US Airways 2006 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

US Airways, Inc.

Notes to the Financial Statements — (Continued)

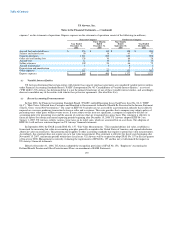

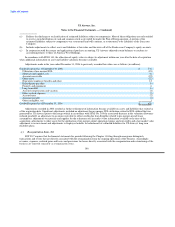

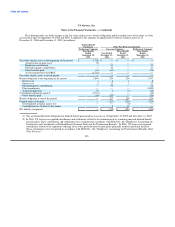

As the result of US Airways' bankruptcy filing in September 2004, it failed to meet the conditions precedent for continued

financing of regional jets and was not able to take delivery of scheduled aircraft and therefore incurred penalties of $7 million in

the fourth quarter of 2004.

(e) Damage and deficiency claims are largely a result of US Airways' election to either restructure, abandon or reject aircraft debt and

leases during the bankruptcy proceedings. As a result of the confirmation of the Plan of Reorganization and the effectiveness of

the merger, these claims were withdrawn and the accruals reversed.

(f) As of September 30, 2005, US Airways recorded $1.5 billion of adjustments to reflect assets and liabilities at fair value, including

an initial net write-down of goodwill of $1.82 billion. Goodwill of $584 million was recorded to reflect the excess of the estimated

fair value of liabilities and equity over identifiable assets. Subsequent to September 30, 2005, US Airways reduced goodwill by

$103 million to reflect adjustments to the fair value of certain assets and liabilities. See Note 2(b) for a description of changes in

goodwill subsequent to September 30, 2005.

(g) In connection with filing for bankruptcy on September 12, 2004, US Airways achieved cost-savings agreements with its principal

collective bargaining groups. In connection with the new labor agreements, approximately 5,000 employees across several of

US Airways' labor groups were involuntarily terminated or participated in voluntary furlough and termination programs.

(h) In connection with the Airbus MOU, US Airways was required to pay a restructuring fee of $39 million, which was paid by means

of offset against existing equipment deposits held by Airbus. US Airways also received credits from Airbus totaling $4 million in

2005, primarily related to equipment deposits. See also Note 3.

(i) The GE Merger MOU provided for the continued use of certain leased Airbus, Boeing and regional jet aircraft, the modification of

monthly lease rates and the return of certain other leased Airbus and Boeing aircraft. The GE Merger MOU also provided for the

sale-leaseback of assets securing various GE obligations. In connection with these transactions, US Airways recorded a net loss of

$5 million.

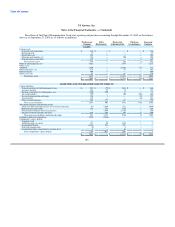

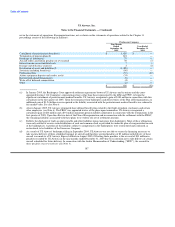

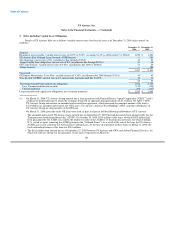

3. Special Items, Net

Special Items, net included within the statements of operations include the following components (in millions):

Successor Company

Year Ended Three Months Ended

December 31, December 31,

2006 2005

Transition and merger integration $ 64(b) $ 15(a)

Airbus restructuring (40)(c) —

Settlement of bankruptcy claims (3)(d) —

$ 21 $ 15

(a) In connection with the merger with America West Holdings, US Airways incurred $15 million of transition and merger integration

costs in the fourth quarter of 2005. These items included $7 million in insurance premiums related to policies for former officers

and directors; $5 million for severance, retention payments and stock awards; $1 million of aircraft livery costs; $1 million of

programming service expense; and $1 million in other expenses.

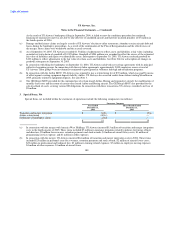

(b) In connection with the merger, US Airways incurred $64 million of transition and merger integration costs in 2006. These items

included $25 million in personnel costs for severance, retention payments and stock awards; $2 million of aircraft livery costs;

$23 million in professional and technical fees; $3 million in training related expenses; $7 million in employee moving expenses;

$4 million of other expenses; $1 million of aircraft lease

188