Asus 2015 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2015 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

239

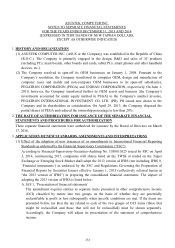

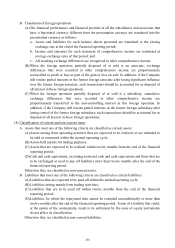

(5) Cash equivalents

Cash equivalents refer to short-term highly liquid investments that are readily convertible to known

amount of cash and subject to an insignificant risk of changes in value. Time deposits can be

classified as cash equivalents if they meet the criteria mentioned above and are held for short-term

cash commitments in operational purpose.

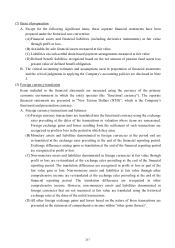

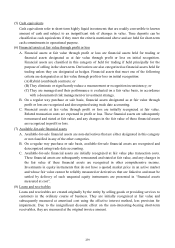

(6) Financial assets at fair value through profit or loss

A. Financial assets at fair value through profit or loss are financial assets held for trading or

financial assets designated as at fair value through profit or loss on initial recognition.

Financial assets are classified in this category of held for trading if held principally for the

purpose of selling in the short-term. Derivatives are also categorized as financial assets held for

trading unless they are designated as hedges. Financial assets that meet one of the following

criteria are designated as at fair value through profit or loss on initial recognition:

(A) Hybrid (combined) contracts; or

(B) They eliminate or significantly reduce a measurement or recognition inconsistency; or

(C) They are managed and their performance is evaluated on a fair value basis, in accordance

with a documented risk management or investment strategy.

B. On a regular way purchase or sale basis, financial assets designated as at fair value through

profit or loss are recognized and derecognized using trade date accounting.

C. Financial assets at fair value through profit or loss are initially recognized at fair value.

Related transaction costs are expensed in profit or loss. These financial assets are subsequently

remeasured and stated at fair value, and any changes in the fair value of these financial assets

are recognized in profit or loss.

(7) Available-for-sale financial assets

A. Available-for-sale financial assets are non-derivatives that are either designated in this category

or not classified in any of the other categories.

B. On a regular way purchase or sale basis, available-for-sale financial assets are recognized and

derecognized using trade date accounting.

C. Available-for-sale financial assets are initially recognized at fair value plus transaction costs.

These financial assets are subsequently remeasured and stated at fair value, and any changes in

the fair value of these financial assets are recognized in other comprehensive income.

Investments in equity instruments that do not have a quoted market price in an active market

and whose fair value cannot be reliably measured or derivatives that are linked to and must be

settled by delivery of such unquoted equity instruments are presented in “financial assets

measured at cost”.

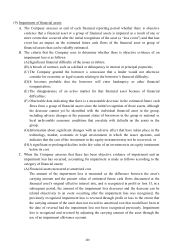

(8) Loans and receivables

Loans and receivables are created originally by the entity by selling goods or providing services to

customers in the ordinary course of business. They are initially recognized at fair value and

subsequently measured at amortised cost using the effective interest method, less provision for

impairment. Due to the insignificant discount effect on the non-interesting-bearing short-term

receivables, they are measured at the original invoice amount.