Chrysler 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

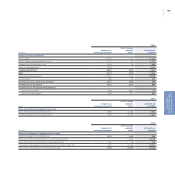

151

Consolidated

Financial Statements

at 31 December 2013

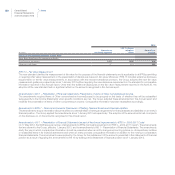

New standards and interpretations not yet effective

In May 2011, a package of three standards was issued: IFRS 10 – Consolidated Financial Statements, IFRS 11 – Joint Arrangements and

IFRS 12 – Disclosure of Interests in Other Entities. IAS 27 – Consolidated and Separate Financial Statements (which has been renamed IAS

27 – Separate Financial Statements) and IAS 28 – Investments in Associates (which has been renamed IAS 28 – Investments in Associates

and Joint Ventures) were consequently revised. Subsequently, other amendments were issued to clarify transitional guidance on the first-time

adoption of the standards. The new standards are effective for annual periods beginning on or after 1 January 2013, and must be applied

retrospectively. The European Union endorsed these standards by postponing their effective date to 1 January 2014, allowing early adoption

from 1 January 2013. The Group will apply the new standards from 1 January 2014. In particular:

IFRS 10 – Consolidated Financial Statements will replace SIC-12 – Consolidation: Special Purpose Entities and parts of IAS 27 – Consolidated

and Separate Financial Statements (which has been renamed IAS 27 – Separate Financial Statements and addresses the accounting

treatment of investments in separate financial statements). The new standard builds on existing principles by identifying a single control

model applicable to all entities, including “structured entities”. The standard also provides additional guidance to assist in the determination

of control where this is difficult to assess. At the date of this Annual report, adoption of this new standard would have no effect as no changes

to the control conclusions reached before and after the adoption of the new standard would arise.

IFRS 11 – Joint Arrangements supersedes IAS 31 – Interests in Joint Ventures and SIC-13 – Jointly Controlled Entities: Non-monetary

Contributions by Venturers. The adoption of this new standard for the Group will require the reclassification of investments classified as jointly

controlled entities under IAS 31 as either Joint ventures (if the Group has rights to the assets, and obligations for the liabilities, relating to an

arrangement) or Joint operations (if the Group has right only to the net assets of an arrangement). The classification will focus on the rights

and obligations of the arrangements, rather than their legal form. Notwithstanding the reclassification, the Group investments that will be

classified as Joint ventures under IFRS 11 will continue to be recognized by applying the equity method and the Group expects no impact

on its Consolidated financial statements for these investments. In relation to its interests in Sevel S.p.A. and in Fiat India Automobiles Limited,

that will be classified as Joint operations upon the adoption of IFRS 11, the Group will recognize its share of assets, liabilities, revenues and

expenses instead of recognizing its interests by using the equity method. At 31 December 2013, this adoption of IFRS 11 would lead to an

estimated increase in total Assets recognized of approximately €440 million, an increase in Debt of approximately €380 million (the effect on

Net industrial debt is an increase of approximately €360 million). No effect will arise on the Group’s Profit/(Loss) or Equity from the adoption

of the standard.

IFRS 12 – Disclosure of Interests in Other Entities, is a new and comprehensive standard on disclosure requirements for all forms of interests

in other entities, including subsidiaries, joint arrangements, associates, special purpose vehicles and other unconsolidated vehicles. The

application of the new standard will result in expanded disclosure in the Notes to the Consolidated financial statements.

On 16 December 2011, the IASB issued certain amendments to IAS 32 – Financial Instruments: Presentation to clarify the application of certain

offsetting criteria for financial assets and financial liabilities in IAS 32. The amendments are effective for annual periods beginning on or after

1 January 2014 and are required to be applied retrospectively. No significant effect is expected from the first time adoption of the standard.

On 29 May 2013, the IASB issued an amendment to IAS 36 – Recoverable Amount Disclosures for Non-Financial Assets addressing the

disclosure of information about the recoverable amount of impaired assets if that amount is based on fair value less cost of disposal. The

amendments are effective retrospectively for annual periods beginning on or after 1 January 2014. Earlier application is permitted for periods

when the entity has already applied IFRS 13. The application of this amendment will result in an expanded disclosure in the Notes to the

Consolidated financial statements in case of impairment based on fair value less cost of disposal.

On 27 June 2013, the IASB issued narrow scope amendments to IAS 39 – Financial Instruments: Recognition and Measurement entitled “Novation

of Derivatives and Continuation of Hedge Accounting”. The amendments will allow hedge accounting to continue in a situation where a derivative,

which has been designated as a hedging instrument, is novated to effect clearing with a central counterparty as a result of laws or regulation, if

specific conditions are met. Similar relief will be included in IFRS 9 - Financial Instruments. The amendments are effective retrospectively for annual

periods beginning on or after 1 January 2014. No significant effect is expected from the first time adoption of these amendments.