Chrysler 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

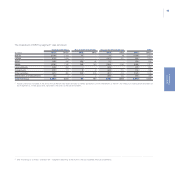

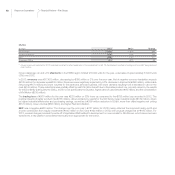

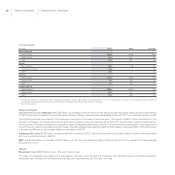

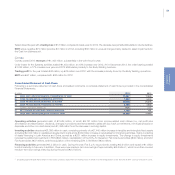

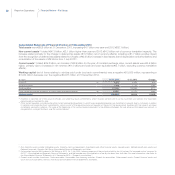

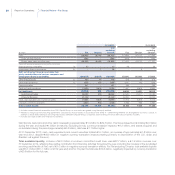

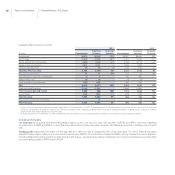

46 Report on Operations Financial Review – Fiat Group

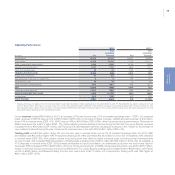

Results by Segment

Following is a summary of revenues, trading profit and EBIT by segment and comparison with 2012.

NAFTA

(€ million) 2013 2012(*) Change

Net revenues 45,777 43,521 2,256

Trading profit 2,220 2,443 -223

EBIT 2,290 2,491 -201

Shipments (000s) 2,238 2,115 123

(*) Figures previously reported for 2012 have been restated to reflect application of the amendment to IAS 19. Restatement resulted in trading profit and EBIT being reduced

by €250 million.

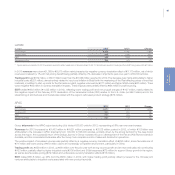

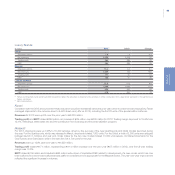

Group shipments in NAFTA totaled 2,238,000 units for 2013, a 6% increase over 2012. A total of 1,876,000 vehicles were shipped in the U.S.

(up 7% from 2012), 269,000 in Canada (up 5%) and 93,000 for Mexico and other.

Revenues for 2013 were €45,777 million, up €2,256 million or 5% over the prior year (+9% at constant exchange rates). Approximately

€1.4 billion of the increase was due to a 6% increase in shipments driven primarily by increased demand for Chrysler Group vehicles,

including the Ram 1500 trucks, the launch of the all-new 2014 Jeep Cherokee which began shipping to dealers in late October 2013, the

Jeep Grand Cherokee, which launched in the first quarter of 2013, as well as increases in the Jeep Wrangler. These increases were partially

offset by a reduction in Jeep Liberty shipments due to its discontinued production at the end of the second quarter of 2012 in preparation

of the all-new 2014 Jeep Cherokee. During the third quarter of 2012, Chrysler Group continued to ship the residual Jeep Liberty inventory

to dealers.

Approximately €800 million of the increase in revenues was attributable to favorable vehicle line mix as there was a higher percentage growth in

truck shipments as compared to minivan and passenger car shipments. In addition, revenues increased by approximately €800 million as a result

of favorable net pricing from vehicle content enhancements in the Group’s 2014 model year vehicles as compared to prior model years. Further,

approximately €300 million of the increase in revenues was due to a favorable shift in market mix to greater retail shipments as a percentage of

total shipments, which is consistent with the Group’s continuing strategy to grow U.S. retail market share while maintaining stable fleet shipments.

Typically, the average revenue per vehicle for retail shipments is higher than the average revenue per vehicle for fleet shipments, as retail

customers tend to purchase vehicles with more optional features. Additionally, revenues were negatively impacted by €1.5 billion in currency

translation impacts.

Trading profit for 2013 was €2,220 million (€2,443 million for 2012, IAS 19 restated), with positive volume/mix (+€588 million) and pricing

(+€868 million) effects that were more than offset by higher industrial costs (€1,456 million), including costs associated with new models and

content enhancements as well as higher R&D amortization, increased SG&A costs (€90 million) to support volume growth and commercial

launches of the new products, in addition to negative currency translation impacts (~€80 million).

EBIT was €2,290 million (€2,491 million for 2012, IAS 19 restated), mainly reflecting lower trading profit and €23 million higher net unusual

income. For 2013, net unusual income of €71 million included a gain of €166 million, with a corresponding net reduction to pension obligations

following amendments to Chrysler’s U.S. and Canadian salaried defined benefit pension plans, partly offset by charges related to the June 2013

voluntary safety recall for the 1993-1998 Jeep Grand Cherokee and the 2002-2007 Jeep Liberty, as well as the customer satisfaction action

for the 1999-2004 Jeep Grand Cherokee.