Asus 2015 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2015 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

215

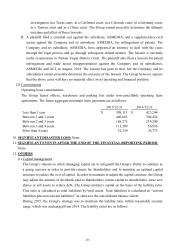

investigation in a Texas court, in a California court, in a Colorado court, in a Germany court,

in a Taiwan court and in a China court. The Group cannot presently determine the ultimate

outcome and effect of these lawsuits.

B. A plaintiff filed a criminal suit against the subsidiary, ASMEDIA, and a supplementary civil

action against the Company and its subsidiary, ASMEDIA, for infringement of patents. The

Company and its subsidiary, ASMEDIA, have appointed an attorney to deal with the cases

through the legal process and go through subsequent related matters. The lawsuit is currently

under examination in Taiwan Taipei District Court. The plaintiff also filed a lawsuit for patent

infringement and trade secret misappropriation against the Company and its subsidiaries,

ASMEDIA and ACI, in August, 2014. The lawsuit has gone to trial, but the Company and its

subsidiaries cannot presently determine the outcome of the lawsuit. The Group however expects

that the above cases will have no material effect on its operating and financial position.

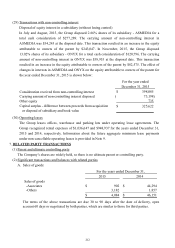

(2) Commitments

Operating lease commitments

The Group leases offices, warehouse and parking lots under non-cancellable operating lease

agreements. The future aggregate minimum lease payments are as follows:

10. SIGNIFICANT DISASTER LOSS: None.

11. SIGNIFICANT EVENTS AFTER THE END OF THE FINANCIAL REPORTING PERIOD:

None.

12. OTHERS

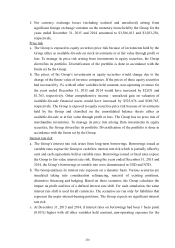

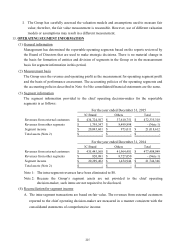

(1) Capital management

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as

a going concern in order to provide returns for shareholders and to maintain an optimal capital

structure to reduce the cost of capital. In order to maintain or adjust the capital structure, the Group

may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new

shares or sell assets to reduce debt. The Group monitors capital on the basis of the liability ratio.

This ratio is calculated as total liabilities by total assets. Total liabilities is calculated as “current

liabilities plus non-current liabilities” as shown in the consolidated balance sheets.

During 2015, the Group’s strategy was to maintain the liability ratio within reasonable security

range, which was unchanged from 2014. The liability ratios are as follows:

2015/12/31 2014/12/31

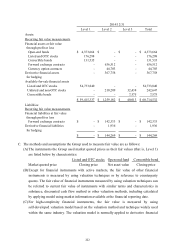

Less than 1 year 509,111$ 423,244$

Between 1 and 2 years 406,663 304,424

Between 2 and 3 years 189,275 214,240

Between 3 and 4 years 113,309 56,936

More than 4 years 32,130 38,773