Asus 2015 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2015 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

208

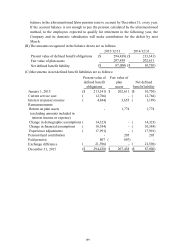

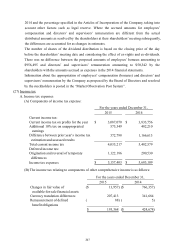

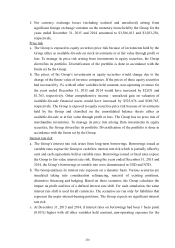

B. Reconciliation between income tax expenses and accounting profit:

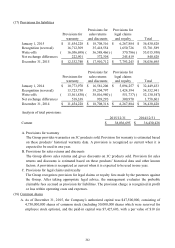

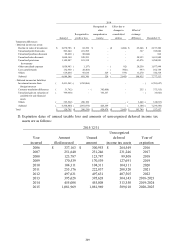

C. Amounts of deferred tax assets or liabilities as a result of temporary differences and loss

carryforwards are as follows:

2015 2014

Income tax calculated based on profit 4,394,986$ 4,661,022$

before tax and statutory tax rate

Effect from items disallowed by tax regulations 425,124)( 331,981)(

Effect from tax exemption on investment 87,400)( 165,412)(

income (loss)

Effect from investment tax credit 37,538)( 21,426)(

Effect from net operating loss carryforward 180,734)( 112,003)(

Difference between prior year’s income tax 372,798 1,166,613

estimation and assessed results

Additional 10% tax on unappropriated earnings 575,349 482,210

Change in assessment of realization of deferred 158,270)( 63,075

tax assets

Effect of different tax rates on unrealized profit 371,696 190,524)(

from sales

Effect of exchange rates 349,328 123,339

Others 17,688)( 8,196

Income tax expenses 5,157,403$ 5,683,109$

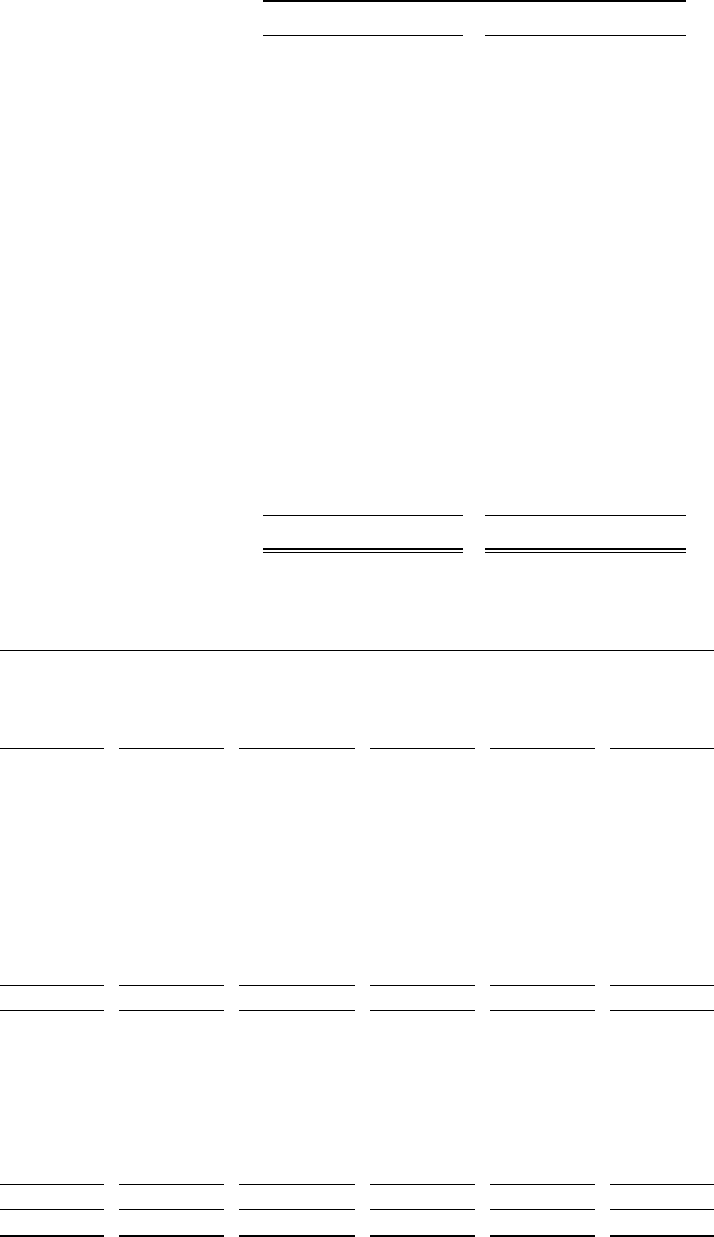

For the years ended December 31,

Recognized in Effect due to

other changes in Effect of

Recognized in comprehensive consolidated exchange

January 1 profit or loss income entities difference December 31

Temporary differences:

- Deferred income tax assets:

Decline in value of inventories 2,197,300$ 40,590$ -$ -$ 6,808$ 2,244,698$

Unrealized profit from sales 725,606 228,841 - - 671 955,118

Unrealized purchase discounts 816 5,644 - - - 6,460

Unrealized sales discounts 1,651,840 248,172 - - 9,932 1,909,944

Unrealized provisions 1,294,881 86,779 - - 1,458 1,383,118

for warranty

Other unrealized expenses 1,077,994 96,408 - - 8,479)( 1,165,923

Loss carryforwards 102,758 232,293 - - 40,100)( 294,951

Others 726,318 297,354)( 650 - 20,519)( 409,095

Subtotal 7,777,513 641,373 650 - 50,229)( 8,369,307

- Deferred income tax liabilities:

Investment income from 6,703,627)( 1,793,890)( - - - 8,497,517)(

foreign investees

Currency translation differences 373,515)( - 207,974)( - - 581,489)(

Unrealized gain on valuation of 33,601)( - 13,956 - - 19,645)(

available-for-sale financial

assets

Others 128,813)( 30,331 - - 5,735 92,747)(

Subtotal 7,239,556)( 1,763,559)( 194,018)( - 5,735 9,191,398)(

Total 537,957$ 1,122,186)($ 193,368)($ -$ 44,494)($ 822,091)($

2015