Chrysler 2013 Annual Report Download - page 282

Download and view the complete annual report

Please find page 282 of the 2013 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

281

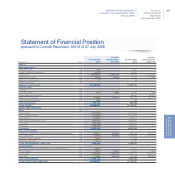

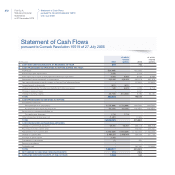

Fiat S.p.A. Statutory

Financial Statements

at 31 December 2013

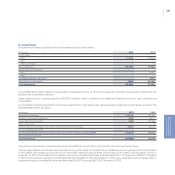

Use of estimates

The statutory financial statements are prepared in accordance with IFRS, which require the use of judgments, estimates and assumptions that

affect the carrying amount of assets and liabilities, the disclosure of contingent assets and liabilities and income and expense for the period.

The estimates and underlying assumptions are based on information available at the time the financial statements are prepared, historical

experience and other relevant factors.

The continuing difficult economic and financial environment in many Eurozone countries, in addition to a slowdown in growth and other

difficulties in several major emerging markets mean that assumptions regarding future performance are subject to significant levels of

uncertainty. As a consequence, it cannot be excluded that actual results may differ from those estimates and, therefore, require adjustments

to book values in future periods, which may be significant and which at present can neither be estimated nor predicted. The line item most

impacted by the use of estimates is “Investments in subsidiaries and associates” (non-current assets), where estimates are used to determine

impairment losses and reversals. With regard to recognition of employee benefits, taxes or provisions, no particular reliance was placed on the

use of estimates and no significant issues are expected in the future, particularly given the relatively minor book values involved.

The use of estimates had a significant impact on the determination of the carrying amount of Fiat Group Automobiles S.p.A. (FGA), which

accounts for a substantial portion of “Investments in subsidiaries and associates”. Measurement was based on FGA’s estimated “value in

use” at 31 December 2013, which took into consideration the investee’s expected performance for 2014 together with the auto industry and

economic outlook for 2015-2019, based on studies from leading research institutes (e.g., Global Insight), in addition to the announced strategic

decision to leverage on the Group’s historic brands (such as Alfa Romeo) and the success of the new 500 family. The assumptions and results

are also consistent with information provided in “Subsequent Events and Outlook” (Report on Operations). The earnings projections are based

on prudent assumptions that reflect the continued difficult and uncertain trading environment in many key markets. Those projections also take

account of the expected impact of the ongoing strategic realignment of Fiat and Chrysler’s manufacturing and commercial activities, including

the benefits of the recent acquisition of full control of Chrysler. On the basis of the strategy announced on 30 October 2012 to redeploy

industrial assets in EMEA for production of a renewed portfolio of products focused on the premium segment and brands with international

potential, it was considered reasonable to use explicit cash flow projections up to 2019. With regard to Chrysler, given loan covenants that

restrict dividend distributions, the assumed contribution for the period to 2019 is 50% of projected earnings, with the remainder being added

to the terminal value.

The normalized cash flow used in the terminal value (“TV”) calculation was based on a weighted average of the expected contribution from

each geographic market, which takes the cyclicality and maturity of the auto business into account. The TV calculation also assumes a long-

term growth rate of zero.

As the cash flows are assumed equivalent to expected net profit, the discount rates applied are based on the estimated cost of equity. Different

and increasing rates were applied over the cash flow projection period (2014-2019) to reflect the geographic distribution of earnings and

the level of risk associated with achieving targets. The weighted average discount rates ranged from 10.9-16.9% for EMEA, 12.8-16.8% for

LATAM, and 11.3-15.3% for Chrysler. For TV, a weighted average discount rate of 16% was used, which includes a 6% premium for EMEA

and 4% for LATAM and Chrysler to reflect the execution risks associated with achieving targets.

The resulting estimate of FGA’s value in use was €8.9 billion, representing a more than €0.5 billion premium to the carrying amount of the

investment at 31 December 2013. Historic and prospective P/E multiples for a panel of comparable companies used as a control further

supported the valuation result.

A sensitivity analysis was also conducted with changes to the base case financial assumptions and the market assumptions in EMEA,

where the greatest level of uncertainty exists. A 50 basis point change in the discount rate would impact the value in use of the investee by

approximately €400 million. If demand levels in the European auto market were assumed to drop by 5% in 2015, 7.5% in 2016 and 10% for

the period 2017-2019 (in line with the assumptions used in the impairment test on net assets in EMEA) and all other base case assumptions

remained unchanged, the value in use would be €7.7 billion.