

... in the capital markets; obtaining adequate credit lines; monitoring future liquidity on the basis of business planning. The Group manages liquidity risk by monitoring cash flows and keeping an adequate level of funds at its disposal. The operating cash management and liquidity investment of the... -

Page 235

...rate swaps and, in limited cases, by forward rate agreements. Exposure to changes in the price of commodities is generally hedged by using commodity swaps and commodity options. Counterparties to these agreements are major financial institutions. Information on the fair value of derivative financial... -

Page 236

...in Poland and Turkey; JPY mainly in relation to purchase of parts from Japanese suppliers and sales of vehicles in Japan; U.S.$/BRL, EUR/BRL, relating to Brazilian manufacturing operations and the related import and export flows. The Group's policy is to use derivative financial instruments to hedge... -

Page 237

... terms of cash flows). The fixed rate financial instruments used by the Group consist principally of part of the portfolio of the financial services companies (basically customer financing and financial leases) and part of debt (including subsidized loans and notes). The potential loss in fair value... -

Page 238

... to U.S.$64.7675; and The common share prices included within the definition of "Early Conversion Rate" applicable to a "fundamental change" (as defined in the prospectus of the Mandatory Convertible Securities) were also adjusted. The relevant fraction used to affect the adjustments noted above was... -

Page 239

Company Financial Statements AT DECEMBER 31, 2015 Income Statement _____ 240 Statement of Financial Position _____ 241 Notes to the Company Financial Statements _____ 242 Other Information _____ 256 -

Page 240

240 2015 | ANNUAL REPORT Company Financial Statements Income Statement Income Statement for the Years Ended December 31, 2015 and 2014 For the Years Ended December 31, 2015 Note (â,¬ million) 2014 890 63 (28) (132) (475) 318 9 327 241 568 Result from investments Other operating income Personnel ... -

Page 241

2015 | ANNUAL REPORT Company Financial Statements Statement of Financial Position 241 Statement of Financial Position At December 31, 2015 and 2014 At December 31, 2015 Note (â,¬ million) 2014 ASSETS Property, plant and equipment Investments in Group companies and other equity investments Other ... -

Page 242

... 2015 | ANNUAL REPORT Company Financial Statements Notes to the Company Financial Statements Notes to the Company Financial Statements PRINCIPAL ACTIVITIES On January 29, 2014, the Board of Directors of Fiat approved a proposed corporate reorganization resulting in the formation of Fiat Chrysler... -

Page 243

...FCA's financial statements from January 1, 2014 and FCA, as successor of Fiat, is the parent company. As the Merger resulted in FCA being the surviving entity, all Fiat ordinary shares outstanding as of the Merger date (1,167,181,255 ordinary shares) were canceled and exchanged. FCA allotted one new... -

Page 244

244 2015 | ANNUAL REPORT Company Financial Statements Notes to the Company Financial Statements ACCOUNTING POLICIES Basis of preparation The 2015 Company Financial Statements represent the separate financial statements of the parent company, Fiat Chrysler Automobiles N.V., and have been prepared ... -

Page 245

2015 | ANNUAL REPORT 245 COMPOSITION AND PRINCIPAL CHANGES 1. Result from investments The following table summarizes the Result from investments: For the Years Ended December 31, 2015 (â,¬ million) 2014 883 7 890 Share of the profit/(loss) of Group companies Dividends from other companies Total ... -

Page 246

..., payroll, security and facility management), costs for legal, administrative, financial and IT services in addition to the compensation component from stock grant plans representing the notional cost of the Long Term Incentive Plan awarded to the Chief Executive Officer and Executives (net of... -

Page 247

2015 | ANNUAL REPORT 247 8. Investments in Group companies and other equity investments The following table summarizes Investments in Group companies and other equity investments: At December 31, 2015 (â,¬ million) 2014 22,103 124 22,227 Change (783) 79 (704) Investments in Group companies ... -

Page 248

...S.p.A. and Fiat Chrysler Finance Europe S.A., resulting in â,¬285 million of intercompany payables at December 31, 2015 reported within Other financial liabilities (â,¬135 million at December 31, 2014). 10. Current financial assets At December 31, 2015, Current financial assets related to a loan of... -

Page 249