US Airways 2006 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

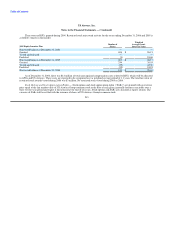

The weighted average fair value per share of US Airways Group Class A Common Stock grants was $1.87 in the year ended

December 31, 2004. In order to calculate the stock-based compensation for stock options and warrants using the fair value method

provisions in SFAS 123, US Airways used the Black-Scholes stock option-pricing model with the following weighted-average

assumptions:

Predecessor Company

Year Ended

December 31, 2004

Stock volatility 65%

Risk free interest rate 2.9%

Expected life 4 Years

Dividend yield —

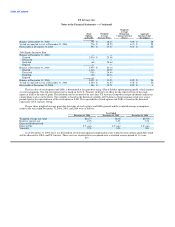

US Airways recognized compensation expense related to US Airways Group Class A Common Stock, stock option and stock

warrant grants to US Airways employees of $11 million and $50 million for the nine months ended September 30, 2005 and the year

ended December 31, 2004, respectively.

(b) Successor Company

Effective with the merger on September 27, 2005, US Airways applied the provisions of APB 25 and related interpretations.

Effective January 1, 2006, US Airways Group adopted SFAS 123R, using the modified prospective transition method.

Substantially all of America West Holdings' and AWA's employee stock options outstanding at the time of the merger were fully

vested in accordance with the change of control provisions of America West Holdings' stock option plans and were converted into

options of US Airways Group. Existing stock options of US Airways Group outstanding prior to the merger on September 27, 2005 were

cancelled as part of the plan of reorganization. Accordingly, as of January 1, 2006, only unvested stock options, stock appreciation rights

and restricted stock units granted subsequent to and in connection with the merger are subject to the transition provisions of SFAS 123R.

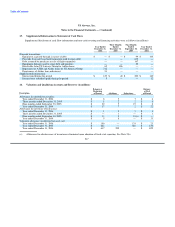

As part of the plan of reorganization, the Bankruptcy Court approved a new equity incentive plan, referred to as the 2005 Incentive

Equity Plan (the "2005 Incentive Plan"). The 2005 Incentive Plan provides for the grant of incentive stock options, nonstatutory stock

options, stock appreciation rights, stock purchase awards, stock bonus awards, stock unit awards, and other forms of equity

compensation, collectively referred to as stock awards, as well as performance-based cash awards. Incentive stock options granted under

the 2005 Incentive Plan are intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue

Code of 1986, as amended. Nonstatutory stock options granted under the 2005 Incentive Plan are not intended to qualify as incentive

stock options under the Internal Revenue Code.

A maximum of 12.5% of the fully-diluted shares (as of the completion of the merger) of US Airways Group common stock is

available for issuance under the 2005 Incentive Plan, totaling 10,969,191 shares. Any or all of these shares may be granted pursuant to

incentive stock options. Shares of US Airways Group common stock issued under the 2005 Incentive Plan may be unissued shares or

reacquired shares, purchased on the open market or otherwise. At December 31, 2006, approximately 5.5 million shares are available for

grant under the 2005 Equity Incentive Plan.

The number of shares of US Airways Group common stock available for issuance under the 2005 Incentive Plan will be reduced by

(i) one share for each share of stock issued pursuant to a stock option or a stock appreciation right, and (ii) three shares for each share of

stock issued pursuant to a stock purchase award, stock bonus award, stock unit award, and other full-value types of stock awards. Stock

awards that are terminated, forfeited or repurchased will result in an increase in the share reserve of the 2005 Incentive Plan

corresponding to the reduction originally made in respect of the award.

211