US Airways 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways Group, Inc.

Notes to Consolidated Financial Statements — (Continued)

Effective December 31, 2006, the Company adopted the recognition provisions of SFAS No. 158, "Employers' Accounting for

Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)." This

statement requires employers to recognize in their balance sheets the overfunded or underfunded status of defined benefit postretirement

plans, measured as the difference between the fair value of plan assets and the benefit obligation (the projected benefit obligation for

pension plans and the accumulated postretirement benefit obligation for other post-retirement plans). Employers must recognize the

change in the funded status of the plan in the year in which the change occurs through other comprehensive income. This statement also

requires plan assets and obligations to be measured as of the employer's balance sheet date. The measurement provisions of this statement

will be effective for years beginning after December 15, 2008. The Company has not yet adopted the measurement provisions of this

statement with respect to its postretirement benefit plans and is in the process of determining the impact of the adoption on the

Company's consolidated financial statements. The Company's defined benefit pension plans are measured as of the balance sheet date.

Prior to the adoption of the recognition provisions of SFAS No. 158, the Company accounted for its defined benefit pension and

postretirement benefit plans under SFAS No. 87, "Employers Accounting for Pensions" and SFAS No. 106, "Employers' Accounting for

Postretirement Benefits Other Than Pensions." SFAS No. 87 required that a liability (minimum pension liability) be recorded when the

accumulated benefit obligation (ABO) liability exceeded the fair value of plan assets. Any adjustment is recorded as a non-cash charge to

accumulated other comprehensive income in stockholders' equity. SFAS No. 106 required that the liability recorded should represent the

actuarial present value of all future benefits attributable to an employees' service rendered to date. Under both SFAS No. 87 and No. 106,

changes in the funded status were not immediately recognized; rather, they were deferred and recognized ratably over future periods.

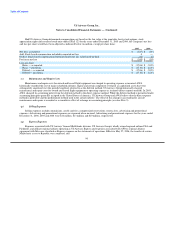

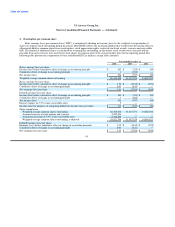

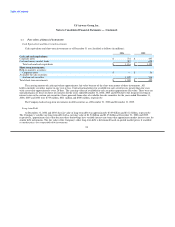

Upon adoption of the recognition provisions of SFAS No. 158, the Company recognized the amounts of prior changes in the funded

status of its post-retirement benefit plans through accumulated other comprehensive income. As a result, the Company recognized the

following adjustments in individual line items of its consolidated balance sheets as of December 31, 2006:

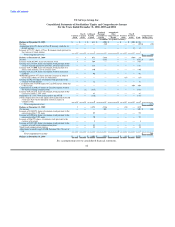

Prior to Adoption Effect of Adopting As Reported at

of SFAS No. 158 SFAS No. 158 December 31, 2006

Pension liabilities $ 16 $ (2) $ 14

Postretirement benefits other than pensions 216 (1) 215

Total liabilities 232 (3) 229

Accumulated other comprehensive income — 3 3

Total stockholders' equity 967 3 970

The adoption of the recognition provisions of SFAS No. 158 had no effect on the Company's consolidated statements of operations

for the year ended December 31, 2006 or for any prior period presented.

This statement also requires plan assets and obligations to be measured as of the employer's balance sheet date. The measurement

provisions of this statement will be effective for years beginning after December 15, 2008. The Company has not yet adopted the

measurement provisions of this statement with respect to its postretirement benefit plans, which are measured on September 30, and is in

the process of determining the impact of the adoption on the Company's consolidated financial statements. The Company's defined

benefit pension plans are measured as of the balance sheet date.

In September, 2006, the FASB issued FASB Staff Position ("FSP") No. AUG AIR-1 "Accounting for Planned Major Maintenance

Activities". This amends the existing major maintenance accounting guidance contained within the AICPA Industry Audit Guide "Audits

of Airlines" and prohibits the use of the accrue in advance method of accounting for planned major maintenance activities for owned

aircraft. The provisions of the announcement are applicable for fiscal years beginning after December 15, 2006. US Airways Group

currently uses the direct expense method of accounting for planned major maintenance, an acceptable method under generally accepted

accounting

92