Asus 2015 Annual Report Download - page 271

Download and view the complete annual report

Please find page 271 of the 2015 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

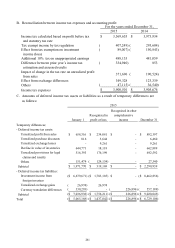

267

12. OTHERS

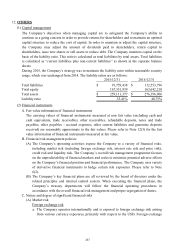

(1) Capital management

The Company’s objectives when managing capital are to safeguard the Company’s ability to

continue as a going concern in order to provide returns for shareholders and to maintain an optimal

capital structure to reduce the cost of capital. In order to maintain or adjust the capital structure,

the Company may adjust the amount of dividends paid to shareholders, return capital to

shareholders, issue new shares or sell assets to reduce debt. The Company monitors capital on the

basis of the liability ratio. This ratio is calculated as total liabilities by total assets. Total liabilities

is calculated as “current liabilities plus non-current liabilities” as shown in the separate balance

sheets.

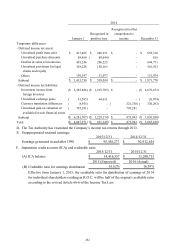

During 2015, the Company’s strategy was to maintain the liability ratio within reasonable security

range, which was unchanged from 2014. The liability ratios are as follows:

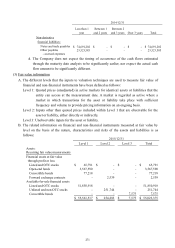

(2) Financial instruments

A. Fair value information of financial instruments

The carrying values of financial instruments measured at non fair value (including cash and

cash equivalents, trade receivables, other receivables, refundable deposits, notes and trade

payables, other payables - accrued expenses, other current liabilities and guarantee deposits

received) are reasonably approximate to the fair values. Please refer to Note 12(3) for the fair

value information of financial instruments measured at fair value.

B. Financial risk management policies

(A) The Company’s operating activities expose the Company to a variety of financial risks,

including market risk (including foreign exchange risk, interest rate risk and price risk),

credit risk and liquidity risk. The Company’s overall risk management programme focuses

on the unpredictability of financial markets and seeks to minimise potential adverse effects

on the Company’s financial position and financial performance. The Company uses variety

of derivative financial instruments to hedge certain risk exposures. Please refer to Note

6(2).

(B) The Company’s key financial plans are all reviewed by the board of directors under the

related principles and internal control system. When executing the financial plans, the

Company’s treasury departments will follow the financial operating procedures in

accordance with the overall financial risk management and proper segregation of duties.

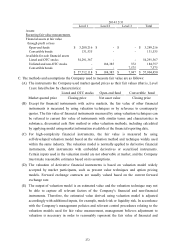

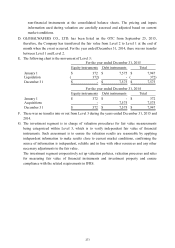

C. Nature and degree of significant financial risks

(A) Market risk

Foreign exchange risk

a. The Company operates internationally and is exposed to foreign exchange risk arising

from various currency exposures, primarily with respect to the USD. Foreign exchange

2015/12/31 2014/12/31

Total liabilities 91,759,438$ 112,553,796$

Total equity 167,351,939 163,642,210

Total assets 259,111,377$ 276,196,006$

Liability ratio 35.41% 40.75%