Chrysler 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366

|

|

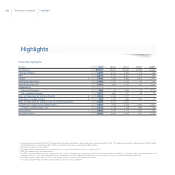

10 Letter from the Chief Executive Officer

In Canada, we recorded 49 straight months of growth and reconfirmed our position as the number two selling automaker, posting our strongest

annual sales performance in 13 years.

In LATAM, we registered positive results, although below the prior year’s level primarily as a result of negative currency impacts, principally the

weakening of the Brazilian Real, input cost inflation for the Brazilian operations and initial start-up costs for the new Pernambuco plant.

The year-over-year comparison for LATAM is also against a record 2012, when the Group demonstrated exceptional flexibility in responding to

a sharp increase in demand in Brazil following the introduction of government incentives.

Despite the above, the Group continued to be the market leader in Brazil, a position we have held for 12 years, with a 270 basis point lead over

our nearest competitor.

In Argentina, sales were up 31% and market share increased 140 basis points.

In APAC, the Group posted strong earnings on the back of significant volume growth.

Retail sales in the region, including JVs, were up 73% – significantly outpacing industry growth of around 9% for the year.

In China, the Fiat Viaggio continued to gain momentum and it is now the Group’s best-selling model in the region. In India, where the distribution

network is now fully owned and operated by the Group, volumes were up 41% for the year. In Australia, we posted the industry’s best year-

over-year performance, up 53%.

In EMEA trading conditions remained extremely weak with the industry in Europe registering its sixth straight year of decline.

Despite market conditions, however, losses in EMEA were reduced to €470 million, representing a €233 million improvement over 2012, due

in large part to a better product mix, driven primarily by the early success of the commercial strategy centered around the 500 family, as well

as increased cost efficiencies achieved during the year.

In addition, the premium strategy announced in 2012 in response to difficult market conditions has yielded promising initial results.

The first fruits of this decision to expand into the more profitable premium end of the market are evident in Maserati’s outstanding results.

The brand closed the year with a particularly strong fourth quarter following the introduction of the new Ghibli in October, building on the

success of the new Quattroporte launched in March. For the full year, vehicle shipments were up 148%, revenues up 120%, trading profit up

€114 million to €171 million and trading margins exceeded 10%.

Ferrari also turned in an excellent performance. Despite production volumes being held below the 2012 level to preserve the brand scarcity and

exclusivity, revenues were 5% higher at €2.3 billion and trading profit was up 9% to €364 million with trading margins increasing to 15.6%.

On the production front, we continued in our commitment to World Class Manufacturing standards at Group plants worldwide, achieving further

quality improvements in products and processes.

As evidence of that commitment, the plants in Pomigliano d’Arco (Italy), Tychy (Poland) and Bursa (Turkey) all achieved WCM Gold level during

2013 and in Chrysler we began to introduce WCM into suppliers’ locations.

With regard to the near-term outlook, the Group will be presenting an updated business plan in early May 2014 to provide increased visibility

on the Group’s strategic direction and execution priorities.

We have already given guidance for the current year, with expected revenues of around €93 billion, trading profit in the €3.6-€4.0 billion range

and net profit of €0.6-0.8 billion. The net industrial debt target in the €9.8 billion to €10.3 billion range takes into account the €2.7 billion

payment to the VEBA Trust in January 2014 to acquire the remaining 41.5% interest in Chrysler.