Asus 2015 Annual Report Download - page 239

Download and view the complete annual report

Please find page 239 of the 2015 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279

|

|

235

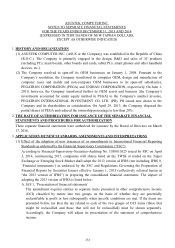

B. IFRS 12, ‘Disclosure of interests in other entities’

The standard integrates the disclosure requirements for subsidiaries, joint arrangements,

associates and unconsolidated structured entities. Accordingly, the Company will disclose

additional information about its interests in consolidated entities and unconsolidated entities

accordingly.

C. IFRS 13, ‘Fair value measurement’

The standard defines fair value as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date.

The standard sets out a framework for measuring fair value for market participants’ perspective,

and requires disclosures about fair value measurements. For non-financial assets only, fair value

is determined based on the highest and best use of the asset. Based on the Company’s

assessment, the adoption of the standard has no significant impact on its financial statements,

and the Company disclosed additional information about fair value measurements accordingly.

D. Disclosures - Transfers of financial assets (amendments to IFRS 7)

The amendment enhances qualitative and quantitative disclosures for all transferred financial

assets that are not derecognized and for any continuing involvement in transferred assets,

existing at the reporting date. The Company includes qualitative and quantitative disclosures for

all transferred financial assets.

E. Article 11, Paragraph 2 of Regulations Governing the Preparation of Financial Reports by

Securities Issuers

The new regulation allows the Company to recognize the remeasurement amount of defined

benefit plan as retained earnings or other equity. It cannot be reclassificated to income or

retained earnings if it is recognized as other equity. As a result of the new regulation, retained

earnings increased by $20,045 and $4,936, and other equity decreased by $20,045 and $4,936 at

December 31, 2014 and January 1, 2014, respectively.

(2) Effect of new issuances of or amendments to International Financial Reporting Standards as

endorsed by the FSC but not yet adopted by the Company

None.

(3) International Financial Reporting Standards issued by IASB but not yet endorsed by the FSC

New standards, interpretations and amendments issued by IASB but not yet included in the 2013

version of IFRSs as endorsed by the FSC:

New Standards, Interpretations and Amendments

Effective Date by

International Accounting

Standards Board

IFRS 9, “Financial instruments” January 1, 2018

Sale or contribution of assets between an investor and its associate or

joint venture (amendments to IFRS 10 and IAS 28)

To be determined by

International Accounting

Standards Board