US Airways 2006 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2006 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

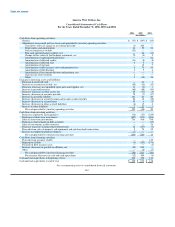

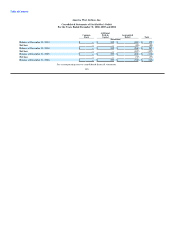

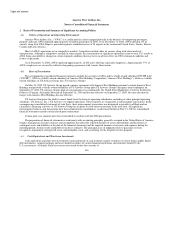

America West Airlines, Inc.

Notes to Consolidated Financial Statements — (Continued)

principle is not presented net of tax as any tax effects resulting from the change have been immediately offset by the recording of a

valuation allowance through the same financial statement caption.

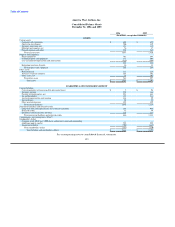

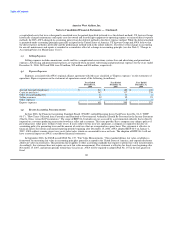

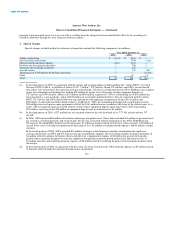

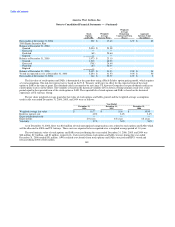

3. Special Charges

Special charges included within the statements of operations include the following components (in millions):

Year Ended December 31,

2006 2005 2004

Airbus restructuring $ (51)(a) $ 57(a) $ —

Sale leaseback transactions — 27(b) (1)(g)

Merger related transition expenses 68(c) 13(c) —

Power by the hour program penalties — 7(d) —

Severance due to change in control — 2(e) —

Aircraft returns — 1(f) 2(f)

Termination of V2500 power by the hour agreement — — (16)(h)

Other — (1) (1)

Total $ 17 $ 106 $ (16)

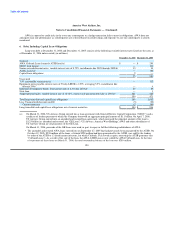

(a) In the third quarter of 2005, in connection with the merger and a memorandum of understanding (the "Airbus MOU") executed

between AVSA S.A.R.L., an affiliate of Airbus S.A.S. ("Airbus"), US Airways Group, US Airways and AWA, certain aircraft

firm orders were restructured. In connection with that restructuring, US Airways Group and America West Holdings were required

to pay non-refundable restructuring fees totaling $89 million by means of set-off against existing equipment deposits of

US Airways and AWA held by Airbus of $39 million and $50 million respectively. AWA's restructuring fee of $50 million has

been classified as a special charge, along with $7 million in associated capitalized interest. Also in connection with the Airbus

MOU, US Airways and AWA entered into two loan agreements with aggregate commitments of up to $161 million and

$89 million. As described in further detail in Note 6, on March 31, 2006, the outstanding principal and accrued interest on the

$89 million loan was forgiven upon repayment in full of the $161 million loan in accordance with terms of the Airbus loans. As a

result, AWA recognized a gain associated with the return of these equipment deposits upon forgiveness of the loan totaling

$51 million, consisting of the $50 million in equipment deposits and accrued interest of $1 million.

(b) In the third quarter of 2005, a $27 million loss was incurred related to the sale-leaseback of six 737-300 aircraft and two 757

aircraft.

(c) In 2006, AWA incurred $68 million of transition and merger integration costs. These items included $16 million in personnel costs

for severance, retention payments and stock awards; $12 of costs associated with the integration of the AWA FlightFund and

US Airways Dividend Miles frequent traveler programs; $1 million in merger related aircraft lease return expenses; $15 million of

aircraft livery costs; $15 million in professional and technical fees; $3 million of training related expenses; and $6 million of other

expenses.

In the fourth quarter of 2005, AWA recorded $13 million of merger related expenses related to transitioning the employees,

systems and facilities of AWA and US Airways into one consolidated company. The $13 million includes insurance premiums of

$4 million related to policies for former officers and directors, compensation expense of $3 million for special stock awards,

granted under a program designed to retain key employees through the integration period, professional and technical fees of

$3 million and sales and marketing program expenses of $2 million related to notifying frequent traveler program members about

the merger.

(d) In the fourth quarter of 2005, in connection with the return of certain leased aircraft, AWA incurred expenses of $7 million related

to penalties incurred under the outsourced maintenance arrangement.

143