US Airways 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281

|

|

Table of Contents

bankruptcy, US Airways contracted with Air Wisconsin, a related party, and Republic to purchase a significant portion of these

companies' regional jet capacity for a period of ten years. US Airways has determined that it is not the primary beneficiary of these

variable interest entities, based on cash flow analyses. Additionally, US Airways has analyzed the arrangements with other carriers with

which US Airways has long-term capacity purchase agreements and concluded that it is not required to consolidate any of the entities.

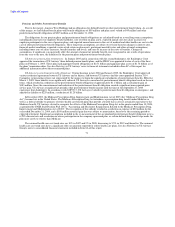

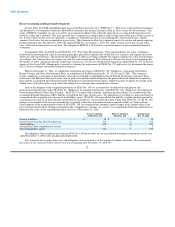

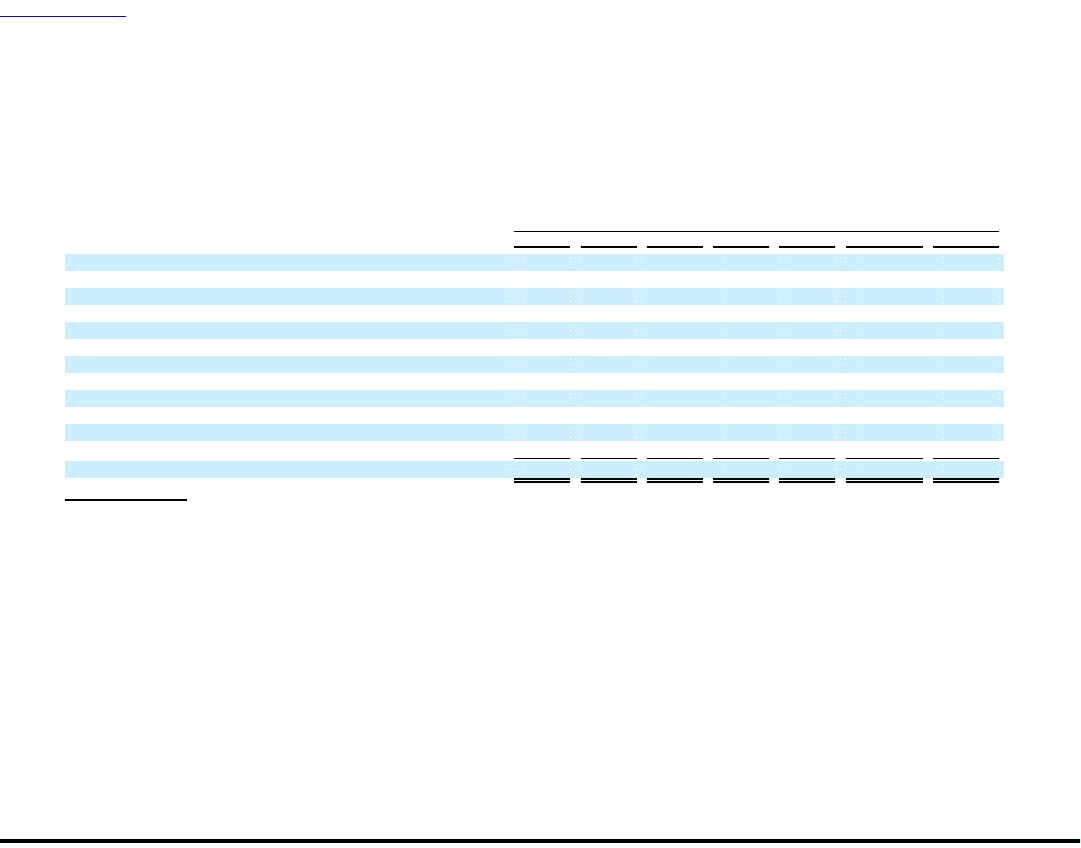

Other Indebtedness and Obligations

The following table provides details of our future cash contractual obligations as of December 31, 2006 (in millions):

Payments Due by Period

2007 2008 2009 2010 2011 Thereafter Total

US Airways Group(1)

Debt(2) $ — $ — $ — $ — $ 1,250 $ 74 $ 1,324

Aircraft related and other commitments 302 442 40 48 239 1,429 2,500

US Airways(3)

Debt and capital lease obligations 93 98 87 92 105 947 1,422

Aircraft purchase and operating lease commitments 625 598 530 488 471 3,067 5,779

Regional capacity purchase agreements(5) 1,031 1,194 1,248 1,273 1,298 7,277 13,321

AWA(3)

Debt and capital lease obligations 2 111 139 108 — 29 389

Aircraft purchase and operating lease commitments 483 686 1,126 770 250 1,637 4,952

Regional capacity purchase agreements(5) 538 530 541 552 563 287 3,011

Other US Airways Group subsidiaries(4) 11 10 4 1 1 2 29

Total $ 3,085 $ 3,669 $ 3,715 $ 3,332 $ 4,177 $ 14,749 $ 32,727

(1) These commitments represent those specifically entered into by US Airways Group or joint commitments entered into by

US Airways Group, AWA and US Airways under which each entity is jointly and severally liable.

(2) Includes $74 million aggregate principal amount of 7% Senior Convertible Notes due 2020 issued by US Airways Group and the

$1.25 billion GE loan due March 31, 2011

(3) Commitments listed separately under US Airways or AWA represent commitments under agreements entered into separately by

those companies.

(4) Represents operating lease commitments entered into by US Airways Group's other airline subsidiaries Piedmont and PSA.

(5) Represents minimum payments under capacity purchase agreements with third-party express carriers.

We expect to fund these cash obligations from funds provided by operations and future financings, if necessary. The cash available

to us from these sources, however, may not be sufficient to cover these cash obligations because economic factors outside our control

may reduce the amount of cash generated by operations or increase our costs. For instance, an economic downturn or general global

instability caused by military actions, terrorism, disease outbreaks and natural disasters could reduce the demand for air travel, which

would reduce the amount of cash generated by operations. An increase in our costs, either due to an increase in borrowing costs caused

by a reduction

66