Chrysler 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

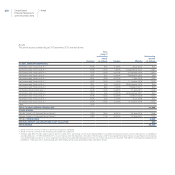

210 Consolidated

Financial Statements

at 31 December 2013

Notes

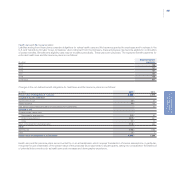

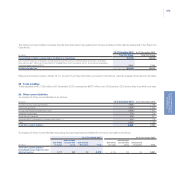

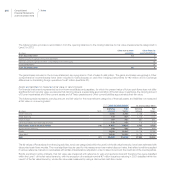

The bonds issued by Fiat Finance and Trade Ltd S.A. and by Fiat Finance North America Inc. impose covenants on the issuer and, in certain

cases, on Fiat S.p.A. as guarantor, which is standard international practice for similar bonds issued by companies in the same industry sector

as the Group. Such covenants include: (i) negative pledge clauses which require that, in case any security interest upon assets of the issuer

and/or Fiat S.p.A. is granted in connection with other bonds or debt securities having the same ranking, such security should be equally and

ratably extended to the outstanding bonds; (ii) pari passu clauses, under which the bonds rank and will rank pari passu with all other present

and future unsubordinated and unsecured obligations of the issuer and/or Fiat S.p.A.; (iii) periodic disclosure obligations; (iv) cross-default

clauses which require immediate repayment of the bonds under certain events of default on other financial instruments issued by the Group’s

main entities; and, (v) other clauses that are generally applicable to securities of a similar type. A breach of these covenants can lead to the early

repayment of the notes. In addition, the agreements for the bonds guaranteed by Fiat S.p.A. contain clauses which could lead to requirement

to make early repayment if there is a change of the controlling shareholder of Fiat S.p.A. which leads to a resulting downgrading by the ratings

agencies.

In addition, the indenture of the Secured Senior Notes issued by Chrysler Group LLC includes negative covenants which limited Chrysler’s

ability and, in certain instances, the ability of certain of its subsidiaries to, (i) pay dividends or make distributions of Chrysler’s capital stock or

repurchase Chrysler’s capital stock; (ii) make certain payments; (iii) create certain liens to secure indebtedness; (iv) enter into sale and leaseback

transactions; (v) engage in transactions with affiliates; (vi) merge or consolidate with certain companies and (vii) transfer and sell assets. The

indenture provides for customary events of default, including but not limited to, (i) non-payment; (ii) breach of covenants in the indenture; (iii)

payment defaults or acceleration of other indebtedness; (iv) a failure to pay certain judgments and (v) certain events of bankruptcy, insolvency

and reorganization. If certain events of default occur and are continuing, the trustee or the holders of at least 25% in principal amount of the

notes outstanding under one of the series may declare all of the notes of that series to be due and payable immediately, together with accrued

interest, if any.

Chrysler’s Secured Senior Notes are secured by liens junior to the Senior Secured Credit Facilities on substantially all of Chrysler Group LLC’s

assets and the assets of its U.S. subsidiary guarantors, including 100% of the equity interests in Chrysler’s U.S. subsidiaries and 65% of the

equity interests in its non U.S. subsidiaries held directly by Chrysler Group LLC and its U.S. subsidiary guarantors.

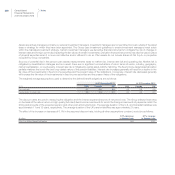

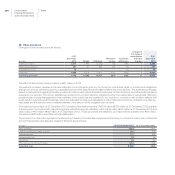

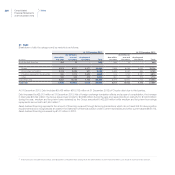

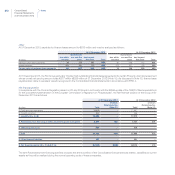

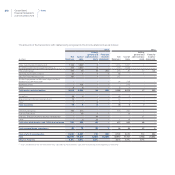

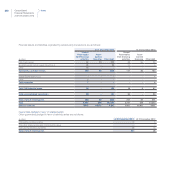

Borrowing from banks

At 31 December 2013, the item includes €2,119 million (€2,265 million at 31 December 2012) outstanding on the $3.0 billion Tranche B

Term Loan of Chrysler, payable in equal quarterly installments of $7.5 million, with the remaining balance due at maturity in May 2017. Taking

advantage of market conditions and its improved credit profile, in June 2013, Chrysler had reduced the interest rate for its $3.0 billion Tranche

B Term Loan and its undrawn $1.3 billion Revolving Credit Facility, maturing in May 2016. Certain loan covenants were also amended to be

consistent with those in the Chrysler’s bond agreement. Subsequently, in December 2013, Chrysler further reduced the interest rate on the

Tranche B Term Loan.

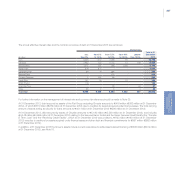

Medium/long term committed credit lines (expiring after twelve months) currently available to the treasury companies of Fiat Group excluding

Chrysler amount to approximately €3.2 billion at 31 December 2013, of which €2.1 billion related to the 3-year syndicated revolving credit line

due in July 2016 that was undrawn at 31 December 2013. In June 2013, Fiat S.p.A. signed a new €2 billion 3-year revolving credit line, which

replaced the existing of €1.95 billion signed in July 2011. The syndication of the new line was successfully completed on 18 July 2013 with a

group of 19 banks and, as a result of the positive response, the facility was increased to €2.1 billion.

Additionally, the operating entities of Fiat Group excluding Chrysler have committed credit lines available, with residual maturity after twelve

months, to fund scheduled investments, of which approximately €1.8 billion was still undrawn at 31 December 2013.